Bitcoin’s price premiums have resurfaced amidst the recent bullish fervor gripping the market.

Kimchi premium

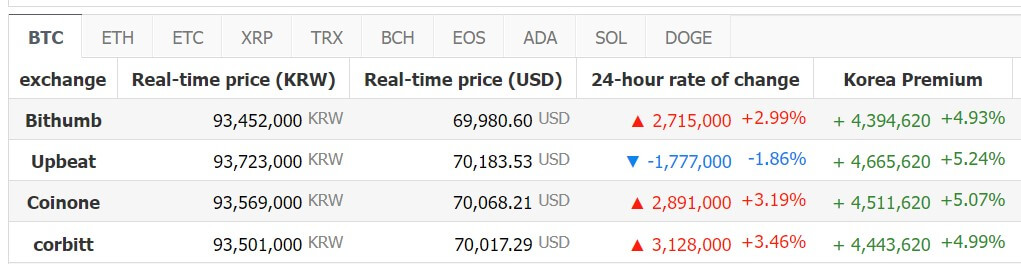

Data reveals BTC trading at a $4,000 premium in South Korea compared to other markets. As of press time, Bitcoin was priced at $66,893 on Binance, while Korean platforms like Upbit, Coinone, and Bithumb boasted prices around $70,000.

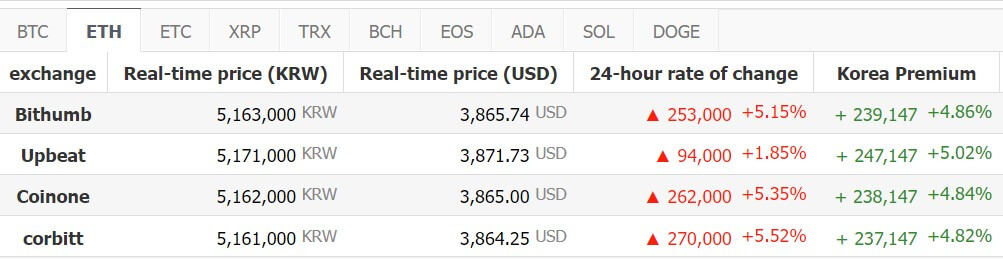

This premium trend extends to Ethereum, the second-largest crypto by market cap. ETH commands around $3,900 on Korean platforms, whereas it hovers around $3,600 on other exchanges.

The Kimchi premium denotes a scenario where a digital asset’s price is notably higher on South Korean exchanges than in US or European markets, opening up arbitrage opportunities for traders with access to both markets.

Typically seen as a bullish indicator, the Kimchi premium suggests increased buyer activity in the Korean market. The premium is also used to deduce robust engagement with digital assets in South Korea.

CryptoQuant’s CEO Ki Young Ju recently highlighted robust institutional demand for BTC in Korea, citing widespread adoption even among older demographics on platforms like Upbit.

While the current premium resurgence isn’t unprecedented, it echoes previous occurrences, notably during bullish cycles such as in 2021 when BTC commanded significantly higher prices on South Korean exchanges than Coinbase and other major platforms.

CME Premium

Similarly, several market observers have identified BTC trading at a premium of over $69,000 on the Chicago Mercantile Exchange (CME) futures, a new all-time high.

They explained that this indicates that traders are willing to pay a premium for the CME because they believe that the price of BTC will continue to increase regardless.

On-chain analytical platform CoinGlass data shows that CME’s BTC open interest hit a record high of almost $10 billion during the past day, while the overall open interest on the flagship asset totals a record high of $32.36 billion.

The post Bitcoin sees return of Kimchi Premium in South Korea and CME futures market appeared first on CryptoSlate.