BitcoinWorld

Spectacular BlackRock Bitcoin ETF Inflows Signal Strong Institutional Adoption

Are you following the pulse of the cryptocurrency market? If so, you’ve likely noticed the significant impact that regulated investment products are having. Among these, the BlackRock Bitcoin ETF, known by its ticker IBIT, is making waves with its consistent performance and substantial asset accumulation.

What’s Driving the Massive IBIT Inflows?

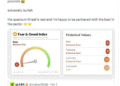

Recent data highlights a remarkable trend for BlackRock’s spot Bitcoin ETF. Following a notable $482 million net inflow on May 28th, industry observers pointed out just how consistent IBIT’s performance has been. Nate Geraci, president of The ETF Store, a U.S.-based wealth management firm, shared insights on this impressive run.

According to Geraci, IBIT has recorded inflows on 30 out of the past 31 trading days. This isn’t just a fleeting moment of interest; it represents sustained demand. This consistent influx of capital positions IBIT as a major player in the ETF landscape, far beyond just the crypto space.

- Consistent Performance: Inflows on 30 of the last 31 trading days.

- Significant Daily Inflows: Averaging around $430 million recently.

- Total Recent Accumulation: $3.86 billion over the past two weeks.

How Does This Rank Among All ETFs?

The scale of these Bitcoin ETF inflows is particularly noteworthy when viewed against the broader ETF market. Nate Geraci emphasized that IBIT now firmly holds a spot among the top five best-performing ETFs by inflows this year. This is out of more than 4,200 listed funds across all asset classes, including stocks, bonds, and commodities.

This high ranking underscores the significant investor interest specifically directed towards Bitcoin through this regulated investment vehicle. It suggests that capital is flowing into the crypto asset class at a rate comparable to, or even exceeding, many traditional investment areas.

Understanding the Significance of Institutional Bitcoin Adoption

The consistent and large-scale inflows into funds like BlackRock’s IBIT are widely interpreted as a strong signal of increasing institutional Bitcoin adoption. Large financial institutions, wealth managers, and even corporations are increasingly comfortable allocating capital to Bitcoin via accessible, regulated products like spot ETFs.

Why is this significant?

- Validation: It provides a level of legitimacy and validation for Bitcoin as a serious, investable asset class.

- Accessibility: ETFs simplify the process of investing in Bitcoin for institutions and retail investors alike, removing technical hurdles like managing private keys.

- Scale: Institutional capital has the potential to move markets on a much larger scale than individual retail investors.

- Market Maturity: The presence of major players like BlackRock indicates a maturing market infrastructure around crypto assets.

While retail interest remains a factor, the bulk of the significant, sustained inflows is attributed to larger players gaining exposure to Bitcoin through these channels.

Comparing IBIT to Other Spot Bitcoin ETF Performance

While IBIT has been a leader, it’s part of a group of newly launched spot Bitcoin ETFs in the U.S. Other funds, such as those from Fidelity, Ark Invest, and VanEck, have also seen significant inflows since their launch in January 2024. However, IBIT has consistently been one of the top performers in terms of attracting new capital, often vying for the top spot on any given trading day, alongside Fidelity’s FBTC.

The collective success of these funds, particularly IBIT’s dominant performance, highlights the pent-up demand for regulated Bitcoin exposure in the U.S. market.

Recent Inflow Snapshot (Example Data):

| ETF Ticker | Issuer | Approx. Inflows (Past 2 Weeks) |

|---|---|---|

| IBIT | BlackRock | $3.86 billion |

| FBTC | Fidelity | Significant (Specific data varies daily) |

| ARKB | Ark Invest/21Shares | Notable (Specific data varies daily) |

Note: Inflow data is dynamic and subject to change. The figures mentioned for IBIT are based on recent reports.

What’s Next for IBIT and Bitcoin?

The sustained inflows into the BlackRock Bitcoin ETF suggest continued strong interest from investors seeking exposure to the leading cryptocurrency. This trend could potentially provide upward price pressure on Bitcoin as ETF issuers purchase BTC to back the new shares being created due to inflows.

However, it’s important to remember that markets are complex and influenced by many factors, including macroeconomic conditions, regulatory news, and overall market sentiment. While institutional adoption via ETFs is a powerful narrative, it’s just one piece of the puzzle.

For investors, IBIT and other spot Bitcoin ETFs offer a convenient way to gain exposure to Bitcoin within traditional brokerage accounts. The consistent inflows indicate that a growing number of market participants are choosing this route.

Summary: IBIT’s Inflow Streak is a Major Headline

BlackRock’s IBIT has demonstrated exceptional performance in attracting capital, with inflows on 30 of the last 31 trading days and accumulating billions in recent weeks. This places it among the elite ETFs by inflows this year, signaling robust and ongoing institutional and potentially retail interest in gaining exposure to Bitcoin through regulated products. The success of IBIT underscores the growing maturity of the Bitcoin market and the increasing comfort level of traditional finance with digital assets.

To learn more about the latest Bitcoin ETF trends, explore our articles on key developments shaping Bitcoin institutional adoption.

This post Spectacular BlackRock Bitcoin ETF Inflows Signal Strong Institutional Adoption first appeared on BitcoinWorld and is written by Editorial Team