Key Takeaways:

- Market sentiment is softening as technical indicators shift.

- Accumulation patterns and ETF strikes sign broader hesitance.

- Indicators recommend this isn’t a routine pullback however a deeper recalibration.

- Underlying vulnerabilities might reshape long-term developments.

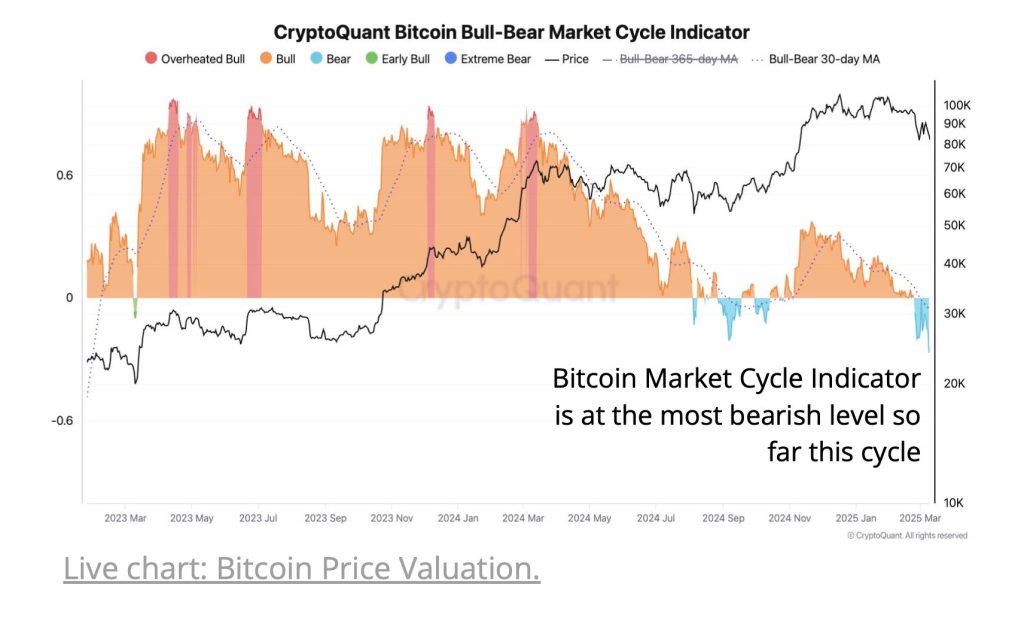

Bitcoin’s valuation metrics are pointing to bearish territory, and in accordance with a CryptoQuant analyst, the market could also be teetering between deep worth ranges and the onset of a bear market.

ryptoQuant’s evaluation, revealed on March 11, reveals that just about each main indicator now alerts warning.

The Bitcoin Bull-Bear Market Cycle Indicator is at present at its most bearish stage this cycle—a stage that, in earlier cycles, has both preceded a pointy correction or marked the start of a downturn.

In parallel, the MVRV Ratio Z-score has fallen under its 365-day shifting common, suggesting that Bitcoin’s beforehand sustained upward momentum has markedly dissipated.

This shift in sentiment could be seen by the noticeable contraction in Bitcoin demand.

Lately, the obvious demand progress for Bitcoin dropped by 103,000 BTC in a single week, representing the quickest tempo of contraction noticed since July 2024.

Bitcoin Whales Sluggish Accumulation, Signaling Lowered Demand

This steep decline signifies clear purchaser hesitation and weakening market help.

Main whales, who’ve historically performed a task in driving market actions by their large accumulations, have additionally slowed their price of Bitcoin acquisition.

U.S.-based spot ETFs have transitioned into internet sellers of Bitcoin this yr, additional including downward strain on costs.

Whereas Bitcoin’s present 22% value drawdown may appear consistent with corrections skilled throughout earlier bull market cycles, the valuation metrics paint a extra regarding image.

The metrics point out that this isn’t a typical pullback however quite a deeper, extra basic correction.

Bitcoin is buying and selling round $81,000 as of writing—a variety barely under the dealer’s on-chain realized value decrease band, a key help stage.

This precarious place was compounded Tuesday because the broader crypto market shed 6% amid investor nervousness triggered by President Donald Trump’s newest commerce insurance policies.

Heightened tensions over tariffs concentrating on main U.S. buying and selling companions—Canada, Mexico, and China—have rattled markets, prompting a wave of sell-offs throughout danger belongings

Ought to Bitcoin fail to keep up this help, its subsequent main goal is round $63,000.

This stage corresponds with the Dealer’s minimal on-chain realized value band, a threshold that has traditionally acted as the final word security internet throughout extreme value corrections.

The insights offered by the CryptoQuant analyst spotlight a convergence of things which are amplifying market uncertainty.

Given the bearish alerts, decreased demand, slowing whale accumulation, and ETFs changing into internet sellers, Bitcoin’s market stands at a vital juncture.

Traders face a vital query: Are these indicators merely short-term anomalies, or do they signify deeper, structural vulnerabilities within the Bitcoin market?

How stakeholders interpret these alerts within the coming weeks might decide whether or not Bitcoin rebounds strongly or slips additional into bearish territory.

Continuously Requested Questions (FAQs)

What might a deeper correction imply for Bitcoin’s long-term outlook?

A deeper correction might sign a market reset, exposing underlying vulnerabilities whereas providing strategic entry factors. This section can recalibrate inflated valuations and probably foster a extra strong, sustainable long-term Bitcoin development.

How may institutional actions affect the present Bitcoin development?

Shifts in institutional conduct, like modifications in ETF methods and slower accumulation, can drive broader market sentiment. Their actions have an effect on liquidity and should form Bitcoin’s value trajectory considerably.

What broader financial components might amplify Bitcoin’s present market dynamics?

Wider financial shifts, like political unrest and modifications in commerce guidelines, could make markets extra unpredictable. These exterior pressures typically make Bitcoin extra reactive to investor moods, rushing up value modifications.

The publish Bitcoin May Be at Deep Worth Ranges or Begin of a Bear Market: CryptoQuant appeared first on Cryptonews.