The SEC has approved several spot Ethereum exchange-traded funds (ETFs), allowing them to begin trading on Tuesday, July 23rd after weeks of registration statement revisions.

The U.S. Securities and Exchange Commission gave the green light to registration forms from 21Shares, Bitwise, BlackRock, Fidelity, Franklin Templeton, VanEck, and Invesco Galaxy, with forms for the Grayscale Ethereum Trust and the Grayscale Ethereum Mini Trust also going into effect.

Spot Ethereum ETFs Trading Commences July 23rd, 2024

Official Ethereum ETF “effective” filings are now coming in. https://t.co/G6yOTt0epR

— James Seyffart (@JSeyff) July 22, 2024

On July 22, the US SEC) approved the final S-1 registration statements for the launch of spot Ethereum exchange-traded funds (ETFs) across major stock exchanges, including Nasdaq, the New York Stock Exchange (NYSE), and the Chicago Board Options Exchange (CBOE).

The approved issuers include BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, and Invesco Galaxy.

This approval follows the SEC’s green light on May 23 for rule changes that allowed spot Ether ETFs to be listed and traded. BlackRock’s iShares Ethereum Trust will be listed on Nasdaq, while the Grayscale Ethereum Trust will be on the NYSE.

Most spot Ether ETFs, except for the Grayscale Ethereum Trust, will offer management fees ranging from 0.15% to 0.25%.

Bitwise will offer a competitive 0.20% fee with an initial discount for the first $500 million in assets, contrasting with Grayscale’s higher fee of 2.5% and BlackRock’s 0.25% fee.

Also Fidelity, 21Shares, Franklin Templeton, and VanEck have announced they will waive fees for a certain period or until their products reach specific net asset thresholds.

The Grayscale Ethereum Mini Trust will waive fees for the first six months or until it accumulates $2 billion in assets.

Notably, retail investors will be able to purchase these Ether ETFs through brokerages like Robinhood and Fidelity, similar to other ETFs and stocks.

The anticipated increase in institutional demand could lead to supply shortages, potentially increasing price volatility and driving Ethereum’s price higher.

Listing Approval Process

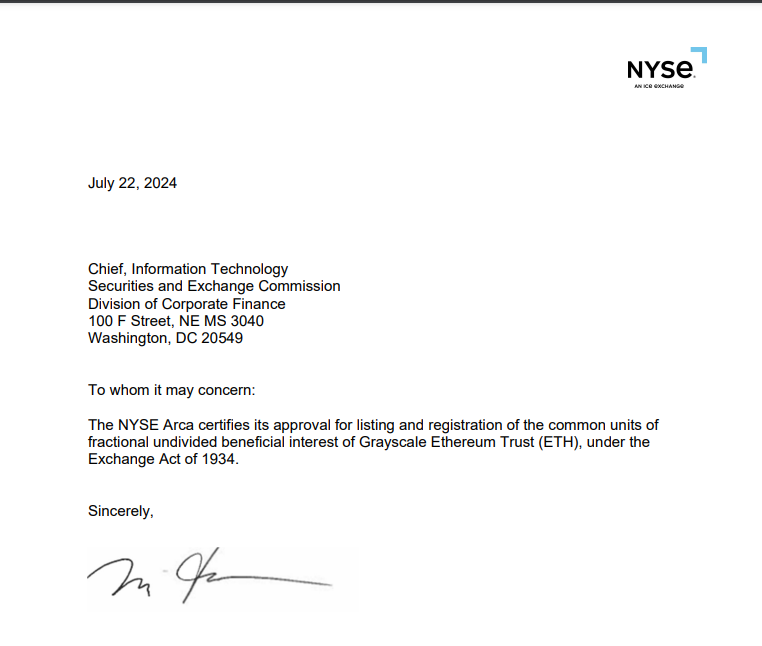

The New York Stock Exchange Arca has confirmed the listing and trading approval for ETFs from Grayscale and Bitwise, marking a significant milestone for regulated exposure to Ethereum.

Simultaneously, the CBOE has confirmed that its proposed spot Ethereum ETFs, including those from Fidelity Investments, Franklin Templeton, Invesco, 21Shares, and VanEck, will commence trading on the same day.

Documents filed with the U.S. Securities and Exchange Commission (SEC) reveal that NYSE Arca has approved the registration and listing of spot Ethereum ETFs from Grayscale and Bitwise under the Exchange Act of 1934.

This certification marks regulatory acceptance and the formal introduction of these financial products to the market, aiming to offer investors a regulated means of gaining exposure to Ethereum.

The listing process involved a comprehensive two-step procedure. The initial step saw the SEC approve 19b-4 forms in May, which is essential for NYSE Arca to proceed with the listing.

The final step, which was finalised on Monday, involves the SEC allowing the registration statements to become effective, enabling the ETFs to commence trading on Tuesday.

Introducing these ETFs could pave the way for additional cryptocurrency-related financial products.

Bloomberg ETF analyst Eric Balchunas noted that the launch of Ether ETFs might open the door to other altcoin ETFs, such as Solana’s native token, SOL.

“Keep in mind after launch there are flows and then additional ETH products I’m sure, then Solana, and then… it’s probably never going to end. The dam has broken,” Balchunas stated.

While optimism surrounds these new financial products, some analysts speculate that these spot ETFs could drive ETH to unprecedented price levels, with predictions of up to $100k and beyond.

The post Spot Ethereum ETFs Approved for Trading Tuesday After SEC Greenlight appeared first on Cryptonews.