Solana (SOL) dropped 13% this week, buying and selling at $173.52, following the fallout from Argentine President Javier Milei’s involvement within the $LIBRA meme coin scandal. The controversy, generally known as “Cryptogate” in Argentina, has triggered a corruption investigation into Milei, who promoted $LIBRA as a software for financial development.

The coin’s worth briefly surged to a $4 billion market cap earlier than collapsing as early holders cashed out, resulting in accusations of a “rug pull.”

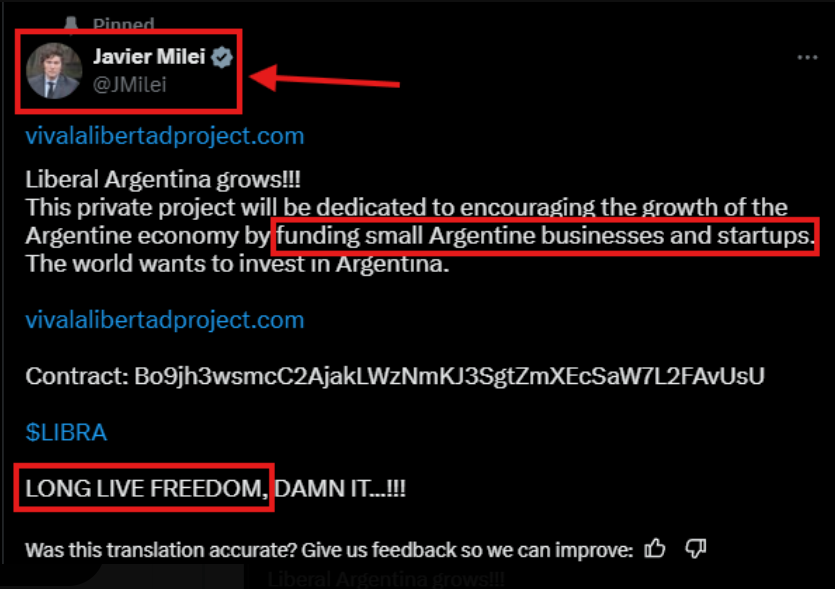

Milei deleted his promotional put up after the value crash and distanced himself from the challenge. Nonetheless, he now faces authorized scrutiny for potential fraud, bribery, and abuse of authority.

This scandal has raised questions concerning the regulation and stability of meme cash, impacting investor sentiment throughout the crypto market, together with Solana.

All of it started with this put up at 5:01 PM ET from Javier Milei.

As seen throughout President Trump's memecoin launch, the primary hour was filled with hypothesis:

Was this a hack or an actual launch?

It turned out to be actual as a number of different Argentinian politicians posted the information. pic.twitter.com/cL0ZQgxtCB— The Kobeissi Letter (@KobeissiLetter) February 15, 2025

Key Particulars of the $LIBRA Scandal:

- Market Manipulation: $LIBRA’s value surged earlier than collapsing, suggesting market manipulation.

- Authorized Implications: Milei faces allegations of fraud, bribery, and abuse of authority.

- Investor Sentiment: The scandal has eroded investor confidence in meme cash and the broader crypto market.

Solana (SOL) Faces Bearish Momentum Amid Market Uncertainty

Solana’s bearish pattern has intensified because it struggles to interrupt above the descending trendline, indicating continued promoting strain. The 50-Day Exponential Shifting Common (EMA) at $179.15 is performing as robust resistance, stopping a restoration.

SOL Key Resistance Ranges:

- Speedy Resistance: $180.48 – A breakout above this stage might set off shopping for curiosity.

- Subsequent Resistance: $191.39 and $206.01 – Clearing these ranges could shift sentiment to bullish.

SOL Key Assist Ranges:

- Speedy Assist: $161.32 – A break under this stage might speed up the bearish pattern.

- Subsequent Assist: $149.24 and $136.25 – These are vital assist zones that would stop a deeper decline.

The descending trendline and the 50 EMA reinforce the bearish outlook, indicating that Solana could proceed to wrestle until it breaks above $180.48.

Influence on Meme Cash and Broader Crypto Market

The $LIBRA scandal has affected investor sentiment towards meme cash and the broader cryptocurrency market. Meme cash, recognized for his or her speculative nature, have been criticized for enriching insiders on the expense of retail traders. This scandal has amplified skepticism and led to elevated warning amongst merchants.

Regulatory Issues and Future Implications:

- Elevated Scrutiny: The scandal has raised questions on regulatory oversight and transparency within the world crypto market.

- Potential Regulation: Analysts warn that the controversy might result in stricter rules for meme cash and speculative digital property.

- Market Volatility: Regardless of unfavorable sentiment, meme cash are prone to persist resulting from their potential for prime returns.

SOL Outlook and Conclusion

Solana stays bearish under $180.48 and the 50 EMA at $179.15. If costs fail to interrupt above these ranges, the bearish pattern is prone to proceed, focusing on assist at $161.32. Nonetheless, a decisive breakout above $180.48 might reverse the bearish pattern, pushing Solana towards $191.39.

Key Insights:

- Bearish Momentum Beneath $180.48: Solana is bearish under $180.48, with the 50 EMA performing as robust resistance.

- Key Assist Ranges: Speedy assist at $161.32, with the subsequent assist at $149.24.

- Breakout Potential: A breakout above $180.48 might push Solana towards $191.39, reversing the bearish pattern.

Greatest Pockets Token ($BEST): Superior Crypto Administration & Excessive-Yield Staking

Greatest Pockets Token ($BEST) powers Greatest Pockets, an revolutionary digital asset administration platform designed for each novice and skilled crypto merchants. Obtainable on Google Play and the App Retailer, Greatest Pockets offers safe storage, funding insights, and built-in staking, positioning itself as a pacesetter within the crypto administration house.

What Makes Greatest Pockets Distinctive?

- Greatest Pockets stands out from different digital wallets resulting from its superior options and user-centric design:

- Early-Entry to Rising Tokens: Customers can spend money on new crypto tasks earlier than they develop into extensively obtainable, maximizing potential good points.

- Enhanced Safety: Constructed on Fireblocks’ MPC-CMP safety framework, Greatest Pockets ensures strong safety for transactions and portfolio administration.

- Extensive Crypto Assist: The platform helps over 1,000 cryptocurrencies, providing a seamless consumer expertise for various crypto portfolios.

- Newest Replace (v2.4.5): Customers can now declare tokens instantly inside the app, eliminating the necessity for third-party platforms.

Why Traders Are Bullish on $BEST

- Aggressive Staking Rewards: 157% APY on staking, one of many highest out there.

- Sturdy Investor Confidence: 169.97 million $BEST tokens staked, displaying robust neighborhood assist.

- Rising Demand: $10.39 million raised, reflecting rising curiosity forward of the subsequent value hike.

With excessive staking rewards, robust backing, and superior expertise, $BEST is positioned as one of the crucial promising utility tokens within the trade.

The put up SOL Value Dropped 13% This Week Amid Milei Meme Coin Rugpull: What’s Subsequent? appeared first on Cryptonews.