It’s been a quiet begin to the 12 months in crypto markets, with the Ethereum (ETH) value transferring sideways within the $3,300s now for round one week.

However volatility is coming, and is prone to hit very quickly. Chart evaluation suggests ETH might expertise declines within the short-term.

The Ethereum value is at present beneath each its 21 and 50DMAs and beneath the important thing short-term resistance space round $3,500.

A retest of key help within the type of the 200DMA round $3,000 may very well be on the playing cards. However merchants would do nicely to not count on the draw back to final lengthy.

US President Donald Trump’s November election victory tees up the prospect of a brand new golden age for the US crypto trade and broader markets over the following 4 years, which is about to spur adoption at an unprecedented charge.

Furthermore, historic value patterns recommend that an Ethereum value surge may very well be proper across the nook.

Ethereum Value Explosion Imminent?

Incoming pro-crypto US President Donald Trump is about to land within the White Home with an administration filled with crypto trade supporters and advocates.

In the meantime, anti-crypto sitting SEC Chair Gary Gensler is about to depart in favor of Trump’s choose Paul Atkins, which ought to kickstart a brand new period of SEC/crypto trade cooperation, slightly than the present adversarial surroundings.

In the meantime, the incoming pro-crypto Congress is anticipated to approve pro-crypto trade laws to provide the trade readability.

They might even vote in favor of laws to construct a strategic Bitcoin reserve, which Trump might additionally kickstart by way of an government order.

#Bitcoin will go parabolic after the Trump inauguration.

pic.twitter.com/yUThE9U0Lu

— Crypto Rover (@rovercrc) December 29, 2024

All of that is nice for Bitcoin. However its even higher for altcoins like Ethereum. Whereas anti-crypto forces within the US in the previous couple of years weren’t in a position to block the institution of Bitcoins ETFs (or Ethereum ETFs), they have been in a position to considerably stifle innovation and suppress altcoins costs.

Meaning altcoins have nice room for a restoration versus Bitcoin, which already flew to document highs at $108,000 in December.

All of which means January may very well be an excellent month for ETH. Certainly, the Ethereum value might fast fly again to multi-year highs above $4,000 if it is ready to get above $3,500 resistance.

Whereas the basic outlook for ETH is nice, its price additionally contemplating historic value patterns, which additionally paint a bullish image.

This Key Historic Value Sample Suggests Ethereum ATHs Are Close to

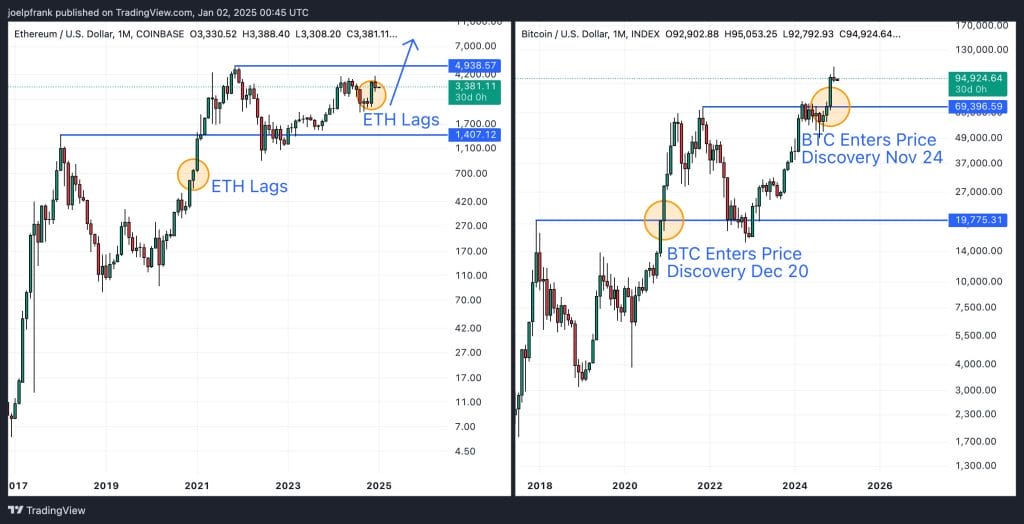

In the course of the previous crypto bull market cycle, when Bitcoin entered a brand new and aggressive part of value discovery in December 2020, Ethereum was lagging behind and nonetheless nicely beneath its 2017 document highs.

While ETH carried out nicely in January 2021, it didn’t enter full-blown value discovery till February 2021.

In 2024, Bitcoin entered full-blown value discovery in November and Ethereum remains to be languishing nicely beneath its document highs.

If historical past is about to repeat itself, which the sturdy basic backdrop suggests is probably going, the Ethereum value may very well be near surging again to retest document highs.

That would doubtlessly tee up an ETH coming into a brand new part of value discovery in February above $5,000.

There stays loads of Ethereum hate and FUD on the market. Sure, different chains are quicker, cheaper and are processing extra transactions, and there’s a lot of improvement happening exterior of the Ethereum ecosystem.

However to assume which means Ethereum gained’t stay a dominant participant is misguided. Firstly, it stays the oldest and most trusted DeFi chain with a commanding 56% of TVL in good contracts, per DeFi Llama.

Dozens of the world most influential companies are constructing on it.

This contains Wall Avenue chief BlackRock, with Ethereum primarily their chosen DeFi chain.

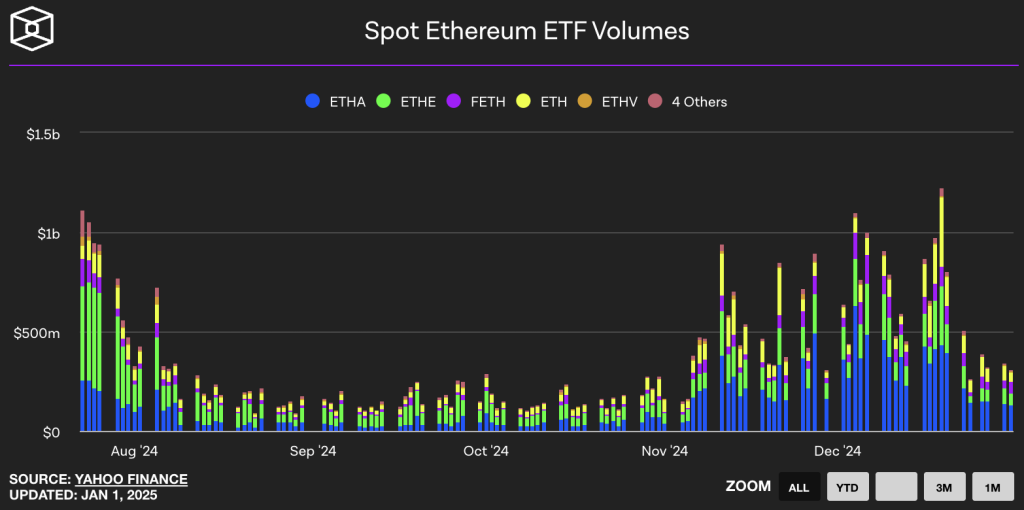

On the final day of 2024, the ETH ETFs had better web inflows than the BTC ETFs

+$36 million for ETH and +$5.3 million for BTC

2025 belongs to Ethereum and ETH— sassal.eth/acc

(@sassal0x) January 1, 2025

With BlackRock’s backing, and given its standing as the one different main crypto aside from Bitcoin to have secured spot ETFs within the US, Ethereum is primed for substantial institutional inflows, which have already been selecting up in latest weeks, per The Block.

Per Steno Analysis, the Ethereum value is about to rocket up greater than 2x to above $8,000 in 2025.

Steno Analysis predicts unprecedented crypto progress and new all-time highs in 2025

Steno Analysis predicts 2025 would be the crypto market’s greatest 12 months but, with Bitcoin and Ethereum hitting new all-time highs, reaching 150k and 8k, respectively. The bullish outlook is pushed by… pic.twitter.com/n50eqBGUuZ— The O Present (Wendyo.eth) (@The_O_Show_) January 1, 2025

Bears beware. This bull market possible has plenty of gasoline left within the tank. Brief at your individual peril.

The submit Ethereum Value Explosion Imminent, This Historic Value Sample Predicts appeared first on Cryptonews.