For years, cryptocurrency has been heralded as the way forward for cash—a revolutionary pressure able to reshaping world finance. But, regardless of its meteoric rise in market worth, crypto stays largely caught within the margins. Why? as a result of the methods underpinning it had been by no means constructed for the calls for of a contemporary, world, and, extra importantly, inclusive economic system.

Legacy blockchain networks like Bitcoin had been groundbreaking of their time 10 years in the past. They confirmed the world what was potential with decentralized expertise. However their evident limitations now maintain your entire trade again. These methods are sluggish, costly, and incapable of dealing with the transaction volumes required for world, on a regular basis funds. If crypto is to attain mass adoption, the trade should settle for a tough reality: scalability isn’t only a technical problem; it’s the defining barrier to crypto’s survival.

The Scalability Disaster

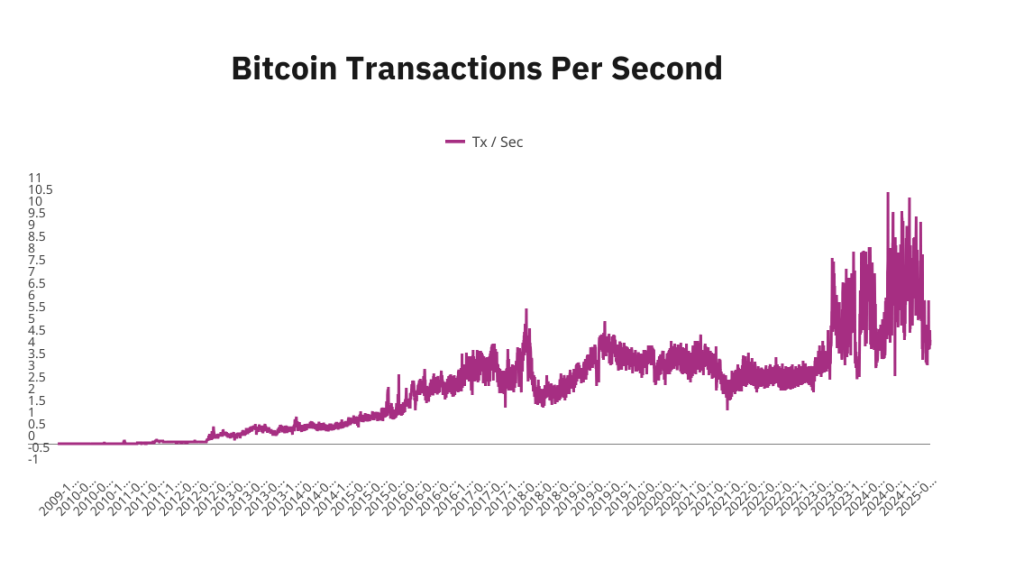

Cryptocurrency’s reliance on early blockchain buildings is a elementary flaw that’s hardly ever acknowledged. Bitcoin, for all its strengths as a safe and decentralized retailer of worth, processes simply round 10 transactions per second (TPS). Ethereum, the second-largest blockchain, fares barely higher with 12-15tps however nonetheless struggles with congestion and exorbitant charges throughout peak demand.

Examine this to conventional fee methods like Visa, which handles over 24,000 TPS effortlessly, and it turns into clear that crypto isn’t prepared to exchange the methods it seeks to disrupt. L2 options just like the Lightning Community goal to handle these limitations, however they’re constructed on prime of the identical outdated structure, providing non permanent fixes fairly than long-term options.

The outcome? A cryptocurrency ecosystem that’s technically spectacular however virtually unusable for the common particular person. The world doesn’t want extra digital gold; it wants fee methods which can be prompt, scalable, and frictionless.

Why Scalability Issues Extra Than Something Else

Scalability isn’t only a technical buzzword – it’s the distinction between cryptocurrency turning into a distinct segment monetary device or a cornerstone of the brand new world economic system. The potential functions of blockchain expertise are monumental: cross-border remittances, retail funds, microtransactions, and extra. However with out scalable networks, these blockchains threat remaining a siloed expertise admired for its potential however virtually unsuitable for on a regular basis transactions.

Think about making an attempt to run a contemporary economic system on methods that may’t course of various transactions per second. The associated fee could be prohibitive, delays could be insufferable, and companies would look elsewhere for options. That is the fact crypto faces immediately.

Take e-commerce, for instance: in a market the place shoppers demand prompt funds, the sluggish speeds and excessive prices of present blockchains make crypto unappealing in comparison with conventional fee processors. Equally, in remittance-heavy areas like Southeast Asia and Africa, excessive charges discourage the usage of blockchain, leaving conventional suppliers to dominate.

Whereas L2 options present non permanent reduction, they inherit the failings of their underlying structure. True scalability requires rethinking blockchain design from the bottom up.

The irony is that the very decentralization that makes blockchain expertise revolutionary can be its Achilles’ heel. To attain scalability, the trade should rethink its strategy, balancing decentralization with the efficiency wanted for real-world usability.

If blockchain can not evolve, it opens the door for centralized methods like CBDCs to dominate, undermining the decentralized ethos of cryptocurrency. Scalability isn’t nearly larger TPS; it’s about making a frictionless expertise the place customers can transact immediately with out worrying about charges or delays.

The Rise of Hyper-Scalable Networks

The way forward for cryptocurrency lies in hyper-scalable networks – blockchains able to processing hundreds of thousands of transactions per second with out compromising safety or decentralization. These methods are not a theoretical idea; they’re actively being developed and examined.

Hyper-scalable networks have the potential to remodel digital funds by enabling instantaneous, fee-free transactions. They’ll help world commerce, eradicate bottlenecks, and produce blockchain expertise into the mainstream. Not like their predecessors, these methods are designed with usability in thoughts, making them accessible not simply to crypto fans however to anybody who must ship or obtain cash.

This shift isn’t nearly higher expertise; it’s about making a monetary system that works for everybody. Hyper-scalable networks might allow the unbanked to take part within the world economic system, cut back the price of remittances, and empower companies to function extra effectively throughout borders.

You may also like Scaling Blockchain: All You Must Know About Layer 1 and Layer 2

Legacy Programs Can’t Assist the Future

The largest impediment to this transformation is the crypto trade’s attachment to legacy methods. Bitcoin and Ethereum are technological marvels, however they’re additionally relics of a bygone period. They weren’t designed for the calls for of contemporary commerce, and no quantity of patchwork options will change that.

The trade must ask itself a tough query: Are we prepared to let go of outdated fashions to embrace the longer term? This doesn’t imply abandoning what’s been constructed – it means constructing on it, studying from its successes and failures, and creating methods which can be match for goal in a digital age.

What’s there to recollect – hyper-scalable networks aren’t simply the subsequent step in blockchain evolution; they’re a necessity. With out them, crypto will stay a distinct segment product, admired for its potential however by no means totally realized.

A Name to Motion for the Crypto Trade

For cryptocurrency to succeed, the trade must shift its focus. Speculative positive factors and market hype have pushed some adoption thus far, however they received’t totally maintain it. The following section of crypto’s evolution requires innovation that prioritizes scalability, usability, and inclusivity. Can the crypto trade really thrive if it clings to methods that don’t meet the calls for of our digital age?

We have to transfer previous the obsession with preserving outdated methods and concentrate on what comes subsequent. Hyper-scalable networks signify a chance to just do that, enabling crypto to fulfil its promise as a transformative pressure in world finance. The query isn’t whether or not these networks will outline the way forward for cryptocurrency – it’s whether or not the trade is able to embrace them.

Disclaimer: The opinions on this article are the author’s personal and don’t essentially signify the views of Cryptonews.com. This text is supposed to offer a broad perspective on its subject and shouldn’t be taken as skilled recommendation.

The put up Legacy Blockchain Is Holding Crypto Again, and Scalability Is the Key to Its Survival appeared first on Cryptonews.