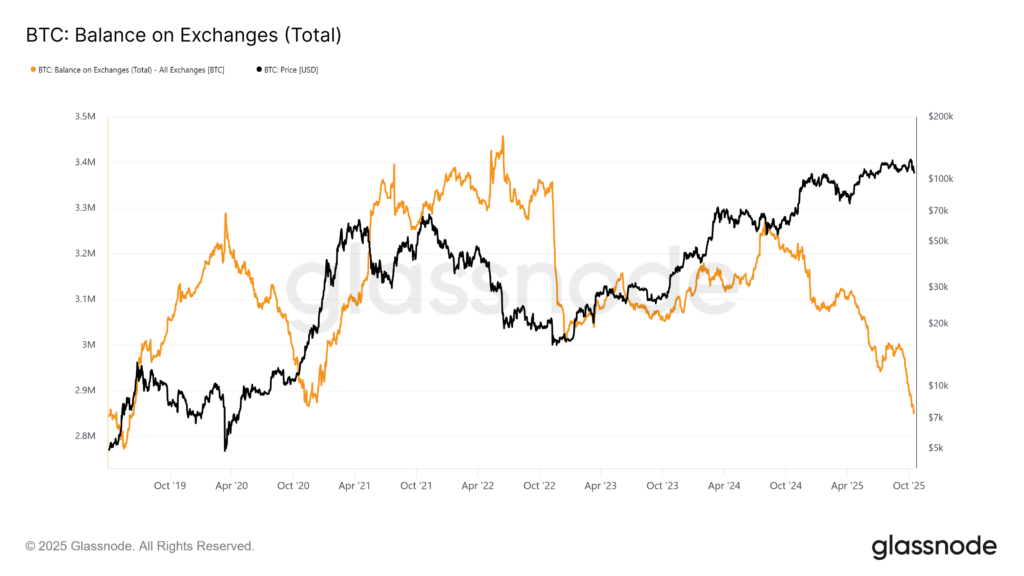

Bitcoin’s exchange balances have dropped sharply, highlighting a deepening supply squeeze as long-term holders tighten control over circulation. Over 45,000 BTC, worth nearly $4.8 billion, has been withdrawn from centralized exchanges since early October, signaling that investors are moving assets into cold storage rather than keeping them available for trading.

Bitcoin Supply on Exchanges Declines Sharply

A lower exchange balance generally means fewer coins are available for sale, reducing immediate market supply. When combined with stable or rising demand, this creates conditions that can accelerate upward price moves. The latest withdrawal trend points to growing investor confidence in Bitcoin’s long-term potential, despite recent volatility.

By contrast, inflows to exchanges tend to rise during uncertainty, when traders seek liquidity. The opposite is now occurring: outflows are increasing even as prices remain subdued. This behavior suggests that many participants see the recent correction as an accumulation opportunity, not a risk event.

At the time of writing, Bitcoin trades at $108,417, up 1.34% in 24 hours, with a total market capitalization of $2.16 trillion. The circulating supply stands at 19.93 million BTC, leaving fewer than 1.1 million coins yet to be mined before the network reaches its hard cap of 21 million.

Long-Term Holders Maintain Control

On-chain metrics show that long-term investors remain active despite short-term uncertainty. According to Santiment, the 30-day Market Value to Realized Value (MVRV) ratio is -7.56%, indicating that recent buyers are holding small unrealized losses.

Historically, negative MVRV readings have marked accumulation phases, where Bitcoin trades below perceived fair value.

In previous cycles, similar setups preceded price recoveries as selling pressure eased and confidence returned. Data also shows that leveraged positions are at multi-year lows, reducing the risk of forced liquidations. With derivatives markets showing more balanced sentiment, the environment supports gradual accumulation and consolidation before a broader recovery phase.

BTC Price Analysis: Recovery Within Reach

From a technical standpoint, Bitcoin price prediction is turning slightly bullish as it’s forming a symmetrical triangle pattern on the two-hour chart. This structure often signals a potential breakout. The price is testing the 200-EMA resistance at $108,500, while maintaining higher lows since the $104,500 bottom on October 17.

The RSI has climbed from 35 to 59, indicating improving momentum without entering overbought territory.

A breakout above $110,850 could open the path toward $113,500 and $115,960, key resistance zones within the previous descending channel. Failure to hold above $107,400, however, could trigger a pullback toward $104,550 or $102,000.

For traders, a long position above $108,800 with a stop below $107,400 presents a measured opportunity targeting $113,500. If strength persists, Bitcoin could approach $116,000 before year-end.

With exchange supply tightening and long-term holders accumulating, Bitcoin’s structural setup appears increasingly bullish. As institutional demand rebuilds and macro pressures stabilize, the supply squeeze may set the stage for the next major price expansion.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.

Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $23.9 million, with tokens priced at just $0.013125 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.

If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Onchain Accumulation Hits Six-Year Low – What Does the Supply Squeeze Mean for BTC? appeared first on Cryptonews.