Indian crypto exchange WazirX has secured overwhelming creditor support, with more than 95% of voters backing its latest restructuring proposal, which now awaits regulatory approval from the Singapore High Court.

The creditor vote on the restructuring framework means the plan now requires judicial endorsement from Singapore’s court to authorize the Amended Scheme following the platform’s hacking incident.

Update on Amended Scheme of Arrangement Revote

95.7% of voting Scheme Creditors supported the Amended Scheme of Arrangement. The Amended Scheme was also supported by 94.6% of associated Approved Claims. This outcome reaffirms the strong support shown in the first round of… pic.twitter.com/hVCZqRXIuZ— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) August 18, 2025

According to a recent statement, WazirX Founder Nischal Shetty outlined that the restructuring blueprint includes platform preparations to restart operations and restore trading services for users “within 10 business days of the scheme taking effect.”

WazirX Creditor Voting Results and Process

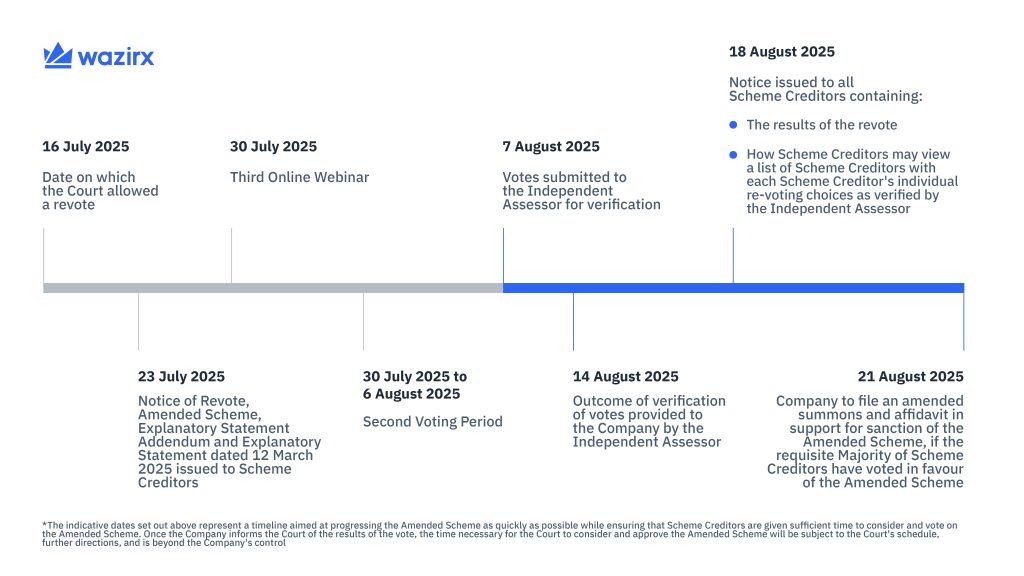

The voting process, coordinated by parent entity Zettai Pte Ltd., was conducted through Kroll Issuer Services between July 30 and August 6, with eligibility restricted to account holders maintaining positive balances as of July 18, 2024.

A total of 149,559 creditors representing $206.9 million in validated claims took part in the process.

Among all participants, 143,190 creditors representing $195.7 million endorsed the proposal, exceeding the statutory thresholds established under Section 210(3AB) of the Singapore Companies Act 1967.

WazirX highlighted the results across social media platforms, disclosing that precisely 95.7% of participating Scheme Creditors backed the Amended Scheme of Arrangement.

The cryptocurrency exchange stated that “this outcome reaffirms the strong support shown in the first round of voting and reflects our community’s continued confidence in the restructuring plan.”

The restructuring framework proposes asset distribution through Zanmai India, which operates under India’s Financial Intelligence Unit oversight, designed to maintain transparency and regulatory compliance.

Following court acceptance of the filing, Zettai will notify creditors via official communications, including copies of the relevant legal documentation.

This represents the second restructuring vote to advance after the Singapore Court previously dismissed the initial proposal.

Although the first plan also received majority creditor support, judicial authorities expressed concerns regarding the proposal’s equity and practical viability.

During that period, the exchange faced criticism from frustrated creditors who alleged fraudulent behavior due to extended delays.

So basically WazirX fund recovery options are:

→ Trust another WazirX product with your money (again).

→ Wait until 2030 to maybe get your funds back in fiat.

Is this even real? Absolute joke. pic.twitter.com/WV3XYqyqNe— IshitaPandey.eth (@IshitaaPandey) February 4, 2025

The platform initially committed to asset redistribution by February 2025, leading many to suspect the exchange was exploiting legal complications to postpone user repayments.

Subsequently, in June, WazirX filed for reconsideration, and the court permitted additional arguments while extending the protective moratorium.

By August 2025, judicial authorities mandated a second vote on the modified restructuring scheme, providing WazirX another opportunity to advance its proposal.

WazirX Creditors Uncertain About Recovery Timeline of Funds

A disaster occurred in July 2024 when the WazirX platform suffered a cyberattack allegedly orchestrated by North Korea’s Lazarus Group, based on intelligence from the U.S. Department of State.

The incident resulted in losses exceeding $230 million, representing 45% of the platform’s total $500 million in holdings.

WazirX’s Singapore-registered parent company, Zettai Pte Ltd, immediately pursued creditor protection and received a four-month moratorium from Singapore’s High Court in September 2024, providing time to develop a comprehensive restructuring strategy.

Despite the positive voting outcome, WazirX customers remain skeptical about fund recovery prospects.

In February, the cryptocurrency exchange disclosed that reimbursements might face delays, potentially extending until 2030, contingent on the restructuring scheme’s final approval status.

The company’s communication outlined dual scenarios, one pathway if the restructuring gains approval and an alternative if rejection occurs.

Based on WazirX’s published framework, successful restructuring would enable systematic repayment scheduling, allowing creditors to recover assets more efficiently.

Two paths, two very different outcomes.

Here's a breakdown of what happens if the Scheme is approved versus if it isn't. Understand what to expect in both scenarios as we approach the voting process. pic.twitter.com/ZcXpC8g79Q— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) February 4, 2025

However, if the scheme faces rejection, creditors might endure prolonged uncertainty while the company’s ownership disputes remain unresolved.

If WazirX proceeds to liquidation, creditors may experience reduced recoveries due to liquidation expenses and the absence of recovery enhancement mechanisms.

The company also warned that extended proceedings could result in creditors missing future market appreciation, as asset values may diminish by the time of final distribution.

The post WazirX Restructuring Plan Wins 95% Creditor Approval, Awaits Court Ruling appeared first on Cryptonews.