Key Takeaways:

- Bitcoin (BTC) rose above the psychological $100,000 mark in 2024, setting the stage for a good larger enhance in 2025.

- Analysts anticipate the rally to proceed this 12 months however consider that Solana, Chainlink, and Bittensor will rise sooner.

- DeFI-related altcoins Aave, Ethena, and Uniswap are additionally tipped to soar.

Bitcoin (BTC) broke data in 2024, hitting an all-time excessive of $108,200 in mid-December. Market analysts anticipate the rally to proceed this 12 months, spurred by discuss of a strategic Bitcoin reserve within the U.S. and elsewhere.

However as 2025 unfolds, many buyers are maintaining a tally of altcoins that might probably outperform Bitcoin. With perception from business specialists, we take a look at three altcoins – crypto belongings aside from BTC—that present promise for vital progress.

24h7d30d1yAll time

Solana (SOL)

Solana has emerged as a frontrunner within the crypto sector, displaying huge progress and fast tech enhancements since its launch in 2020.

In response to Valeriy Yasakov, CEO of the Telegram-based crypto buying and selling mini-app The One, the crypto neighborhood is “buzzing about Solana” due to what he referred to as the blockchain’s “technological superiority.”

He pointed to Solana’s clear benefit over Ethereum – the community that pioneered good contracts – by way of transaction processing velocity and prices. Ethereum’s Ether (ETH) token is the second most dear cryptocurrency after BTC.

The newest information exhibits that Solana can course of transactions 90 occasions sooner than Ethereum. As of Jan. 13, Solana processed over 1,255 transactions per second (TPS) at a median price of $0.00026 per transaction.

That compares with simply 13 transactions processed each second on Ethereum, with common transaction charges of $0.17, per Etherscan information.

Some specialists speculate that Solana’s structure would possibly even enable for as much as 710,000 TPS on a so-called “commonplace gigabit community.”

“This blazing efficiency is attracting builders and customers alike, positioning Solana because the premier platform for decentralized functions and DeFi tasks,” Yasakov instructed Cryptonews.

24h7d30d1yAll time

In 2021, the value of Solana, or SOL, the eponymous native token of the Solana blockchain, soared almost 12,000%. In 2024, SOL climbed about 90%, remaining one of many largest cryptocurrencies by market cap.

SOL’s whole market worth briefly rose above $100 billion in late November, when its worth peaked at $253. As of this writing, SOL is down 2.1% to $182 on the day, with a market capitalization of round $88.4 billion.

“…Solana will break by way of resistance ranges and probably attain $400-$750 within the close to future,” Yasakov predicted.

He spoke about Solana’s increasing ecosystem and the way the “meme coin mania,” fueled by meme coin launchpads reminiscent of Pump.enjoyable, has boosted the community’s visibility and buying and selling quantity.

In response to CoinGecko, the Solana blockchain now hosts hundreds of meme cash, with a mixed market cap of $16.7 billion and a 24-hour buying and selling quantity of $4 billion.

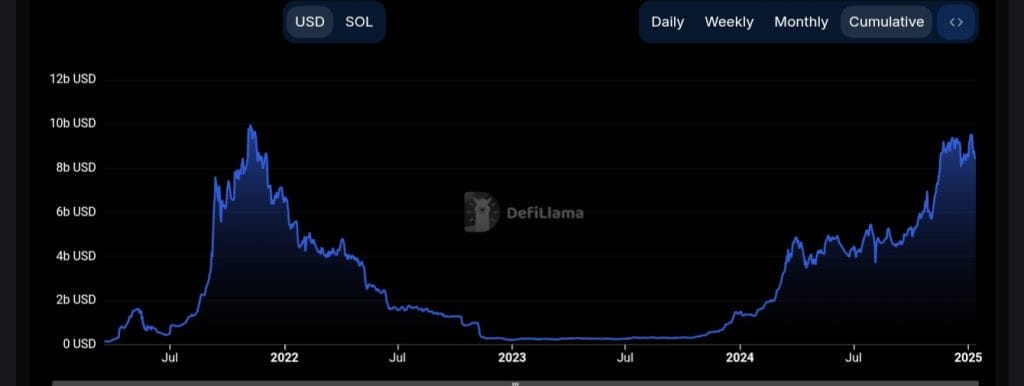

As well as, the community’s Complete Worth Locked (TVL) has elevated, climbing greater than 500% to $8.6 billion in 2024, in response to DefiLlama. Yasakov mentioned this exhibits the rising adoption of Solana in DeFi.

“That is doubtless just the start of Solana’s trajectory,” he mentioned. “As we glance towards 2025, the community is poised for even larger adoption as ‘severe’ tasks start to leverage Solana’s technological benefits.”

Yasakov added, “some decentralized exchanges on Solana are actually seeing increased buying and selling exercise than their Ethereum counterparts…[a shift that] may very well be the catalyst that propels SOL to new heights.”

Chainlink (LINK)

Chainlink is one other cryptocurrency that Yasakov expects to outperform Bitcoin this 12 months. As an oracle community, Chainlink “performs a important function in connecting blockchain good contracts to real-world information,” he says.

In cryptocurrency, oracles are principally what Yasakov described—third-party companies that present trusted info to good contracts from the skin world, reminiscent of costs or trade charges.

He sees worth in Chainlink’s “strategic pivot” towards asset tokenization. “This transfer aligns completely with the rising development of bringing conventional monetary belongings to the blockchain,” Yasakov instructed Cryptonews by way of electronic mail.

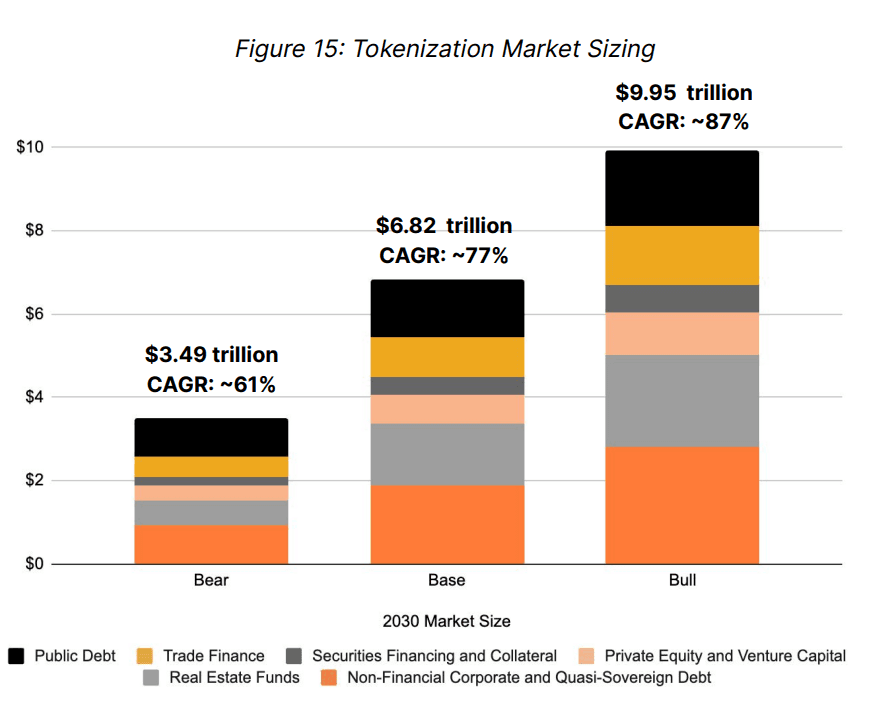

In response to a 2023 report by crypto asset administration agency 21.co, the marketplace for tokenized belongings might attain $10 trillion in a “bull case” and $3.5 trillion in a “bear case” by the top of this decade.

Different experiences have made comparable projections, together with Chainlink itself.

“The convergence between crypto and conventional asset lessons, together with fiat currencies, equities, authorities bonds, and actual property, is experiencing an unprecedented progress,” mentioned the 21.co report.

“Crypto is transitioning from frenzy to synergy. Via this transition, crypto will more and more combine with present monetary software program and produce RWAs on-chain by way of tokenization,” it added.

A rising variety of entities are placing conventional monetary merchandise reminiscent of non-public fairness, debt, and actual property onto the blockchain—a class dubbed real-world belongings (RWA) within the crypto business.

The Chainlink report, launched in September 2024, valued the tokenized asset market at $119 billion, with good contract on the Ethereum community holding 58% of all tokenized belongings. Tron (TRX) and Solana had a piece of the market share, too.

“By partnering with main monetary establishments to facilitate this transition, Chainlink might place itself on the forefront of a monetary revolution,” mentioned Yasakov, the CEO of The One crypto buying and selling platform.

He added:

“LINK is now not only a crypto mission – it’s positioning itself because the spine of a decentralized monetary market infrastructure, fixing trillion-dollar inefficiencies.”

As of this writing, the value of LINK is down 4.5% at $19. Over the previous 52 weeks, the token has climbed 35% however stays 63% off its peak of $52 reached in Might 2021. LINK’s whole market cap is presently at $12 billion.

Bittensor (TAO)

Yasakov mentioned Bittensor represents what he sees as “an intriguing intersection” of two of the most well liked developments in tech: cryptocurrency and synthetic intelligence (AI).

With a restricted provide mirroring Bitcoin’s shortage mannequin of a most of 21 million cash, Yasakov says, “Bittensor has in-built deflationary stress”.

“Because the demand for AI options continues to develop, Bittensor’s function in enabling decentralized AI networks might drive vital worth appreciation,” he mentioned.

“Nevertheless, it’s vital to notice that the AI crypto house continues to be in its infancy and extremely unstable. Whereas Bittensor exhibits promise, buyers must be ready for fast shifts in market sentiment,” Yasakov added.

As Cryptonews beforehand reported, specialists say that AI will work together extra with crypto and improve the performance of blockchain tech in 2025.

They consider AI-powered options on the software stage, quite than AI tokens, would be the actual game-changer. In decentralized finance (DeFi), synthetic intelligence will act as “each a passive assist and an energetic participant.”

As of this writing, the value of TAO has fallen over 7% to $410. Within the final 12 months, the token has soared 85%, reaching a complete market cap of $3.3 billion.

Georgii Verbitskii, founding father of web3 platform Tymio and former managing director of eToro Russia, expects that extra individuals will begin utilizing DeFi companies to handle their digital capital this 12 months.

“Altcoins that show to be helpful will flourish,” he instructed Cryptonews.

Verbitskii’s high altcoin picks for 2025 all relate to decentralized finance, together with Aave, Ethena, and Uniswap, which he described as “the most important incomes protocols with clear product market match.”

“If the regulatory scenario improves, they usually implement ‘charge change’, which permits distributing protocol earnings amongst token holders, these altcoins stand all possibilities of outperforming BTC in 2025,” he predicted.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation. You could possibly lose your whole capital.

The publish 3 Altcoins That Might Outperform Bitcoin in 2025 appeared first on Cryptonews.