What was the reason for the recent decline in the price of Bitcoin (BTC), the world’s largest cryptocurrency? Here is the latest situation and liquidation data.

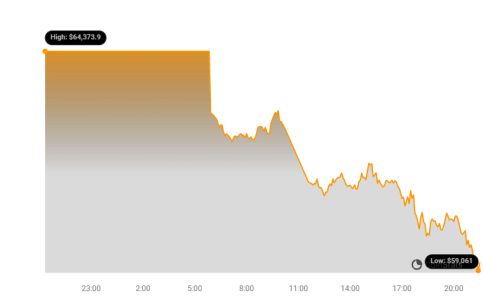

The cryptocurrency market experienced a very deep decline today, led by Bitcoin.

The world’s largest cryptocurrency has fallen to $60,567, which it has not seen since the beginning of May, and is trading at $60,734 at the time of writing. The daily decline rate in BTC was approximately 4%.

During the period when Bitcoin lost so much value, ounce of gold gained 0.32% in value in the last 24 hours and is currently at the level of 2,328 dollars.

The main reason for the decline in BTC price is the former cryptocurrency exchange Mt., which stole thousands of Bitcoins in a hack years ago.

Gox will begin paying BTC and BCH to its creditors. Before this development, the BTC price was in a downward trend and gradually moved away from the $ 70,000 level.

The decline rate in BCH, the other cryptocurrency that the bankrupt cryptocurrency exchange will distribute to its receivables, was recorded as approximately 8%.

The declines are due to the belief that creditors will sell their assets for what they bought. Recently, the German government started to transfer its BTCs to cryptocurrency exchanges, which also fueled the decline.

On the other hand, with the decline in BTC price, many futures positions were liquidated. Crypto assets worth $313 million were liquidated in the last 24 hours. $277 million of these were in short positions.

Sudden declines were observed in almost all of the altcoins, except for some such as Fantom, Injective, LEO, WIF, TIA.