The U.K. says it has cracked open multibillion-dollar money laundering networks that relied heavily on cryptocurrencies to conceal wealth and move it internationally.

“Operation Destabilise” was the brainchild of the National Crime Agency, and exposed malicious actors “supporting serious and organized crime around the world.”

Two Russian networks in particular, known as Smart and TGR, played an instrumental role in helping traffickers — as well as wealthy oligarchs — bypass restrictions.

Investigators describe a scheme where fiat currency collected by drug gangs was converted into digital assets that had been stolen by cybercriminals through ransomware attacks and hacks.

This ultimately made illicit funds much harder for crime agencies to trace, all while reducing the flow of funds across international borders.

According to the NCA, the use of crypto created a vicious cycle, as it meant gangs were able to buy greater volumes of drugs and weapons without detection.

Underlining the significance of this sting, the NCA’s director general of operations Rob Jones said:

“For the first time, we have been able to map out a link between Russian elites, crypto-rich cyber criminals, and drug gangs on the streets of the UK.”

He added that the investigation has caused widespread disruption to this criminal service — with more than 80 arrests made and crypto worth millions confiscated.

In separate developments, the U.S. has now sanctioned six people who were involved in running Smart and TGR — meaning any property they have on American soil is frozen.

Bradley Smith, the acting undersecretary for terrorism and financial intelligence at OFAC, added:

“Through the TGR Group, Russian elites sought to exploit digital assets — in particular U.S. dollar-backed stablecoins — to evade U.S. and international sanctions, further enriching themselves and the Kremlin.”

OFAC says Tether was widely used to sidestep these sanctions and launder funds — and overall, the network extended across more than 30 countries.

Both networks had helped Russian ransomware groups to launder ill-gotten gains, with official estimates suggesting £27m ($34m) was extorted from 149 victims in the U.K. alone.

One of them was Ryuk, which encrypted data on infected systems and held it hostage until cryptocurrency was paid.

This targeted organizations rather than individuals — including hospitals around the world. Some medical centers were left crippled and unable to provide critical care for patients.

Schools and businesses were also affected, with detectives warning it’s difficult to assess Ryuk’s full impact and reach.

While some operations amount to nothing more than a slap on the wrist for the networks that are exposed, the NCA says its action has inflicted real damage, adding:

“This activity has also been extremely costly to the networks, who are assessed to operate on very low profit margins – often charging as little as 3% commission for the amount laundered. Based on this figure, they would need to launder around £700m for free to pay back the £20m seized by the NCA and partners.”

There were also uncomfortable allegations leveled at the Russian crypto exchange Garantex, with both money-laundering networks at the heart of Operation Destabilise said to have “regular exposure” to this platform.

That plays into wider concerns that recent changes to the country’s crypto legislation could be used as an instrument for sanctions evasion, with tighter restrictions initially imposed following Vladimir Putin’s invasion of Ukraine.

Dan Jarvis, a British security minister, described the NCA’s sting as “a significant step against economic crime,” adding:

“Op Destabilise has exposed Russian kleptocrats, drug gangs and cyber criminals — all of whom relied on the flow of dirty money.”

Nonetheless, keeping up with the murky world of organized crime can sometimes feel like a never-ending game of Whac-A-Mole. When money-laundering networks, darknet markets and ransomware strains are taken down, new ones often end up emerging in their place, with bad actors especially emboldened to operate during bull markets.

Critics will be quick to argue that this latest operation is further proof that crypto is a “Wild West” that allows malicious actors to operate in the shadows with impunity.

But this doesn’t acknowledge how on-chain investigations orchestrated by the likes of Chainalysis bring the flow of illicit crypto funds into the open, with a level of transparency that cash can never match.

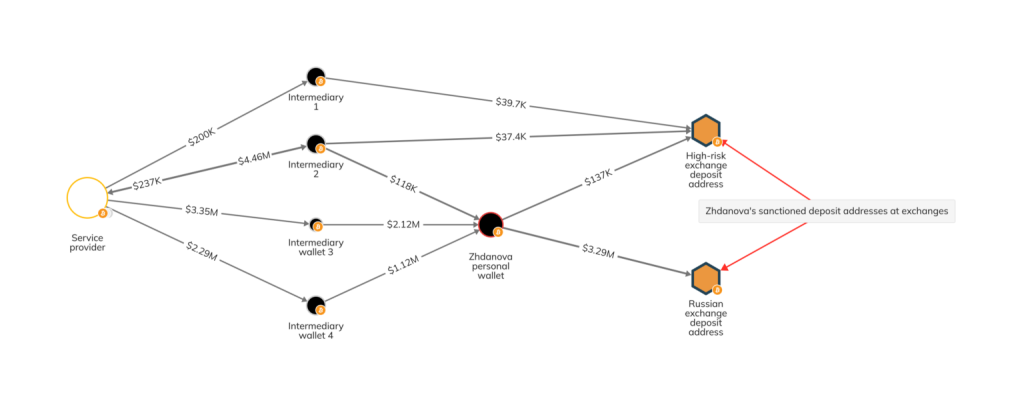

The company has produced intricate graphs that show the connections between service providers, intermediary wallets and the addresses relied on by linchpins in this operation.

And given its official estimates suggest just 0.34% of total on-chain transaction volumes in 2023 were linked to crypto crime, it’s important to put all of this into context.

Operation Destabilise shows digital assets still hold appeal for money launderers, drug kingpins and gangs concealing vast wealth. We’re yet to reach a point where transacting in Bitcoin is prohibitively difficult for those on the wrong side of the law.

The post How Much Did Operation Destabilise Damage Crypto Criminals? appeared first on Cryptonews.