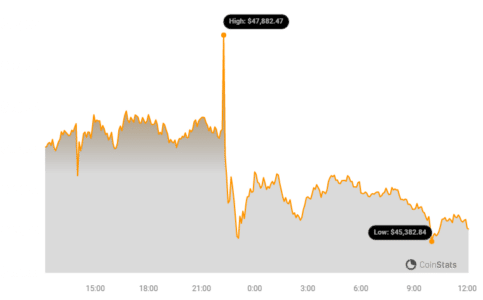

The price of Bitcoin jumped toward $48,000 after the Spot BTC ETF approval post from the hacked SEC X account.

The “misleading” X post caused Bitcoin to spike toward the $47,800 and $48,000 resistance levels.

However, after it was discovered that the X post was fake, Bitcoin trimmed all its gains. Nevertheless, the uptrend support is still intact near $45,200.

At press time, Bitcoin is trading above $45,500 and the 100 hourly Simple moving average.

Bitcoin Price Faces Rejection

Bitcoin price started a fresh increase above the $45,500 resistance zone.

BTC gained bullish momentum above the $46,000 and $46,500 levels after the hacked SEC account tweet about the ETF approval.

After clarification, there was a sharp rejection near the $48,000 zone. A high was formed near $47,988 before the price started a fresh decline.

There was a move below the $47,000 and $46,500 levels. The price dived toward the $45,000 support.

A low was formed near $44,828 and the price is now rising. It is back above the 23.6% Fib retracement level of the recent decline from the $47,988 swing high to the $44,828 low.

See Also: Misleading SEC Tweet Triggered $210m Crypto Meltdown, Did SEC Manipulate The Crypto Market With Fake Tweet?

Bitcoin is now trading above $45,500 and the 100 hourly Simple moving average.

There is also a major contracting triangle forming with resistance near $46,800 on the hourly chart of the BTC/USD pair. On the upside, immediate resistance is near the $465,400 level.

It is near the 50% Fib retracement level of the recent decline from the $47,988 swing high to the $44,828 low.

The first major resistance is $46,800. A clear move above the $46,800 resistance could send the price toward the $47,200 resistance.

The next resistance is now forming near the $48,000 level. A close above the $48,000 level could send the price further higher. The next major resistance sits at $49,250.

If Bitcoin fails to rise above the $46,800 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $45,550 level.

The next major support is $45,200. If there is a move below $45,200, the price could gain bearish momentum.

In the stated case, the price could drop toward the $44,800 support in the near term.

Technical Indicators:

- Hourly MACD – The MACD is now losing pace in the bearish zone.

- Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

- Major Support Levels – $45,500, followed by $45,200.

- Major Resistance Levels – $46,400, $46,800, and $47,200.

The post Bitcoin Price Rejects 48K After The SEC Drama But Uptrend Still Intact appeared first on BitcoinWorld.