Bitcoin’s climb past the $27,000 mark this week, after a prolonged period of hovering around $26,000 throughout September, has triggered a significant market response.

Previous CryptoSlate analysis of the futures market found a marked decrease in derivatives trading. This trend signaled a waning interest among traders in both leveraged and futures trading.

This diminishing enthusiasm isn’t confined to the futures market alone.

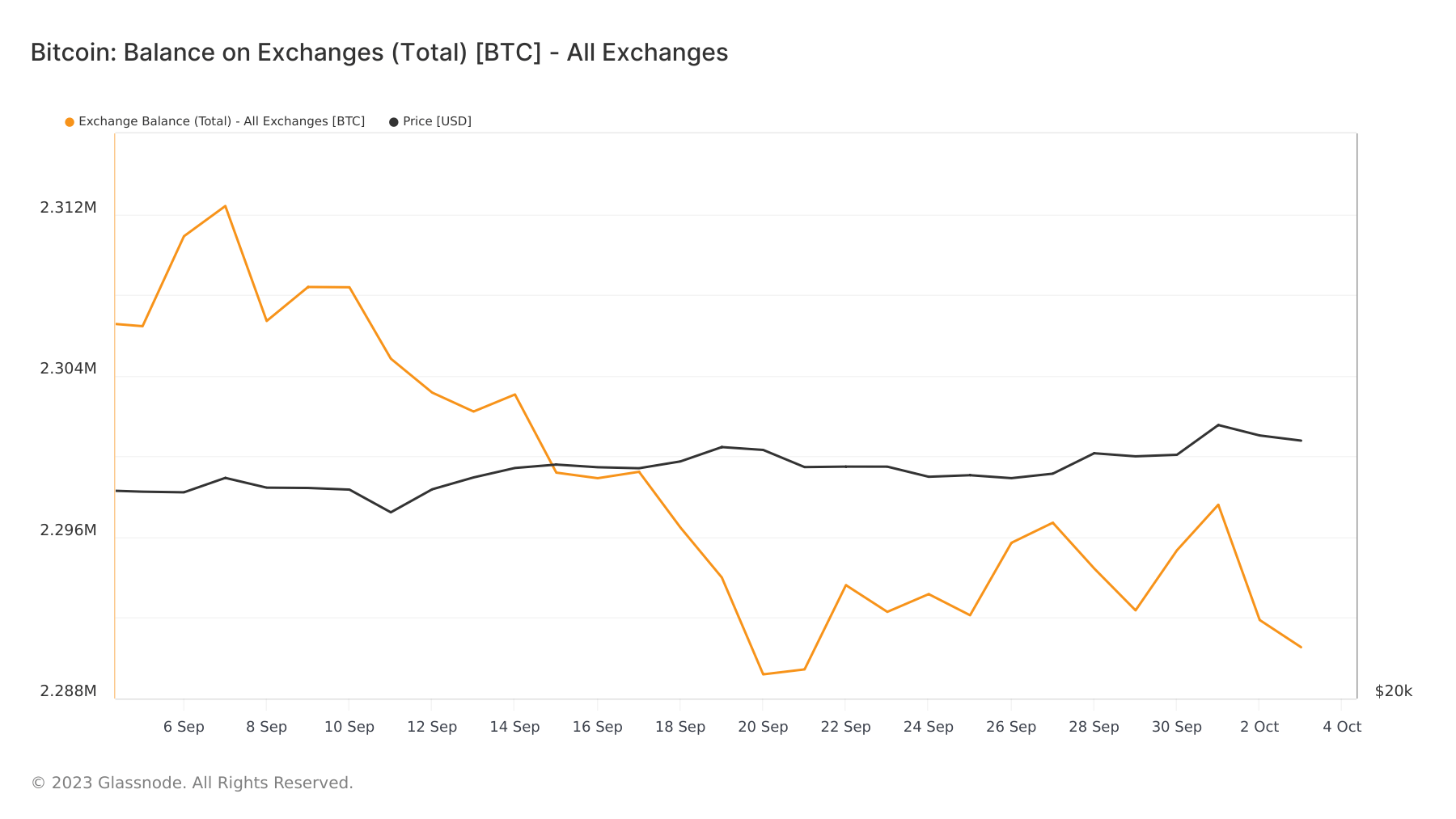

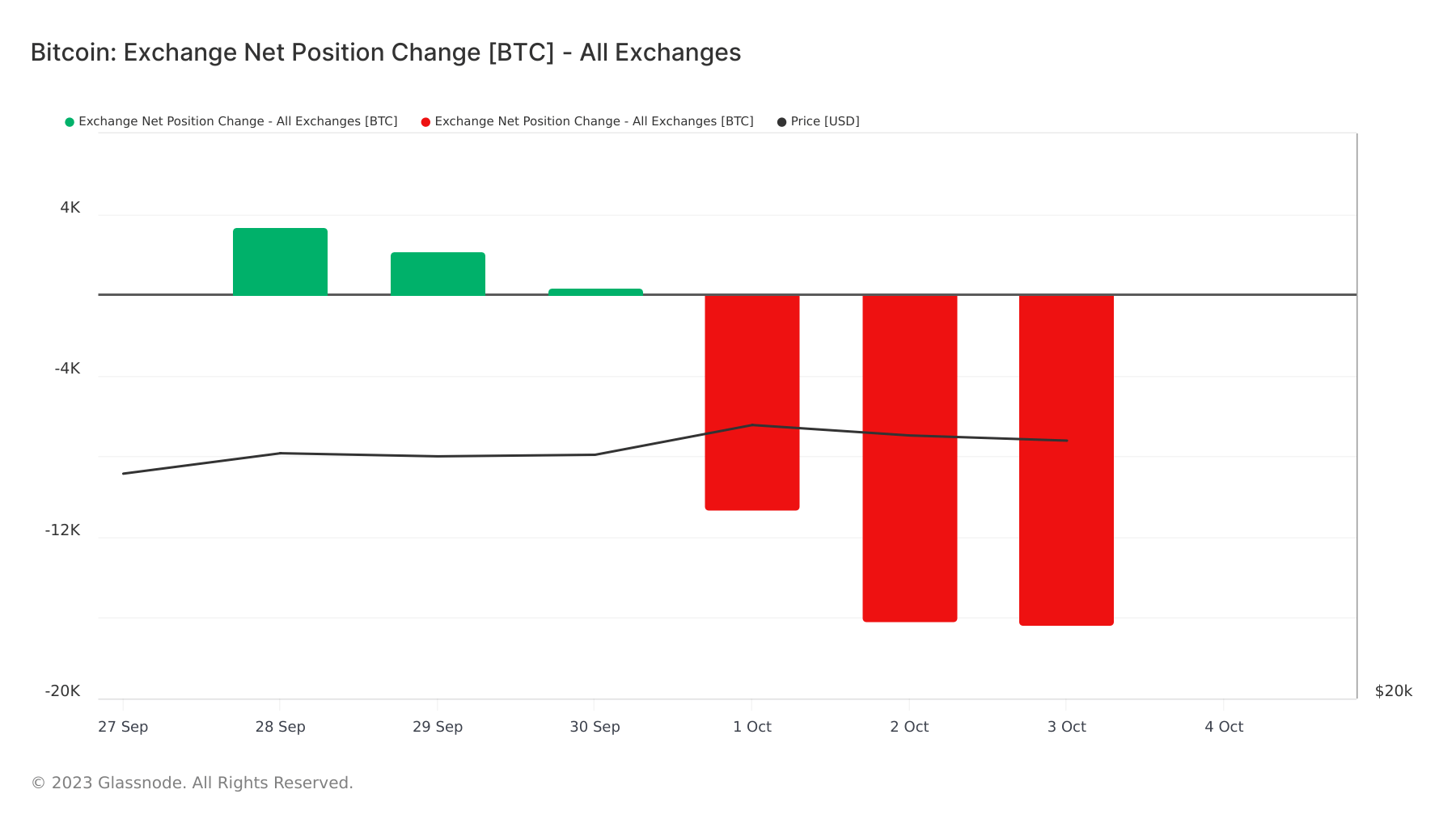

The spot Bitcoin market mirrors this trend, as evidenced by the pronounced drop in Bitcoin balances on exchanges. Glassnode’s data reveals a notable reduction in the total Bitcoin held on exchanges, which fell by over 7,000 BTC since the beginning of October.

A more granular look at the 30-day change in exchange balances shows an even larger decrease. As of Oct. 3, the amount of Bitcoin held on exchanges decreased by 16,351 BTC. This signifies that not only are traders holding back from selling their Bitcoin, but they are also moving them off exchanges, possibly to cold storage or other secure wallets. Such a trend often indicates a long-term holding sentiment among investors, suggesting they anticipate a future price appreciation.

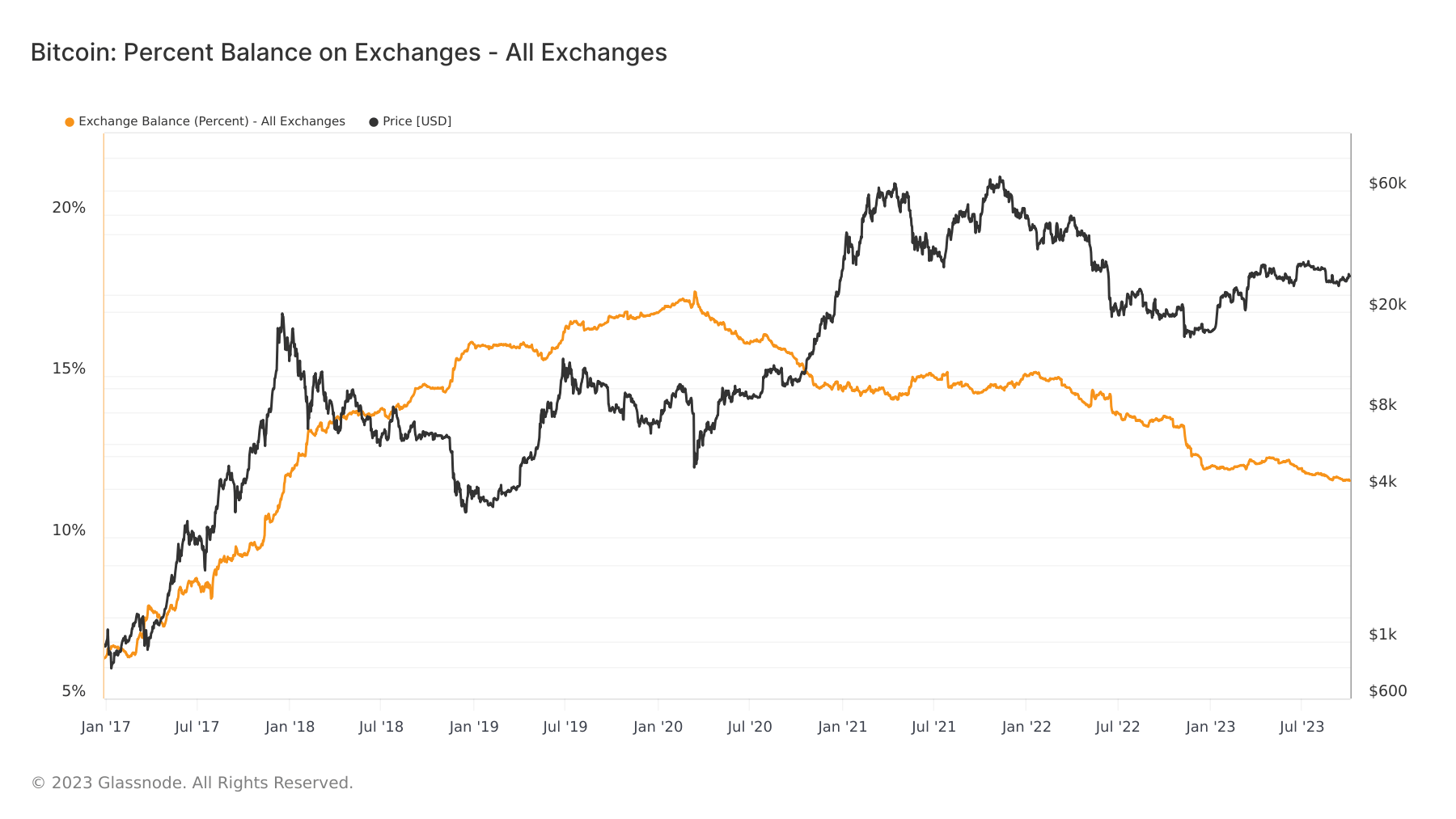

The current 2.29 million BTC held in exchange addresses constitutes 11.74% of the total Bitcoin supply. This figure hasn’t been this low since Dec. 17, 2017, when exchanges held 11.70% of Bitcoin’s supply. For context, the all-time high of Bitcoin’s supply on exchanges was reached in March 2020, when 17.6% resided on exchanges. The trajectory since then has been predominantly downward, punctuated by brief upticks during Bitcoin’s bearish phases. This trend underscores a growing preference among Bitcoin holders to retain their assets rather than trade or sell them, further solidifying the long-term holding narrative.

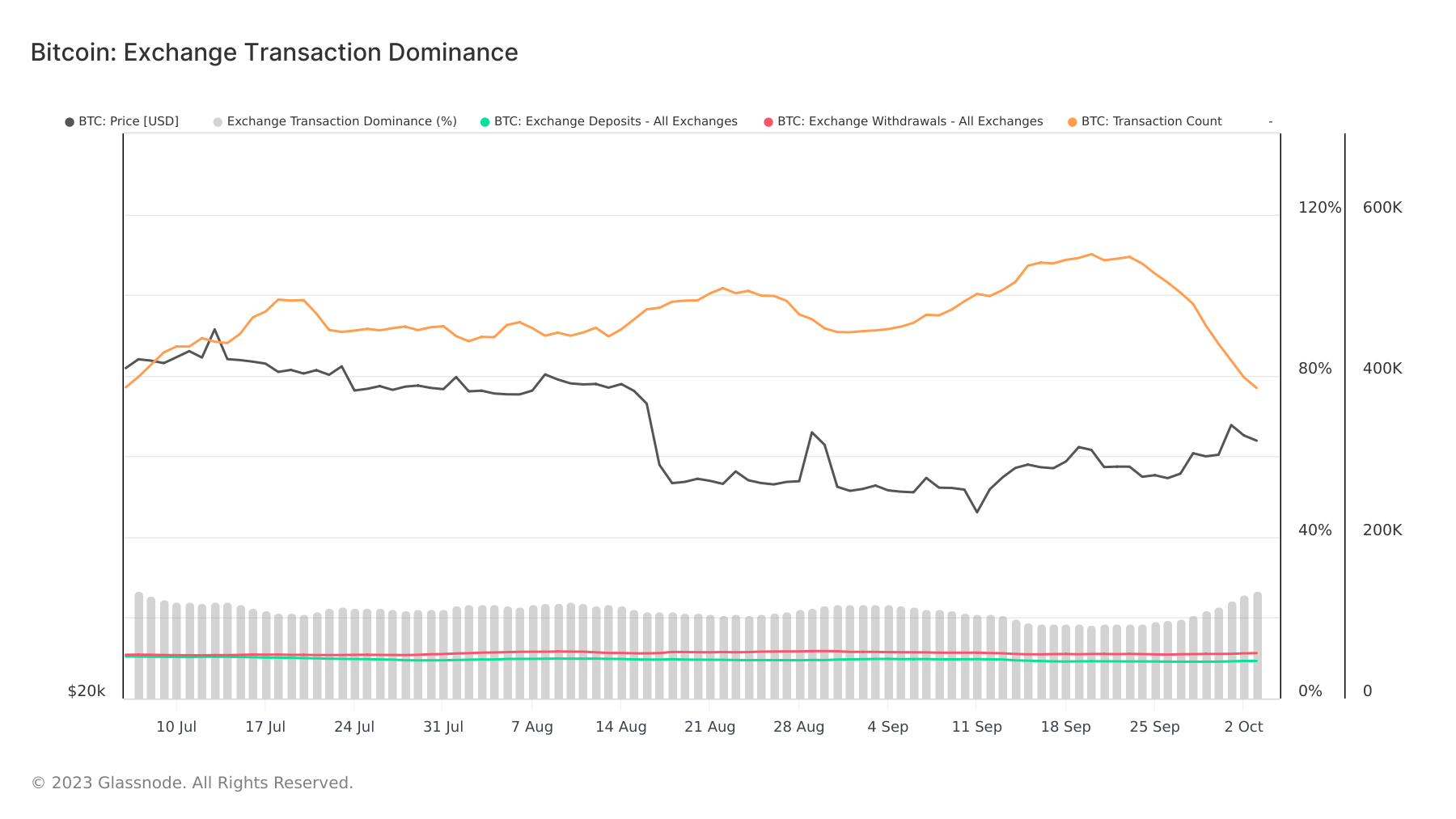

Looking at the exchange transaction dominance offers another layer of insight. There’s been a significant decline in exchange activity, reverting to levels last seen in July of this year. From Sep. 23 to Oct. 3, the exchange transaction count dwindled from 547,000 to 384,765. During this same timeframe, exchange transaction dominance swelled from 18.5% to 26.71%.

This indicates that while the overall number of transactions decreased, a larger proportion of those transactions were associated with exchanges. Furthermore, exchange withdrawals have consistently outstripped deposits since July, a trend that has persisted in October as well. This suggests that while fewer transactions are occurring, more Bitcoin is being moved off exchanges than is being deposited.

The declining Bitcoin balance on exchanges, coupled with the consistent outflow of Bitcoin from these platforms, indicates a strong holding sentiment among investors. Many could be anticipating a bullish future for Bitcoin and are thus moving their assets to more secure storage solutions. This could lead to a supply squeeze on exchanges, potentially driving up prices if demand surges.

The current landscape suggests a market that is confident in Bitcoin’s long-term value proposition. If exchange balances continue their decrease, the market could be poised for potential bullish movements, driven by supply constraints and robust holding sentiments.

The post Declining Bitcoin exchange balances show strong holding sentiment appeared first on CryptoSlate.