Bitcoin (BTC) witnessed a notable price surge in the past week, climbing well above the previously coveted $30,000 mark. The sharp increase affected all market participants, especially the short-term holders. These are entities or individuals who’ve held onto their Bitcoin for less than 155 days. Their behavior, particularly during market rallies, offers valuable insights into market sentiment and potential future movements.

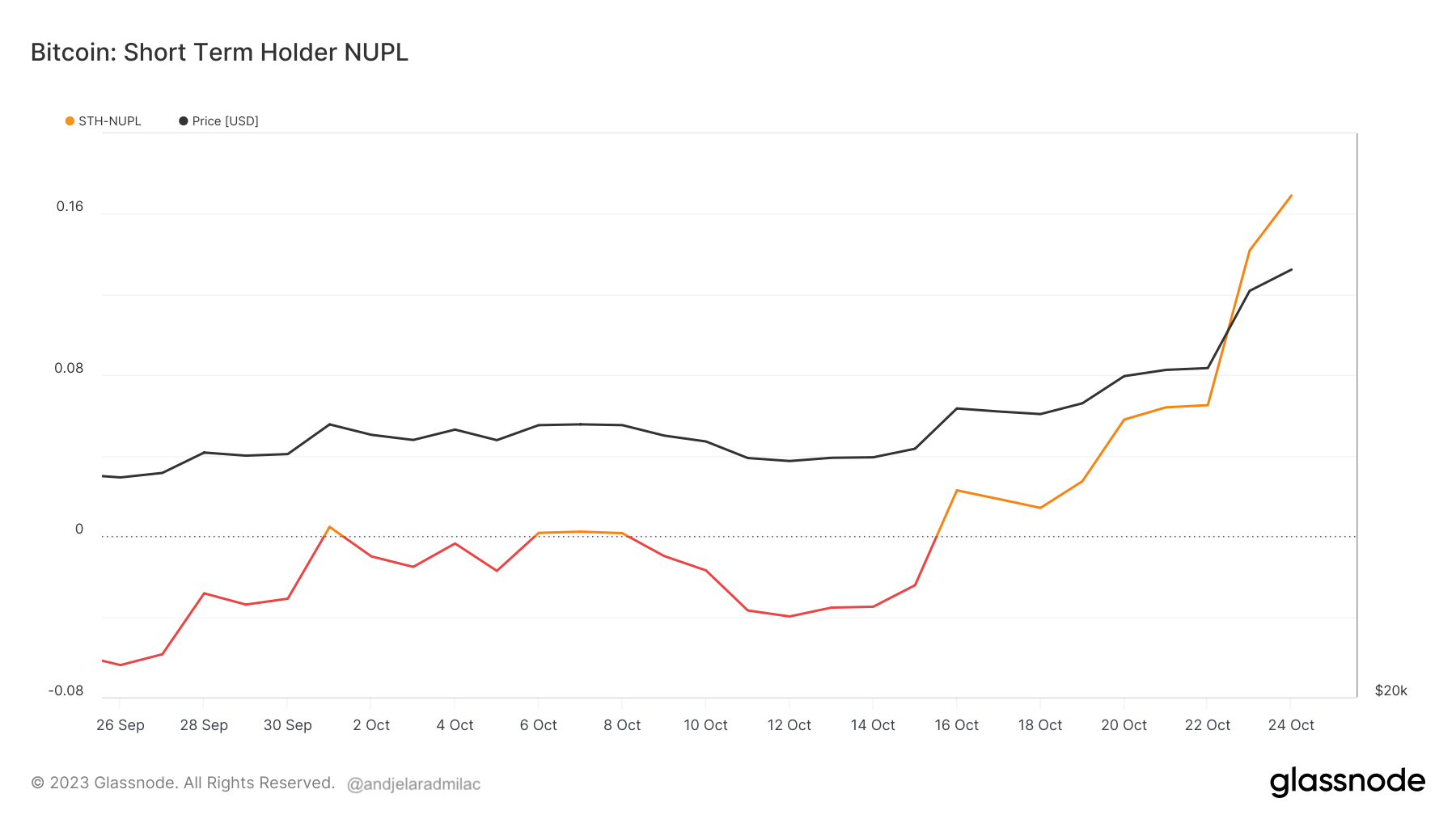

Short-Term Holder NUPL (STH-NUPL), or Net Unrealized Profit/Loss, is a specialized metric that zeroes in on unspent transaction outputs (UTXOs) younger than 155 days, serving as a barometer to gauge the sentiment of these newer market participants. When STH-NUPL is positive, it signals that, on average, these holders are sitting on net unrealized gains, indicating their acquisition price is lower than the current market price.

As Bitcoin’s price began its upward trajectory, the STH-NUPL mirrored this optimism. On Oct. 16, the STH-NUPL shifted from a slightly bearish -0.02 to a neutral 0.02 in just 24 hours. This swift change was not just a fleeting moment; by Oct. 24, as Bitcoin continued its bullish run, the STH-NUPL climbed further to 0.169, showcasing the growing confidence among the newer entrants in the market.

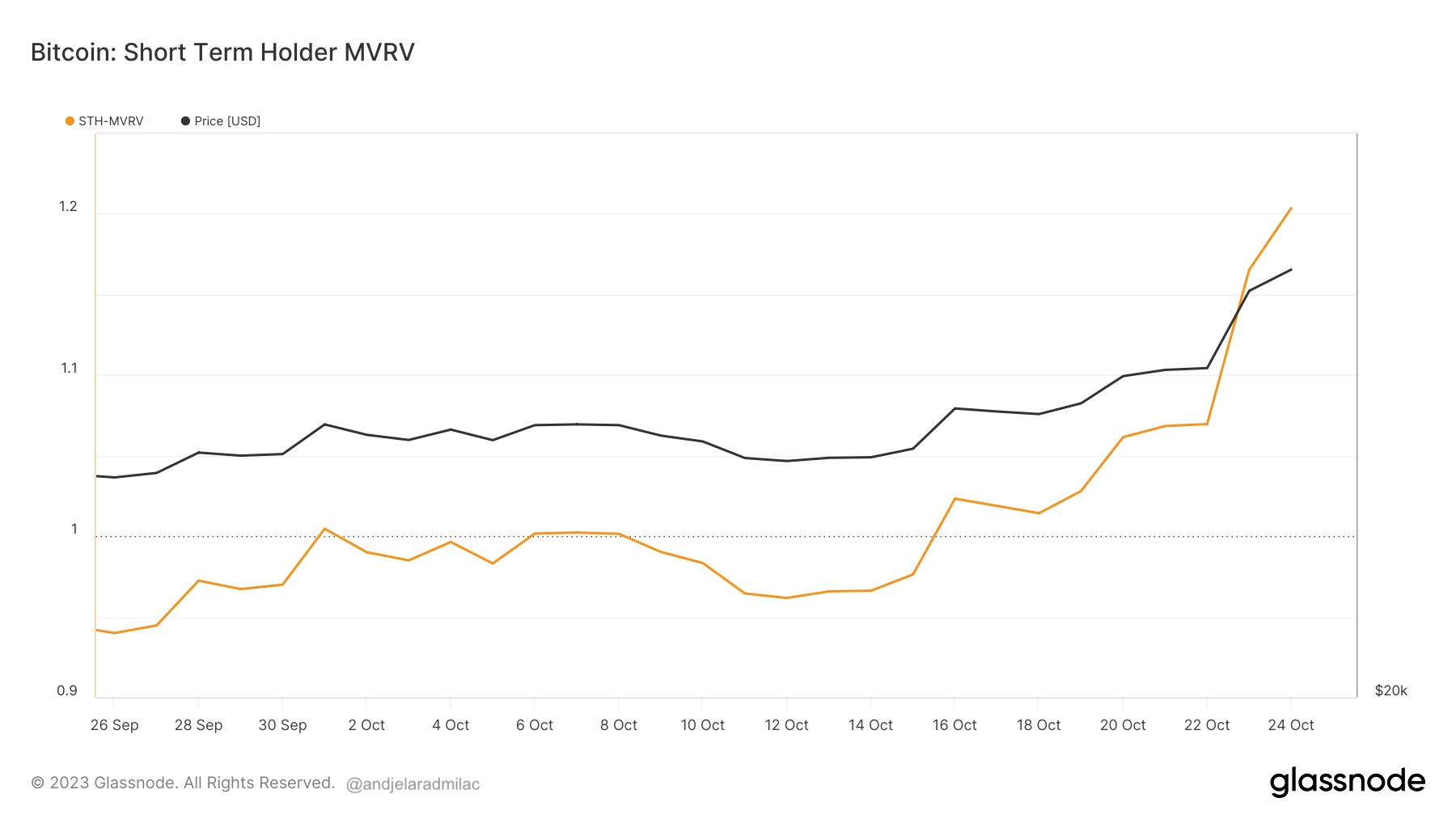

Another pivotal metric in this context is the Short-Term Holder Market Value to Realized Value (STH-MVRV) ratio. While both metrics provide insights into the sentiment and behavior of short-term holders, STH-NUPL offers a direct measure of their unrealized profit or loss. In contrast, STH-MVRV compares the current market value to the realized value for these holders.

On Oct. 16, the STH-MVRV ascended above the 1 mark, and by Oct. 24, it stood at 1.21, confirming that, on average, short-term holders were in a significant unrealized profit.

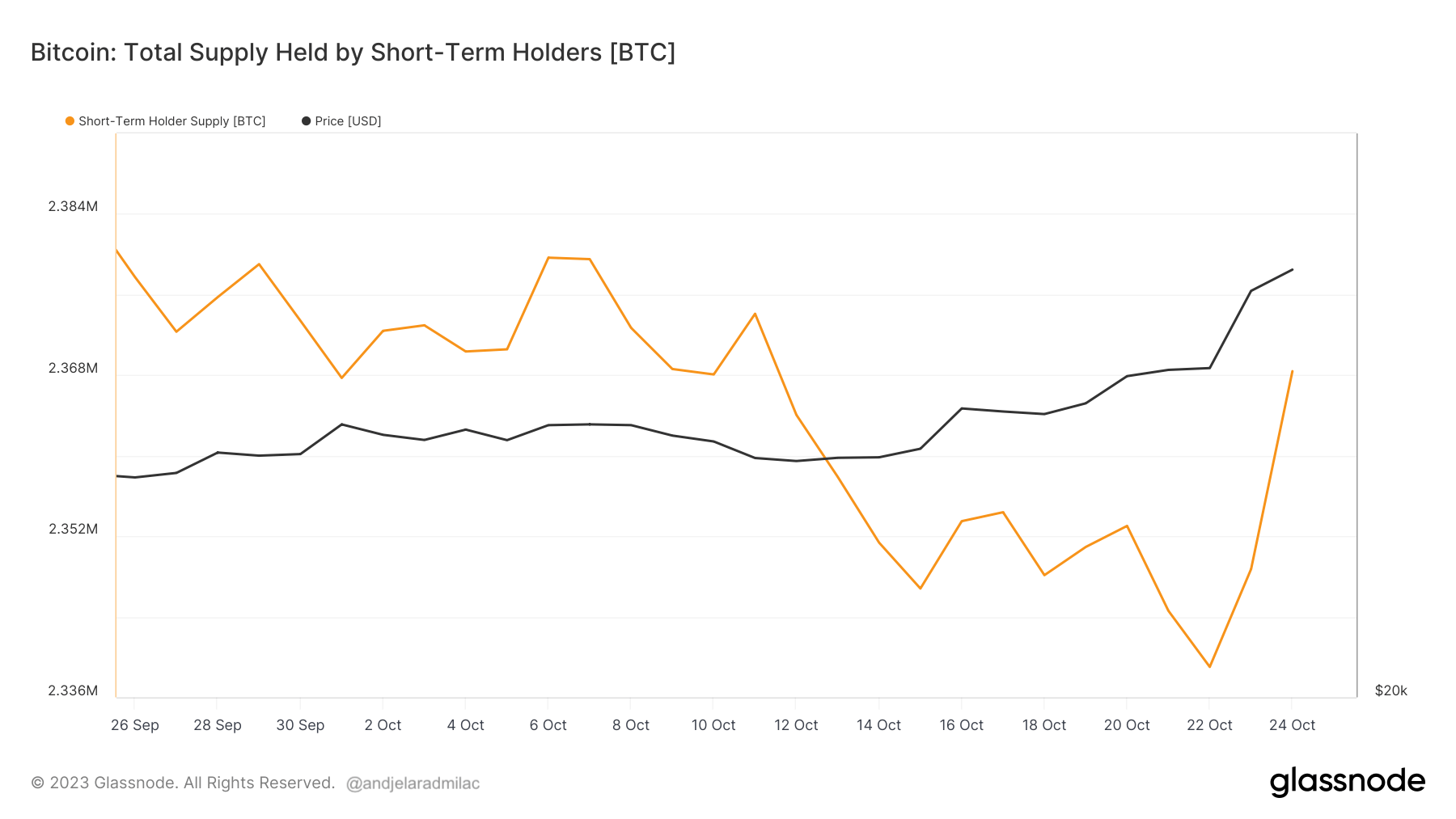

However, the behavior of short-term holders wasn’t solely characterized by optimism. The short-term holder supply, which reflects the amount of Bitcoin held by this group, began to decline rapidly as Bitcoin’s price started its upward trajectory. From 2.354 million BTC on Oct. 17, it decreased to 2.339 million BTC by Oct. 22. This trend mirrors the increase in exchange deposits from short-term holders, as highlighted in a recent CryptoSlate analysis, suggesting that many were capitalizing on the price surge to realize their profits. Yet, the narrative took another twist as the short-term holder supply rebounded, reaching 2.368 million BTC by Oct. 24.

When analyzed collectively, these metrics paint a multifaceted picture of the market. The positive STH-NUPL and STH-MVRV values indicate bullish sentiment among short-term holders. However, the fluctuating short-term holder supply suggests a mix of profit-taking and renewed interest. The initial drop in supply, coupled with increased exchange deposits, points to a significant portion of this group cashing in on their gains. However, the subsequent rise suggests either a return of previous holders or an influx of new ones, possibly driven by FOMO or confidence in Bitcoin’s continued upward trajectory.

The post Bitcoin is soaring, and short-term holders are here for the ride appeared first on CryptoSlate.