Base’s speedy development positions the Coinbase-backed Ethereum Layer-2 resolution to turn out to be a key infrastructure supplier for mainstream shopper blockchain functions, per a brand new report by Nansen.

Nansen highlighted important developments slated for the second quarter, notably Flashblocks, Base Appchains, and sensible pockets enhancements, which mirror infrastructure upgrades wanted for shopper app adoption.

Flashblocks, set for mainnet launch in Q2, will cut back pre-confirmation block instances from 2 seconds to only 200 milliseconds, probably making Base the quickest Ethereum Digital Machine (EVM)-compatible blockchain.

Additional driving shopper use, Base Appchains allow high-throughput apps to deploy devoted Layer-3 networks on Base. Present deployments embody Blackbird’s restaurant loyalty program and Farcade AI’s gaming ecosystem.

In the meantime, Nansen anticipates sensible pockets enhancements that supply superior consumer interfaces and programmable spending limits, that are vital for on a regular basis shopper transactions and subscriptions.

Base’s on-chain metrics showcase this accelerating adoption. Nansen notes that strong each day lively customers and developer exercise persistently outperform competing Layer-2s alongside sustained transaction exercise regardless of current crypto market downturns.

As Nansen wrote, Base presently ranks second solely to Arbitrum in complete worth locked (TVL), although excluding Arbitrum’s Hyperliquid platform would elevate Base to first.

Regulatory developments additionally present tailwinds for Base. The SEC’s current determination to drop its lawsuit in opposition to Coinbase and a extra clear regulatory framework for digital property beneath a crypto-supportive administration cut back the uncertainty that beforehand hampered institutional and retail participation.

Nansen-native property

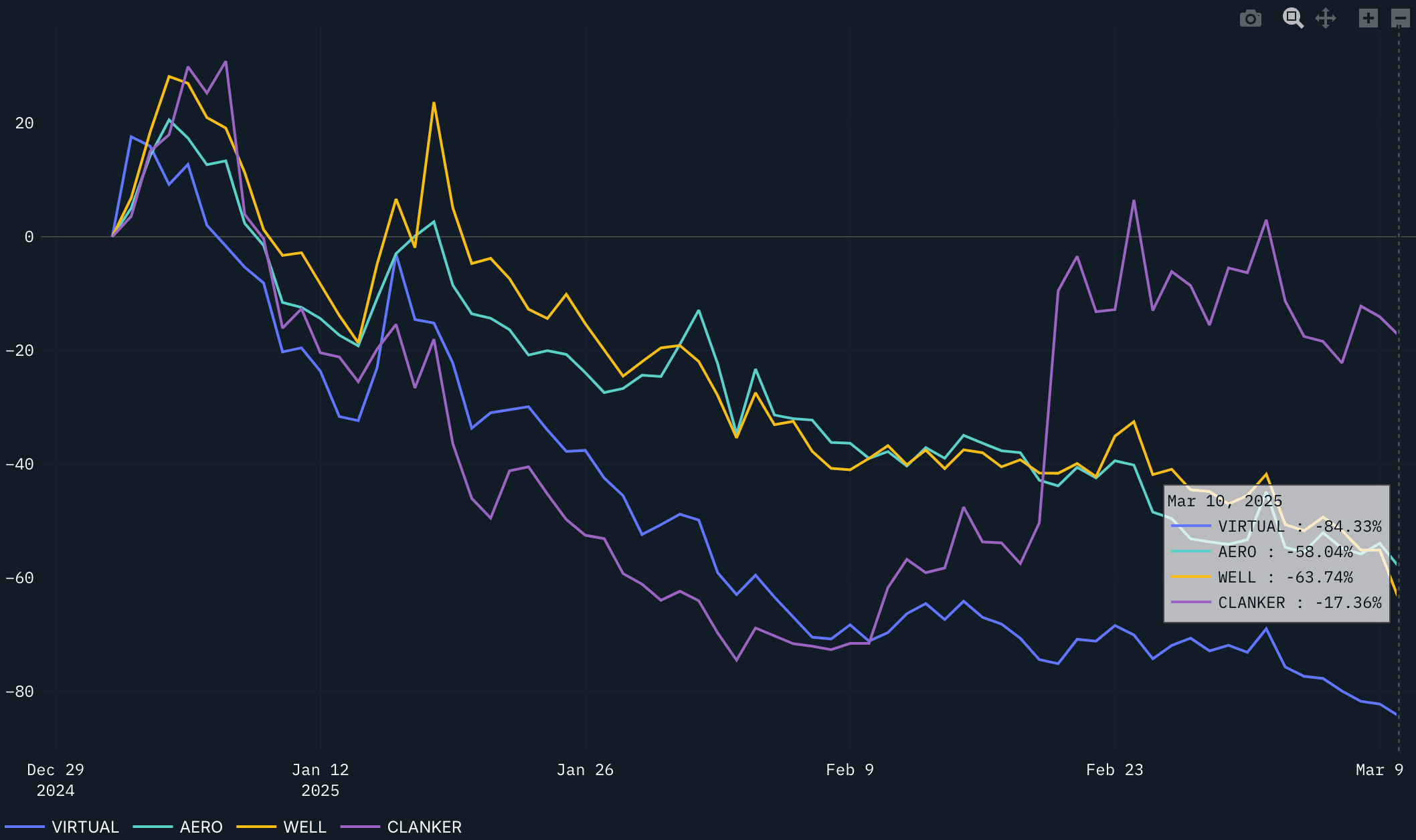

Given the absence of an official base token, base-native tokens corresponding to AERO, VIRTUAL, CLANKER, and WELL, in keeping with Nansen, current a viable route for market contributors in search of oblique publicity to the ecosystem.

Nansen recognized that these tokens had displayed diversified efficiency year-to-date: CLANKER declined simply 18%, outperforming friends like VIRTUAL, which fell 84%. Every token aligns with particular market narratives—AERO leads Base in DeFi quantity and memecoin buying and selling; VIRTUAL intersects AI and gaming; CLANKER incentivizes social content material creation; and WELL facilitates DeFi fee options.

Nansen believes that Coinbase’s direct involvement and token listings add additional credibility to those property. For example, AERO has already secured listings on Kraken and Coinbase, with Coinbase Ventures holding a major stake.

Whereas altcoins linked to Base exhibit important reductions, Nansen recommends awaiting extra exact indicators of broader crypto market restoration earlier than substantial positioning.

“Proper now, we see two main tailwinds:

– Deep reductions throughout Base-related tokens, presenting engaging entry factors.

– Robust catalysts in Q2, together with Flashblocks, appchains, and sensible pockets upgrades, driving additional adoption.”

General, Nansen thinks that Base’s infrastructural enhancements, regulatory readability, and strong ecosystem place it firmly to steer the following wave of shopper blockchain functions.

The submit Altcoin breakout on Base might outperform Bitcoin long run – Nansen appeared first on CryptoSlate.