Cardone Capital has added another 130 Bitcoin to its balance sheet, expanding its strategy of tying digital assets directly to real estate investments.

The move came as part of a refinancing of the firm’s Miami River property, where the company opted to raise equity to pay down debt instead of purchasing interest rate caps. According to Cardone Capital, the project’s Fannie Mae debt was secured at 4.89%.

Grant Cardone’s Firm Adds More BTC as It Targets 4,000 Coins in 2025

The purchase marks the fourth transaction in which the real estate private equity firm has added Bitcoin to its investment portfolio. Chief Executive Grant Cardone confirmed that eight more deals with a similar structure are currently underway, indicating a broader plan to integrate the cryptocurrency into traditional real estate finance.

Cardone Capital add another 130 bitcoin completing its Miami River refinance. Rather than buying rate caps, we raised equity to pay down debt & added 130 BTC. Fannie debt was locked at 4.89%

This is CardoneCapital 4th transaction adding BTC to Real Estate investments with 8… pic.twitter.com/I51KhAN13J— Grant Cardone (@GrantCardone) August 19, 2025

This latest deal follows Cardone Capital’s headline-making announcement in June, when it revealed the acquisition of 1,000 Bitcoin worth just over $101 million at market prices.

At the time, Cardone declared the firm to be the “first ever real estate/Bitcoin company integrated with a full BTC strategy,” positioning the move as a way to combine two long-term assets: multifamily housing and Bitcoin.

The company also outlined ambitions to expand its Bitcoin treasury to 4,000 BTC this year, a target that would place it among the largest nonmining corporate holders of the asset.

Founded in 2017, Cardone Capital manages more than 14,000 multifamily units across the United States, with an estimated $5.1 billion in assets under management. The company pools capital from accredited and non-accredited investors to acquire large-scale residential properties.

The firm’s pivot into Bitcoin has been accompanied by the launch of the 10X Miami River Bitcoin Fund in May, a dual-asset vehicle backed by a 346-unit property on the Miami River and $15 million in Bitcoin.

Cardone has framed the initiative as a hedge against inflation and an alternative to traditional treasury management, arguing that Bitcoin offers a unique store of value when paired with income-generating real estate.

The strategy has drawn attention from across the crypto and business sectors. MicroStrategy’s Michael Saylor, whose firm holds more than 226,000 BTC, publicly congratulated Cardone earlier this year on bringing the digital asset into the real estate space.

With eight more Bitcoin-linked real estate transactions in the pipeline, Cardone Capital is positioning itself as a pioneer in blending digital assets with hard assets.

Global Bitcoin Treasuries Swell to 3.68M BTC Across 294 Entities

The corporate Bitcoin treasury race is accelerating, with Japan’s Metaplanet adding 775 BTC to its reserves, lifting its total holdings to 18,888 BTC, worth around $2.18 billion.

A Monday filing confirmed the purchase, valued at 114.3 billion yen ($775 million), cementing Metaplanet’s position as Japan’s leading corporate Bitcoin holder.

@Metaplanet_JP has boosted its Bitcoin reserves to 18,888 BTC worth about $2.18B after adding 775 coins, continuing its aggressive treasury strategy.#Metaplanet #BitcoinTreasury https://t.co/3CQCrG1Th8

— Cryptonews.com (@cryptonews) August 18, 2025

The company paid an average of roughly $120,000 per coin, though Bitcoin was trading closer to $115,600 when the disclosure was made.

Metaplanet began its aggressive accumulation last year, modeling itself after U.S. software firm MicroStrategy, which pioneered using Bitcoin as a treasury reserve asset. The strategy has quickly elevated the Tokyo-listed company into the top tier of corporate holders.

Other Japanese firms are now following suit. Lib Work, a 3D housing manufacturer listed on the TSE Growth exchange, announced plans to acquire ¥500 million ($3.3 million) worth of Bitcoin between September and December 2025 as both an inflation hedge and a vehicle for overseas expansion.

Meanwhile, Strategy extended its own lead. The Virginia-based company disclosed a fresh buy of 430 BTC for $51.4 million between August 11 and 17, at an average price of $119,666. That brings its total stash to 629,376 BTC, worth nearly $72 billion, with management noting a 25% year-to-date yield from its Bitcoin holdings.

Governments are also entering the fray. U.S. Treasury Secretary Scott Bessent said Washington would build a “Strategic Bitcoin Reserve” from confiscated assets rather than direct purchases, estimating current holdings at $15–20 billion.

His remarks softened the denials of earlier times and reinforced President Trump’s pledge to make the U.S. the “Bitcoin superpower of the world.”

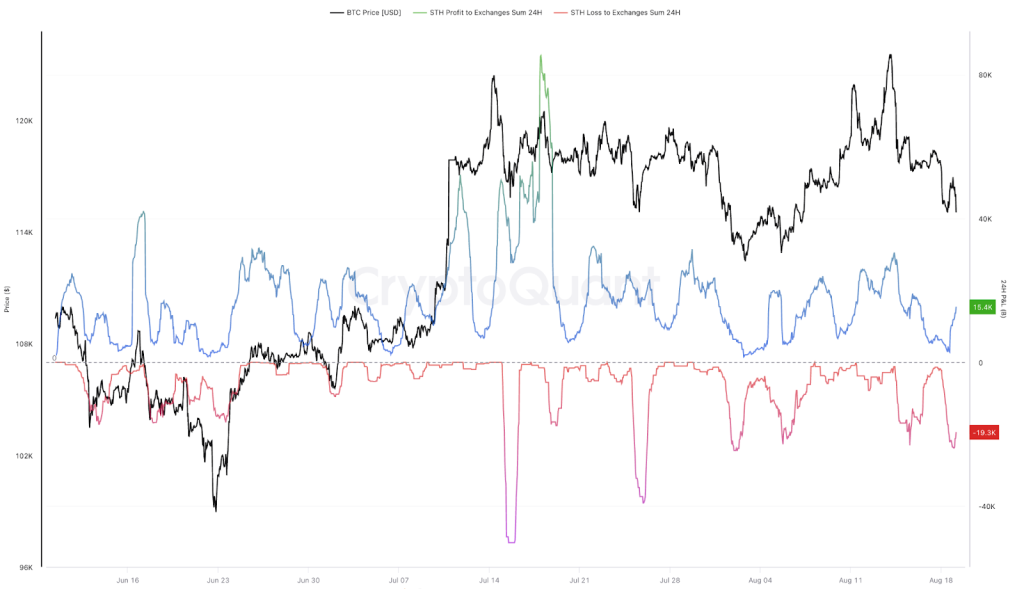

Bitcoin itself has cooled from record highs, slipping below $116,000 after last week’s $124,500 peak. On-chain data shows short-term holders have been offloading coins at a loss, echoing past correction patterns that either precede deeper drawdowns or clear the way for renewed rallies.

According to BitcoinTreasuries.net, 294 entities now hold 3.68 million BTC collectively, about 18% of the circulating supply.

Public companies and ETFs dominate, but governments and custodians are emerging as major players, showing Bitcoin’s growing role as a strategic reserve asset worldwide.

The post Cardone Capital Deepens Bitcoin Bet With 130 BTC Deal – Targeting 4,000 Coins by Year-End appeared first on Cryptonews.