The futures market has traditionally been a barometer for investor sentiment. Open interest, representing the total number of outstanding futures contracts that have not been settled, is a measure of market activity. Historically, rising Bitcoin prices have been correlated with an increase in open interest, signaling heightened speculative activity.

However, Bitcoin’s recent ascent past $28,000 defies this trend.

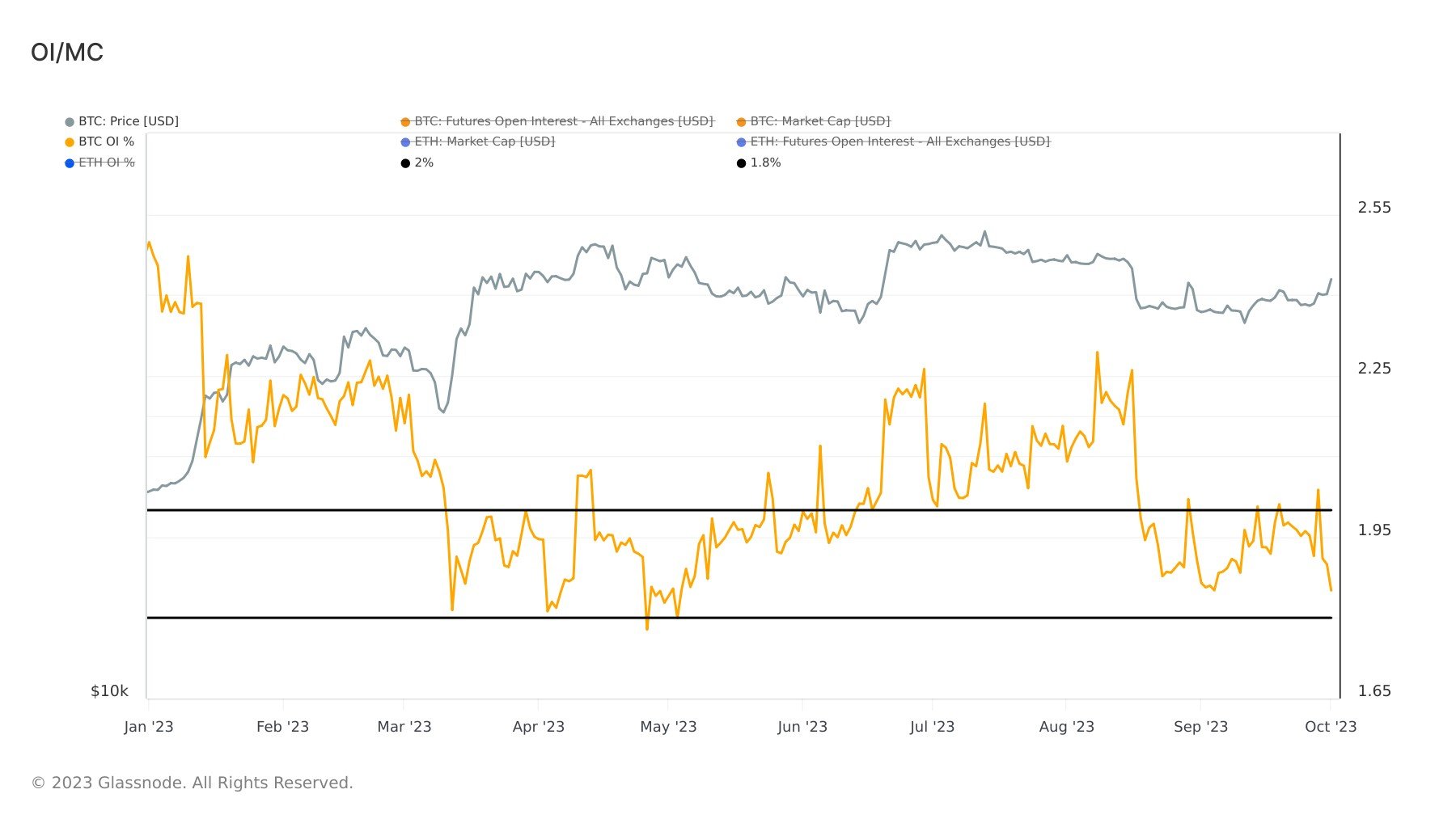

Despite this week’s rally, open interest in Bitcoin futures has notably declined. Specifically, open interest, as a percentage of Bitcoin’s market cap, is approaching a year-to-date low of 1.82%. This marks a 28% decline from figures at the beginning of the year. Such a contraction in open interest typically indicates a decline in speculative trading, a surprising trend given the cryptocurrency’s bullish momentum.

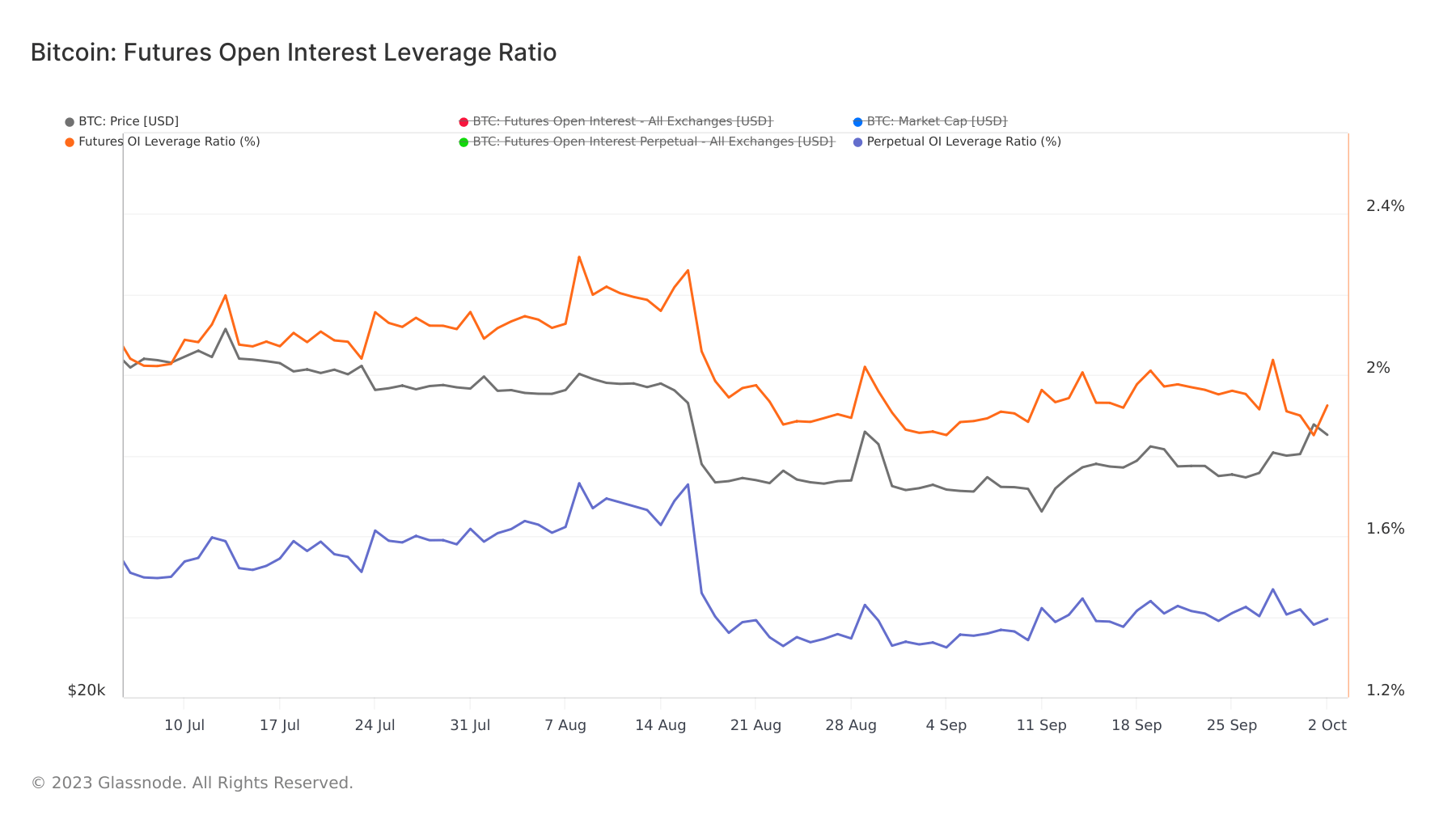

Digging deeper into the futures market reveals more about this evolving dynamic. The futures open interest leverage ratio, which measures the total open interest of futures contracts relative to the underlying asset’s market cap, provides a lens into traders’ risk appetite. On Sept. 27, this ratio stood at 1.91%, rising to 2.03% on Sept. 28, only to drop back to 1.85% by Oct. 1. A similar trend was observed in the perpetual futures open interest leverage ratio, which rose from 1.4% to 1.46% and then decreased to 1.38% within the same timeframe.

Despite the further price increase on Oct. 1, the drop in leverage ratios might indicate that traders were becoming more cautious or taking profits. It suggests that some traders might have been anticipating a potential price correction or consolidation, and hence, they reduced their leveraged positions to minimize risk.

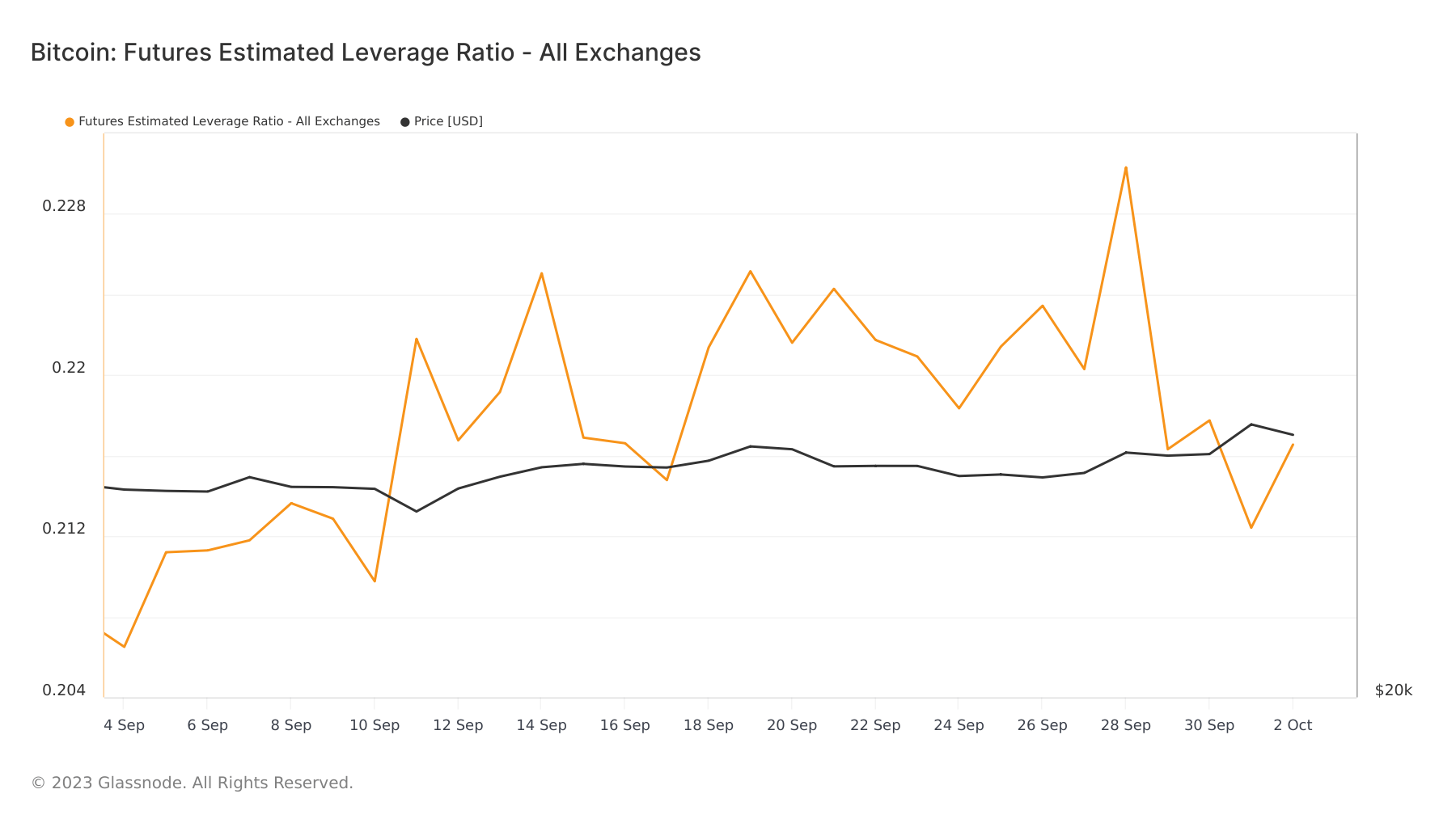

Another metric, the futures estimated leverage ratio across exchanges, dropped from 0.23 on Sept. 28 to 0.21 on Oct. 1. The metric provides an average measure of the leverage used by traders in the futures market. When this ratio decreases, it generally indicates that traders use less leverage across exchanges.

The initial increase in leverage ratios on Sept. 28 might suggest that traders were using more borrowed funds to speculate on further price increases. However, the subsequent drop in both the specific futures open interest leverage ratios and the general estimated leverage ratio across exchanges by Oct. 1 indicates a broader trend of reduced leverage use. Even as Bitcoin’s price continued to rise, traders, on average, reduced their leverage. This might suggest that traders were managing their risk by not over-leveraging in a market that had recently seen significant price movement.

The rising price of Bitcoin amidst falling open interest and reduced leverage indicates that the current price rally might be driven less by short-term speculation and more by genuine long-term investor confidence. This could mean increased participation by institutional investors or a broader shift in retail investor strategy from speculative trading to long-term holding.

While reduced speculative activity can stabilize the market and reduce volatility, it also signifies reduced liquidity. For traders, this means that while the market might be less prone to sudden price corrections due to liquidation events, it could also be less responsive to buy or sell orders, leading to potential price slippages.

The post Declining open interest in futures market contrasts Bitcoin’s bullish rally appeared first on CryptoSlate.