Bitcoin (BTC) has rebounded sharply, climbing 7% this week after dipping to $98,200. At the time of writing, BTC trades around $106,900, just below the $108,250 resistance, which marks the upper boundary of a descending trendline that’s capped price action since June highs.

Technical momentum is cooling, and the next 48 hours could decide whether Bitcoin breaks higher or reverts back toward key support levels.

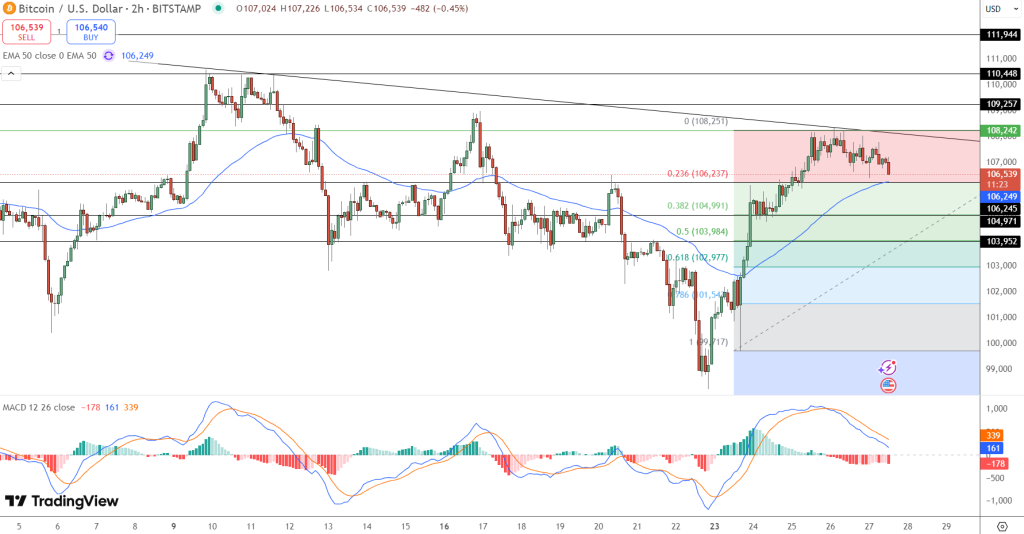

Short-term technicals show a potential reversal brewing. The 2-hour chart displays a rising wedge pattern, with BTC printing a lower high near the 0.236 Fibonacci retracement at $106,237. A break below the 50-period EMA ($106,249) could open a move toward $104,991 and $103,984—marking the 0.382 and 0.5 retracement zones.

- Key resistance: $108,250 and $110,000

- Support to watch: $106,250, then $104,900

- RSI: Neutral at 56

- MACD: Weakening bullish histogram

Traders looking for long exposure may wait for a confirmed breakout above $108,250. Bears, on the other hand, could consider short setups below $106,200, with a downside target near $104,000.

Geopolitics, Fed Signals Fuel Rally

Bitcoin’s latest move is macro driven. A Middle East ceasefire has calmed the nerves of the market and capital is flowing back into risk assets. Bitcoin reclaimed its 50 day simple moving average (SMA) around $106,000 mid week and buyers are defending that zone. The softer geopolitical climate has given BTC the stability to retest $107,000.

Meanwhile the US Federal Reserve has toned down its language on crypto banking so less regulatory pressure ahead. Traders took that as a green light and are reinforcing Bitcoin’s recent strength.

Institutional demand is still strong. ETFs have seen net inflows for 13 days in a row and $1.71 billion this week which is the most since May. Major corporate holders like Metaplanet and ProCap have accumulated over 7,500 BTC in the same period. This is institutional conviction despite retail is still sleeping.

Can Bitcoin Clear $112K and Aim Higher?

Technical resistance between $108,000 and $110,000 remains the key barrier. Analysts say a close above $109,000 with increased volume could push BTC to $112,000 and beyond. Beyond that, potential targets include $120,000 and even $165,000, driven by spot ETF demand and macro tailwinds.

He's right! Bitcoin won't ever go above $112k again because:

The US is getting their spending under control and the federal reserve will permanently stop printing money. https://t.co/jvslq1lrDD— Vijay Kailash, CFA, CFP® (@realvijayk) June 26, 2025

But upside isn’t guaranteed. A failure to clear $108,250 may trigger a short-term pullback. Volume is still low, and on-chain activity has declined—transfer volume is down 32% to $52 billion, while spot trading remains muted around $7.7 billion.

If the price breaks below $106,249, the path to $104,000–$105,000 opens. These zones may act as accumulation points for bulls.

Bottom line: The next 48 hours are pivotal. A confirmed breakout above $108K could ignite a fresh rally. A rejection may spell consolidation—or correction—before the next leg higher.

Bitcoin Hyper Presale Surges Past $1.6M—Layer 2 Just Got a Meme-Sized Boost

Bitcoin Hyper ($HYPER) has smashed through the $1 million mark in its public presale, raising $1,673,470 out of a $1,904,052 million target. With just hours left before the price jumps to the next tier, buyers can still lock in $0.01205 per HYPER.

As the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), Bitcoin Hyper brings fast, low-cost smart contracts to the BTC ecosystem. It merges Bitcoin’s security with SVM’s scalability, enabling high-speed dApps, meme coins, and payments—all with cheap gas fees and seamless BTC bridging.

Audited by Consult, Bitcoin Hyper is engineered for speed, trust, and scale. Over 91 million $HYPER are already staked, with estimated 577% APY post-launch rewards. The token also powers gas fees, dApp access, and governance.

The presale accepts crypto and cards, and thanks to Web3Payments, no wallet is needed. Meme appeal meets real utility—Bitcoin Hyper might be Layer 2’s breakout star of 2025.

The post Bitcoin Price Prediction – Why Traders Are Watching the Next 48 Hours Like Hawks appeared first on Cryptonews.