Fireblocks, the $8 billion crypto infrastructure provider, has launched a stablecoin payment network with over 40 institutional participants.

According to a Fortune report, the Fireblocks Network for Payments includes members such as Bridge (recently acquired by Stripe), stablecoin companies Zerohash and Yellow Card, and issuer Circle.

This network plans to streamline how financial institutions and crypto firms move stablecoins between each other while building new stablecoin products, addressing what CEO Michael Shaulov describes as costly infrastructure challenges.

Unlike Circle’s existing payments network, which focuses exclusively on USDC, Fireblocks’ platform supports multiple stablecoins, giving participants greater operational flexibility.

The network provides users access to banking relationships and regulatory licenses from a broader range of companies than customers would typically reach independently.

Multi-Stablecoin Infrastructure Addresses Enterprise Pain Points

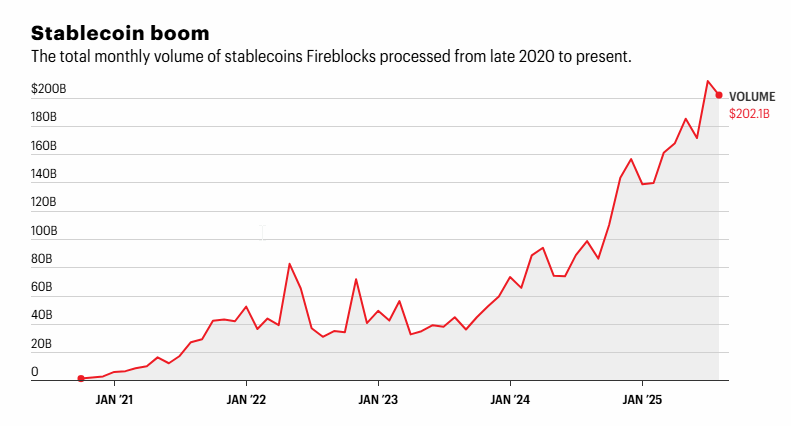

Fireblocks already processes billions of dollars in stablecoin volume daily, achieving a record $212 billion in July alone across its existing infrastructure.

However, Shaulov noted that the company’s original network was built primarily for crypto trading rather than specialized stablecoin operations.

The new network fills this operational gap by allowing seamless conversion between different stablecoins and facilitating cross-border transfers.

This launch builds on Fireblocks’ recent expansion into stablecoin-focused infrastructure, including its June integration with Codex, a purpose-built blockchain for stablecoin finance.

Codex offers instant settlement capabilities and allows institutions to create wallets with zero additional integration work.

The company has also partnered with Japan’s SMBC (through parent Sumitomo Mitsui Financial Group) and Ava Labs to pilot stablecoin launches, with trials expected to begin in the second half of 2025.

SMFG, the parent company of Japan’s second-largest bank SMBC, is preparing to launch a stablecoin in partnership with @avax

and @FireblocksHQ.#SMBC #Avalabshttps://t.co/rLwHg1TNUi— Cryptonews.com (@cryptonews) April 2, 2025

If successful, SMBC could launch its stablecoin as early as next year, potentially reducing cross-border payment costs by bypassing traditional SWIFT intermediaries.

Institutional Adoption Accelerates Across Stablecoin Ecosystem

The Fireblocks launch coincides with rapidly accelerating institutional adoption, as revealed in the company’s May survey of 295 executives across banks, fintech firms, and payment processors.

Research has shown that 90% of financial institutions are either actively using or exploring stablecoin integration into their operations.

Meanwhile, corporate giants are moving beyond exploration toward active development, with Amazon and Walmart reportedly considering their own USD-backed stablecoins to reduce transaction fees.

Payment processor Stripe is also developing a dollar-backed stablecoin for markets outside the U.S., UK, and Europe, building on its October 2024 launch of stablecoin payment options.

According to DefiLlama data, the total stablecoin market capitalization now stands at approximately $285 billion, reflecting 56% year-over-year growth.

Industry projections suggest the sector could reach $1 trillion in annual payment volume by 2028, with Citigroup forecasting even more dramatic expansion to a market cap of over $2 trillion by 2030.

Banking Industry Raises Systemic Risk Concerns

However, this rapid growth has seen pushback from traditional banking institutions, with Citigroup executive Ronit Ghose warning that stablecoin interest payments could trigger a deposit flight similar to the 1980s crisis, when money market funds drained $32 billion from banks in two years.

Citi executive warns stablecoin interest payments could drain bank deposits like the 1980s crisis amid GENIUS Act loophole concerns.#Stablecoin #Bankshttps://t.co/aaHxz9bXHM

— Cryptonews.com (@cryptonews) August 25, 2025

Major banking groups, including the American Bankers Association, are lobbying Congress to close what they call a “loophole” in the GENIUS Act that allows crypto exchanges to offer yields on third-party stablecoins.

Former People’s Bank of China Governor Zhou Xiaochuan has separately warned that stablecoin issuers may pursue aggressive expansion without understanding systemic risks.

Zhou cited amplification effects that can create redemption pressure beyond initial reserves, referencing the May 2022 TerraUSD collapse, where arbitrage mechanisms accelerated rather than contained the crisis.

Recent research suggests that major stablecoins face a roughly one-in-three chance of a crisis over the next decade due to design vulnerabilities in how they handle extreme market stress.

Despite these concerns, Treasury Secretary Scott Bessent has expressed support for stablecoin adoption, arguing that digital dollars will “expand dollar access for billions across the globe and lead to a surge in demand for U.S. Treasuries” as backing assets.

The post Stablecoin Adoption Explodes: Fireblocks Unveils Payment Network With Stripe Bridge, Circle, 40+ Firms appeared first on Cryptonews.