Citigroup plans to launch crypto custody services in 2026, after developing the offering for two to three years, according to global head of partnerships and innovation Biswarup Chatterjee, who told CNBC.

The bank is exploring both in-house technology solutions and potential third-party partnerships, with Chatterjee stating “we’re hoping that in the next few quarters, we can come to market with a credible custody solution” for asset managers and other clients.

Wall Street Coming to Crypto? Citi Said Yes

The upcoming service would involve Citi holding native cryptocurrencies on behalf of clients.

Chatterjee said the bank may deploy entirely in-house designed solutions for certain assets and client segments, while using third-party lightweight solutions for other asset types.

The bank is “not currently ruling out anything” regarding its custody strategy.

Citi’s move contrasts with JPMorgan’s stance, which is that while its bank will allow clients to buy cryptocurrencies, it will not yet hold custody of the assets.

JUST IN: JPMorgan confirms on CNBC that they will allow clients to trade #Bitcoin and crypto but not yet launch custody services

pic.twitter.com/N2oYWPwwhL

— Bitcoin Magazine (@BitcoinMagazine) October 13, 2025

However, JPMorgan has also expressed interest in changing that next year.

The custody plans build on Citi’s broader digital asset ambitions announced throughout 2025.

CEO Jane Fraser confirmed in July that Citi is “looking at the issuance of a Citi stablecoin” while developing tokenized deposit services for corporate clients seeking 24/7 settlement capabilities.

The bank already offers blockchain-based dollar transfers between New York, London, and Hong Kong offices, operating around the clock.

Chatterjee said discussions with clients are underway to identify use cases for sending stablecoins between accounts or instantly converting them into dollars for payments.

Wall Street Consortium Eyes G7 Stablecoin as Competition Intensifies

Earlier this month, nine global banking giants, including Goldman Sachs, Deutsche Bank, Bank of America, Banco Santander, BNP Paribas, Citigroup, MUFG Bank, TD Bank Group, and UBS, announced plans to develop a jointly backed stablecoin focused on G7 currencies.

Nine banks, including Goldman Sachs and Citigroup, unite to launch G7-backed stablecoin as market could hit $50T in payments by 2030 and $1.2T by 2028.#Banks #Stablecoinhttps://t.co/oqPhgT5v9w

— Cryptonews.com (@cryptonews) October 10, 2025

The consortium will explore issuing reserve-backed digital payment assets available on public blockchains, with each unit pegged one-to-one against traditional fiat currency.

The coalition confirmed it is already in contact with regulators across relevant markets.

Notably, earlier this year, JPMorgan, Bank of America, Citigroup, and Wells Fargo reportedly held exploratory discussions about this shared stablecoin venture. However, those talks remained conceptual until the confirmation this month.

The banking giants are rushing in as the business model is proving extraordinarily lucrative for existing issuers who earn substantial yields on Treasury securities and cash equivalents backing their tokens.

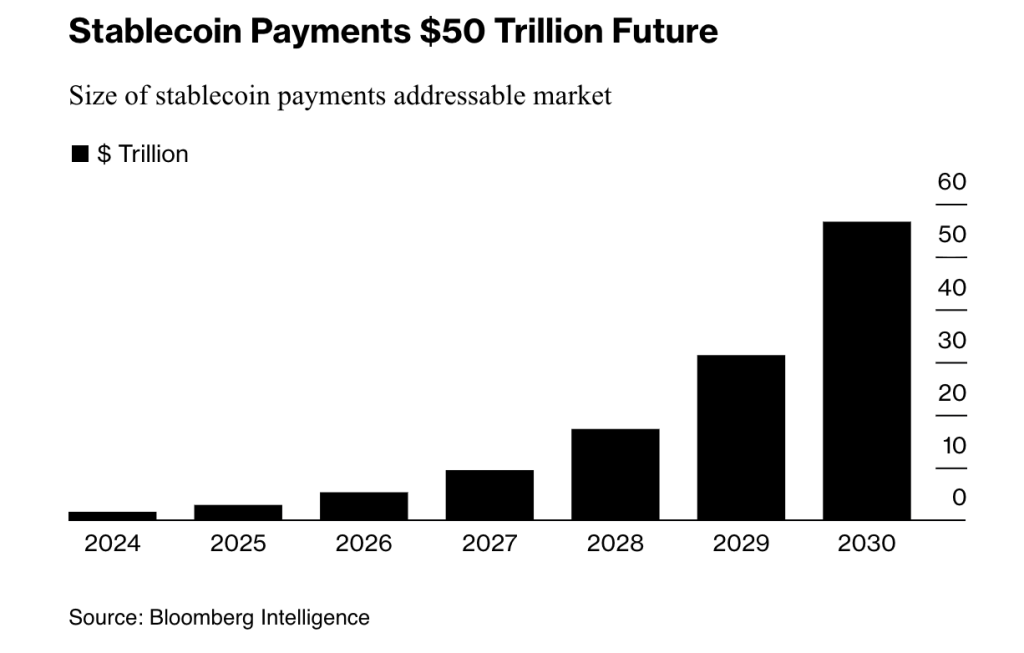

Given this adoption trajectory, Bloomberg Intelligence projects stablecoins could process more than $50 trillion in annual payments by 2030.

However, while banks seem geared towards adoption, it might also be out of, as Standard Chartered warned earlier this month that stablecoin adoption could drain more than $1 trillion from emerging market banks by 2028.

The threat prompted the Bank of England to initially propose ownership caps between £10,000 and £20,000 for retail customers.

However, following criticism, regulators are now preparing to allow exemptions for firms like crypto exchanges, which require large holdings for liquidity and settlement purposes.

Citi Balances Stablecoin Opportunities Against Deposit Flight Fears

Citi’s aggressive digital asset expansion comes despite warnings from its own analyst Ronit Ghose, who cautioned in August that stablecoin interest payments could trigger 1980s-style deposit flight from traditional banks.

Ghose drew parallels to when money market funds skyrocketed from $4 billion to $235 billion in seven years, draining deposits from banks whose rates were tightly regulated.

Between 1981 and 1982, withdrawals exceeded new deposits by $32 billion as consumers chased higher returns.

Major U.S. banking groups, including the American Bankers Association and the Bank Policy Institute, urged Congress to close what they called a “loophole” in the GENIUS Act, which allows crypto exchanges and affiliated businesses to offer yields on third-party stablecoins.

The groups cited Treasury estimates that yield-bearing stablecoins could trigger up to $6.6 trillion in deposit outflows, fundamentally changing how banks fund loans and manage liquidity.

However, crypto industry groups pushed back, with Coinbase Chief Legal Officer Paul Grewal dismissing the banking lobby’s efforts as an “unrestrained effort to avoid competition.“

This was no loophole and you know it. 376 Democrats and Republicans in the House and Senate rejected your unrestrained effort to avoid competition. So did one President. It's time to move on. https://t.co/CGCGxDqKNa

— paulgrewal.eth (@iampaulgrewal) August 13, 2025

Coinbase Research particularly released a dedicated report to the “banking threat” narrative, claiming it found no meaningful correlation between stablecoin adoption and deposit flight for community banks over the past five years.

For Citit, Fraser framed their approach as responding to client needs and the broader shift toward always-on instant settlement, stating that “digital assets are the next evolution in the broader digitization of payments, financing, and liquidity.”

With $2.57 trillion in assets under custody, Citi’s 2026 launch may be the beginning of a strategic adoption of crypto on Wall Street.

The post Citibank to Launch Crypto Custody Services in 2026 After 3 Years of Preparation appeared first on Cryptonews.