It’s been a June to remember for the U.S. stock market. Despite the threat of an escalating conflict in the Middle East, and economic uncertainty, flagship indices surged to record highs on Friday.

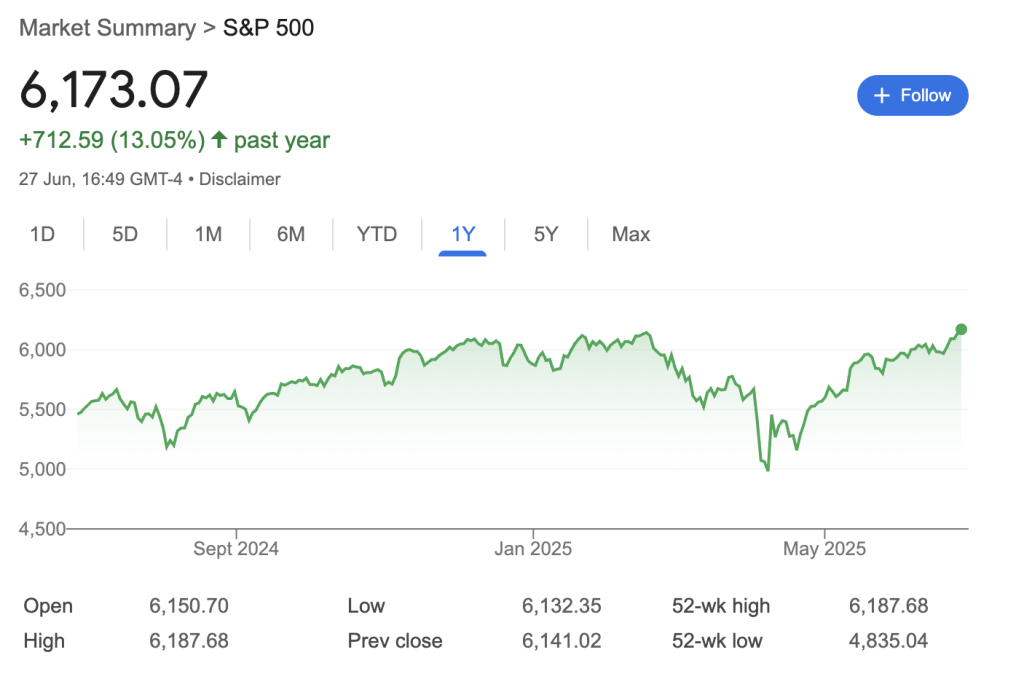

The S&P 500 ended the week at 6,173, returning to all-time-high territory for the first time since February. Meanwhile, the tech-heavy Nasdaq 100 reached unprecedented levels earlier in the week.

Crypto-focused stocks can take a lot of the credit for this. Coinbase has been on a tear since entering the S&P 500 back in May — accelerating by 40% in the space of a month. It also closed at a record-breaking of $369.21 on Friday. To underline the significance of this, the stock hasn’t been this high since November 2021.

Over in the Nasdaq 100, Strategy’s share price has risen by a modest 3% over the past month, indicating that investor enthusiasm for Michael Saylor’s Bitcoin treasury model is beginning to wane. MSTR has accelerated 178% over the past year, but remains some way off its 52-week high of $542.99 last year.

Now you may be wondering why any of this is relevant — after all, this is Cryptonews. But developments on Wall Street have a huge impact on the crypto markets, and can determine whether bull runs continue or bear markets begin.

Newhedge has long tracked the correlation between Bitcoin’s price and the S&P 500, using a scale that runs from -1 to 1. A lower number on this scale shows that both assets are moving in different directions — so when BTC rallies, stocks fall. On the flipside, a number closer to 1 suggests they’re moving in tandem.

At the moment, the correlation stands at 0.47 — indicating that there is a relationship between stocks and cryptocurrencies. This tells us BTC is being driven by macroeconomic factors and broader market sentiment, rather than interest in the digital asset itself, with Newhedge saying:

“When Bitcoin decouples from equities, its price movements are often driven by its intrinsic fundamentals, such as its fixed supply, adoption cycles, and halving events.”

Because of that, let’s take a closer look at what lies ahead for the stock market as 2025 progresses — and explore how that could impact Bitcoin.

For one, analysts say the S&P 500’s rebound from a dramatic slump in April — where it plunged below 5,000 points and risked entering bear market territory — happened remarkably quickly. Such recoveries usually take much longer, and this is a sign that traders are no longer fearful about how Donald Trump’s tariffs could affect the global economy.

If anything, there are signs that tensions between key trading partners are beginning to thaw, with the U.S. and China reaching a new deal that will make it easier for American firms to acquire rare earth minerals and magnets.

Inflation continues to be a worry for consumers and corporations alike — with fears that Trump’s default 10% tariffs on a host of imported goods could soon feed through into the data. The Federal Reserve’s target has long been 2%, but figures continue to show inflation is stubbornly higher than this. This has left Fed chair Jerome Powell reluctant to cut interest rates, with most policymakers in the Federal Open Markets Committee indicating they’ll be held once again at the end of July.

Another hold would undoubtedly irritate Trump, who has repeatedly called for Powell to resign. The U.S. president wants interest rates to be much lower than their current level — and recently suggested they should be 1% on Truth Social.

So… will the S&P 500 keep on rising? Well, there are two schools of thought here.

Bloomberg says that, when this index hits a new all-time high after coming out of a bear market or correction, further gains tend to follow. Tracking seven previous instances, average returns after three months stood at 0.4% — rising to 6.6% after six months, and 13.1% after a year.

But the Carson Group’s chief market strategist Ryan Detrick has a different measurement that looks a little gloomier. He crunched the numbers based on when the S&P 500 had last hit a record high, and found that — when there’s a four to 12-month gap between ATHs — “forward returns are quite muted.”

The S&P 500 hasn't hit a new high in more than four months, but that could end any day now.

Turns out, when it goes between 4-12 months without a new ATH and then hits one, the forward returns are quite muted.

Not once up double digits a year later. Hmm. pic.twitter.com/GLKg4AZmPU— Ryan Detrick, CMT (@RyanDetrick) June 26, 2025

Just like it’s impossible to predict Bitcoin’s price movements, take any S&P 500 forecasts you see with a generous pinch of salt. Donald Trump in the White House means literally anything can happen.

The post Will S&P 500 Keep Rising — and Will It Help Bitcoin? appeared first on Cryptonews.