Circle, issuer of the the second-largest stablecoin by market capitalization, USD Coin, has officially launched USDC on Sui, a Layer-1 blockchain.

Sui is the first blockchain using the Move programming language to support native USDC, opening up new possibilities for developers and users alike, according to Circle’s blog post from Oct. 9.

Navi Protocol, Sui’s lending platform with $364 million in total value locked (TVL), is the first to integrate USDC.

Native $USDC is now live on @SuiNetwork!

Sui is a layer-1 blockchain designed for scalability, speed, and affordability and the first using the Move programming language to support native USDC!

Learn how developers are using USDC in the Sui ecosystem.

… pic.twitter.com/GcR0ebVP5k

— Circle (@circle) October 8, 2024

Expanding Opportunities for Sui Developers

Developers can now leverage USDC in the Sui ecosystem to power innovative applications, such as building U.S.-dollar-backed financial products, creating decentralized finance (DeFi) apps, and holding savings digitally.

In the case of Sui, there also exists a “bridged” form of USDC known as wUSDC, which is USDC that has been transferred from Ethereum through Wormhole, Uniswap’s multichain protocol. Bridged USDC is not issued by Circle and is not compatible with Circle Mint or Circle APIs.

Native USDC issued by Circle is redeemable 1:1 for U.S. dollars and is available on both the mainnet and testnet of Sui. Bridged USDC from Wormhole is also available on the Sui mainnet.

Wormhole has played a crucial role in the growth of bridged USDC on Sui. With Cross-Chain Transfer Protocol (CCTP) coming soon to Sui, Wormhole will continue to be a key integration partner, empowering developers and users to transfer USDC natively between blockchains, according to the blog post.

CCTP offers a secure and capital-efficient way to transact with USDC across supported blockchains without requiring liquidity lock-ups. Sui’s integration with CCTP will enable developers to create seamless cross-chain experiences by connecting their Sui apps to other blockchains like Arbitrum, Base, Ethereum, Solana, and more.

Developers can refer to the migration guide for options on migrating bridged USDC to native USDC in their apps.

More Apps Join the USDC Party

According to Circle, many leading ecosystem apps are expected to support native USDC on Sui for DeFi, gaming, DePIN, ecommerce, and more. This includes prominent projects like Cetus Protocol, Mysten Labs, the aforementioned Navi Protocol, Suilend Protocol, and more. USDC on Sui will also be available on Coinbase soon.

Businesses and institutions can easily access on/off-ramps for USDC on Sui using Circle Mint and its APIs. Circle Mint also facilitates seamless deposit and withdrawal of USDC between supported chains, avoiding the costs and delays associated with third-party bridging.

Developers can build on a stable foundation that is officially supported by Circle. USDC is an open-source, permissionless protocol, enabling any app to send and store digital dollars.

With the addition of Sui, USDC is now natively supported on 16 blockchain networks, further solidifying its position as a leading stablecoin in the cryptocurrency ecosystem.

Sui’s Rise in the DeFi Landscape

Sui is a Layer-1 blockchain based on Proof-of-Stake (PoS), offering fast and cost-effective transactions. Its approach, known as “transaction parallelization,” enables the parallel processing of transactions, leading to improved data organization within the consensus mechanism.

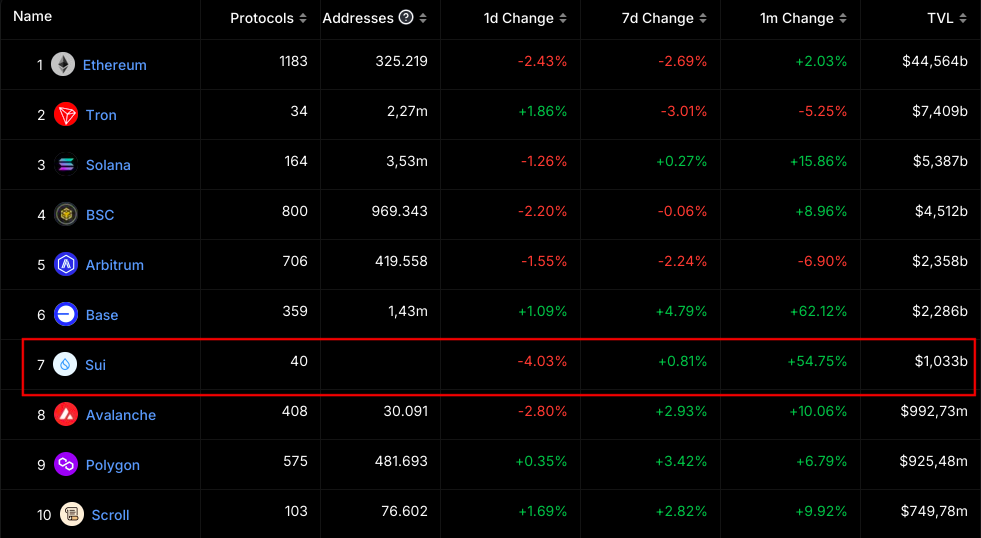

Sui has experienced remarkable growth since its launch last year. The Sui chain has rapidly ascended to the seventh position in terms of TVL, surpassing established chains like Avalanche and Polygon.

With over $1 billion in TVL, Sui’s DeFi ecosystem is nearly three times larger than Cronos and five times greater than Cardano’s.

As of Oct. 9, the SUI token is valued at $1.91, representing a significant increase of 106% over the past 30 days.

The post Native USDC Now Available on Sui Through Navi Protocol appeared first on Cryptonews.