Key Takeaways:

- The rising dangers of full-scale battle in Europe, the Center East, and elsewhere might “translate to heightened scrutiny” of crypto this 12 months.

- Crypto corporations should be ready to defend their actions, relationships, and transactions, analysts say.

- As well as, the potential launch of a number of CBDCs implies that the business will probably “see a big variant of regulatory controls established in 2025.”

The specter of an all-out international warfare continues to solid a shadow on world economies going into 2025. The crypto business, which celebrated Bitcoin’s $100,000 milestone in late 2024, won’t be spared.

Apart from, there are some attention-grabbing regulatory adjustments to look at within the new 12 months, together with the European Union’s (EU) Markets in Crypto-Property (MiCA) regulation and Donald Trump in workplace.

International conflicts have historically inspired speculative funding. Nonetheless, in line with 4 consultants who spoke to Cryptonews, they’ve additionally prompted financial sanctions and larger authorities management of the markets.

“Uncertainty can both encourage funding the place alternatives are recognized or set off profiteering because the warfare machine slowly prompts,” stated Mark Taylor, head of economic crime at crypto change CEX.io.

“Alternatively, it could possibly discourage involvement by exposing vulnerabilities and creating a necessity for stronger controls, each regionally and internationally, by measures like sanctions,” he added.

Specialists say that Bitcoin, as a proxy for the crypto business, introduces a brand new dynamic to the complicated. That’s due to Bitcoin’s fledgling repute as a gold-like retailer of worth, in a position to stand up to war-related market stress.

In keeping with Taylor, the rising dangers for full-scale battle in Europe, the Center East, and elsewhere might “translate to heightened scrutiny” for cryptocurrency corporations this 12 months. He advised Cryptonews:

“They [crypto firms] should be ready to defend their actions, relationships, and transactions, generally lengthy after they happen, as their actions might later be examined within the context of world geopolitical occasions. There isn’t a doubt that such occasions affect markets and confidence.”

For context, geopolitical tensions to look at in 2025:

- The return of assertive and territorial U.S. President Donald Trump to arguably the world’s strongest workplace.

- Russian President Vladimir Putin’s threats to cross “crimson strains,” resembling internationally agreed safeguards in opposition to nuclear warfare, in response to NATO’s help for Ukraine’s warfare effort.

- Ukraine’s counter-offensive efforts and Russia’s escalating aggression.

- Rising tensions within the Center East, with regional powers Israel and Iran exerting affect, whereas the U.S. and Russia stay concerned within the background.

- Regional struggles to fill the geopolitical vacuum left by the autumn of Syrian strongman Bashar al-Assad.

Banking ‘Unlawful Wars’

Rising battle within the Center East and the specter of world warfare will encourage extra sanctioned regimes like Russia, Iran, and North Korea to make use of Bitcoin somewhat than fiat forex, says Slava Demchuk, the CEO of compliance and blockchain forensics agency AMLBot.

“Russian companies are utilizing crypto property to make cross-border transfers, evade sanctions, and launder cash,” Demchuk alleged.

“We might anticipate that the G7 and the Western world might provide you with new measures specializing in crypto enterprise to stop loopholes permitting Russians to evade sanctions,” he stated in an interview with Cryptonews.

The transfer to crypto evasion comes after Russian banks had been sanctioned and faraway from the U.S.-linked SWIFT worldwide cost system.

Dacian Cimpean, digital advertising and marketing specialist at decentralized apps platform MultiversX, noticed that instability drives actors in the direction of safe-haven property.

For instance, he famous that oil costs surged above $100 per barrel at the beginning of the Russia-Ukraine battle in 2022, contributing to inflationary pressures and financial coverage evaluations worldwide.

“On one hand, digital property like Bitcoin are generally seen as alternate options to conventional secure havens, attracting traders throughout occasions of turmoil,” Cimpean advised Cryptonews.

“This notion has been evident in international locations going through financial instability, the place residents flip to cryptocurrencies to protect wealth.”

He added:

“Conversely, heightened geopolitical dangers can result in elevated regulatory scrutiny and potential restrictions on crypto transactions, as governments goal to stop capital flight or sanction evasion. Such measures can dampen market sentiment and introduce volatility.”

Is Bitcoin Really a Protected-Haven Asset?

BRICS+, primarily made up of Brazil, Russia, India, China, and South Africa, are toying with the concept of a collective central financial institution digital forex (CBDC) that may pace up their de-dollarization drive.

The plan to decrease greenback affect utilizing crypto property faces two main hurdles. One is the withdrawal of M-Bridge, the Dutch platform that the nations hoped to make use of for the challenge. The opposite is U.S. President-elect Trump’s menace to suffocate the challenge.

The concept that the BRICS Nations are attempting to maneuver away from the Greenback whereas we stand by and watch is OVER. We require a dedication from these Nations that they’ll neither create a brand new BRICS Foreign money, nor again some other Foreign money to exchange the mighty U.S. Greenback or, they…

— Donald J. Trump (@realDonaldTrump) November 30, 2024

In 2020, Venezuela turned to a government-issued crypto token, Petrodollar, to handle the consequences of U.S. sanctions on its troubled democracy.

Shocked by sanctions in opposition to its nuclear program, North Korea turned to hack crypto funds, to beef up its protection finances. The UN reviews that the pariah state raised $2 billion by cybercrime between 2019 and 2020.

These current episodes symbolize how cryptocurrency has been implicated in geopolitical wrangling.

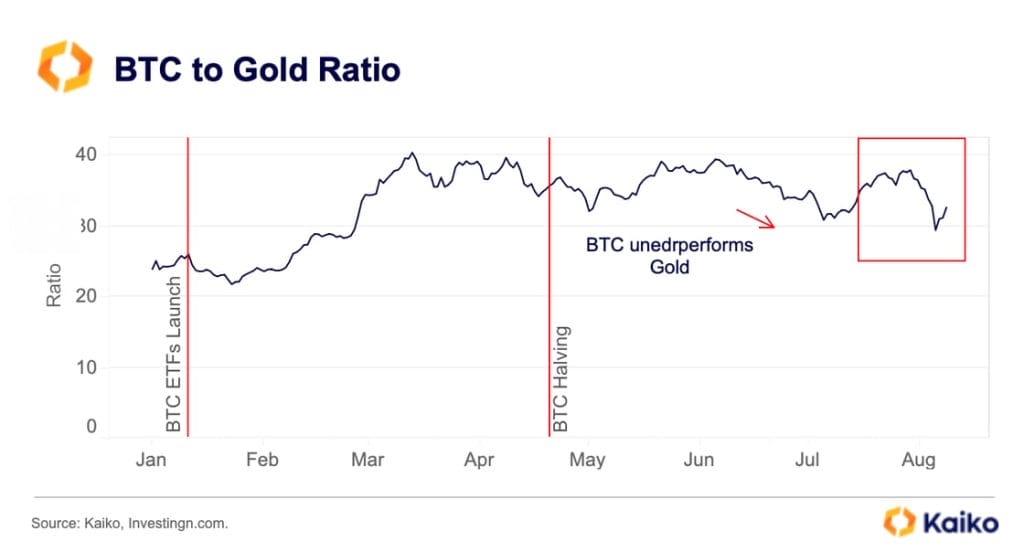

However Bitcoin has not all the time handed the safe-haven check. For instance, BTC plunged 16% because the inventory market crash of Aug. 5, 2024, rippled by crypto markets. By comparability, gold confirmed extra resistance, retreating simply over 1%.

In April, Bitcoin’s market worth fell 6% regardless of a surge in demand for safe-haven property because the battle within the Center East escalated.

Alternatively, gold rose 8%, and the U.S. greenback additionally rallied. Equally, in October 2023, Bitcoin was comparatively unchanged after the Hamas assault on Israel.

Regulatory Outlook: ‘Much less Onerous, Much less Safety’

Within the U.S., the Trump Commerce is again in play, with Bitcoin taking pictures previous the psychological $100,000 mark following Trump’s election win.

In keeping with analysts, listed below are among the regulatory occasions to look at in 2025:

- Europe — The MiCA regulation, which got here into impact on Dec. 30, 2024.

- U.S. — Donald Trump’s election as President and nominating crypto-friendly lawyer Paul Atkins to steer the SEC.

- The potential passage of the Readability for Cost Stablecoins Act to information stablecoin issuers in the USA.

- Measures to simplify tax reporting, cut back evasion, and make sure the crypto market contributes to tax revenues

- Fast passage of clear laws from a crypto-friendly Parliament of U.Okay. — FCA’s newly launched roadmap for crypto regulation

- Australia — Ongoing authorities evaluation of crypto-related markets and ASIC’s regulation by enforcement stance.

- Asia — DABA in South Korea, and persevering with improvement in regulation in Japan, Hong Kong, China, and Singapore.

- Latin America — rising crypto guidelines.

“All of this, together with the potential launch of a number of CBDCs, means we’ll probably see a big variant of controls established across the globe in 2025,” stated Taylor, the CEX.io monetary crime head.

Taylor advised Cryptonews that the inconsistency will rely on whether or not governments view crypto in a optimistic or adverse gentle, including:

“For the U.S., the long run seems to be like there will likely be much less onerous regulation, however due to this fact probably much less safety. In Europe, we are able to anticipate a complete regulatory construction that may assist develop markets and strengthen the method of crypto corporations.”

Nonetheless, the EU may even “introduce complicated necessities, together with areas like market abuse and commerce surveillance, which will likely be costly and difficult to implement in crypto markets,” he stated.

These kind of issues may have knock-on results which will nicely drive regulatory expectations and compliance for the subsequent 5 years or so, Taylor says, including:

“Crypto corporations will want adaptability, experience, and resilience to experience the uncertainty and hold regulators completely satisfied.”

Luc Froehlich, chief industrial officer at crypto corporations’ free zone RAK Digital Property Oasis, is, for probably the most half, optimistic in regards to the European Union’s new rules.

“The EU’s MiCA framework is especially promising, particularly given the dimensions of the market it’ll open,” Froehlich advised Cryptonews.

On the flip facet, the character of Europe as a bloc introduces challenges as there could be friction on a nationwide stage, ensuing within the want for extra regulation.

“With hubs like Singapore and Hong Kong, Asia has managed to remain nimbler and get forward of the race to draw corporations with more and more crypto-accommodative rules, though with the occasional pace bump,” Froehlich famous.

“This complicated leaves the Center East, notably the UAE, in a candy spot, straddling the East and West, providing a launchpad for international corporations and demonstrating a transparent urge for food for blockchain-based options,” he opined.

How US Crypto ETFs Might Form Laws

When requested about how the U.S. Securities and Alternate Fee’s (SEC) approval of spot Bitcoin and Ethereum exchange-traded funds (ETFs) might form regulatory frameworks for crypto property in 2025, AMLBot’s Demchuk stated:

“Institutional ETF flows have traditionally modified market dynamics. Comparable approvals won’t solely bolster adoption but in addition encourage regulatory our bodies to create clearer, extra constant tips that accommodate each conventional finance (TradFi) gamers and the broader crypto ecosystem.”

Froehlich disagrees that the SEC’s approval of crypto ETFs is a “watershed second” for the business.

He questions the mere concept of centralizing possession of Bitcoin, which many individuals within the crypto business contemplate the “most decentralized asset.”

“Bitcoin must be thought of for its personal deserves and never essentially held as consultant of the general ‘asset class’ or different cryptocurrencies,” he stated.

Cimpean, the MultiversX digital advertising and marketing specialist, expects the Trump administration to provide you with “swift legislative motion, together with the probably passage of the Readability for Cost Stablecoins Act.”

“This laws might present regulatory readability and encourage broader adoption of stablecoins within the monetary system,” he stated.

However he additionally warned that “Stricter oversight might restrict stablecoin development in rising markets and impose further burdens on traders and exchanges.”

The publish International Battle and Tighter Legal guidelines Might Derail Crypto in 2025: Specialists appeared first on Cryptonews.