Bitcoin (BTC) and the wider market experienced a minor pullback after President Donald Trump announced the finalization of a new tariff arrangement with China, pending a formal sign-off by him and President Xi Jinping.

Trump announced on Truth Social that the accord grants the US “55% tariffs” on Chinese goods, versus 10% levied on US exports, and secures Chinese supplies of rare-earth magnets.

He also said Washington would preserve access for Chinese students at American universities and that the “relationship is excellent.” The total market value of crypto assets fell 2%, while the S&P 500 declined 0.7%.

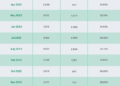

Bitcoin fell to a daily low of $108,331 following the news and was trading at $108,654.87 as of press time, down 1.5% over the past 24 hours. Notably, it is holding above the realized price of $106,900 registered by investors who bought the flagship crypto in the past 24 hours.

According to a recent report by Glassnode, the next realized price levels are $105,200 for investors holding BTC for more than one month and $104,900 for investors holding between one week and one month.

Market read-through

Bitcoin and equities reversed early gains within minutes of the post, reflecting concern that the higher US levy could weigh on global demand even if a formal truce reduces headline tension.

The framework “reduces global uncertainty marginally” if enacted, according to a note shared by Bitfinex head of derivatives Jag Kooner.

Yet, he noted that “much of the market uncertainty has already been priced in.” Kooner expects a short burst of volatility, followed by mean reversion unless the deal delivers a clear liquidity impulse.

Furthermore, he tied June 11 price action to the morning release of May consumer price (CPI) data, arguing that tariff-related inflation has appeared in headline figures since last month and will likely peak by August.

Kooner believes that the CPI is the real volatility trigger, adding that the 0.1% rise in core prices consolidates expectations for Federal Reserve easing and “creates a vacuum above $111,000 for Bitcoin.”

Correlation with S&P 500

The analyst also noted a 30-day correlation of 0.63 between Bitcoin and the S&P 500, describing BTC as “a liquidity barometer rather than a volatility hedge.”

This relationship leaves Bitcoin’s upside capped while equities hold a narrow range but could allow BTC to lead if stocks break higher on softer inflation data.

Kooner wrote:

“Without a direct stimulus mechanism, crypto markets are unlikely to see sustained moves upward.”

However, he views pullbacks as buying opportunities because many coins remain in profit, and exchange balances are light. He projected that any breakout above $111,000 would be “spot driven, with ETF demand accelerating as the macro regime shifts toward easing.”

With no White House or Chinese government statement corroborating Trump’s post, investors now look to any official transcript of the tariff agreement and the June 12 producer price report for additional macroeconomic direction.

Kooner cautioned that until a detailed document emerges, markets must balance the constructive tone against the risk that higher levies could tighten financial conditions during the third quarter.

Lastly, he highlighted that traders should monitor Chinese policy responses, supply chain commentary from US retailers, and Capitol Hill’s reaction to the proposed duty split.

The post Bitcoin dips as Trump finalizes tariff deals with China appeared first on CryptoSlate.