Metaplanet, Japan’s largest corporate Bitcoin holder, secured a new $130 million loan to purchase additional BTC despite sitting on over $635 million in unrealized losses.

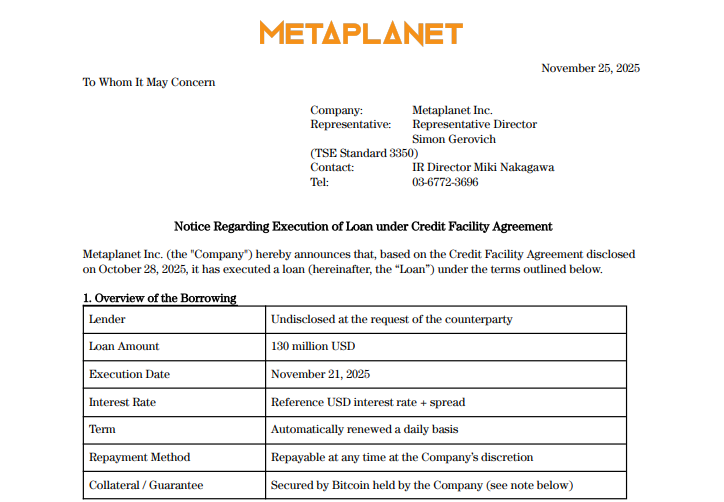

The company disclosed the borrowing in a November 21 filing under a previously established $500 million credit facility announced in late October.

The lender remains undisclosed at the counterparty’s request. According to the filing, the loan carries a floating interest rate, renews daily, and can be repaid at any time. It is fully secured by the company’s Bitcoin reserves.

Metaplanet currently holds 30,823 BTC, valued at approximately $2.7 billion, with an average acquisition cost of $108,070 per BTC and a total cost basis of $3.33 billion.

With Bitcoin trading below that level, Metaplanet has an unrealized loss of $635.97 million, or –19.1%, as of the most recent treasury update.

Metaplanet Leverages BTC Reserves for Credit, Share Buybacks, and Income Growth

The firm emphasized that its collateral capacity remains strong. As of October 31, its Bitcoin holdings totaled the equivalent of $3.5 billion, meaning the combined $230 million it has drawn from the credit line represents a small share of its available backing.

The company said its borrowing strategy maintains a “sufficient collateral buffer even during periods of strong Bitcoin price volatility.”

According to the filing, funds from the new loan will be directed toward accumulating additional Bitcoin, expanding Metaplanet’s Bitcoin income generation business, and executing share repurchases when market conditions allow.

The income business, selling bitcoin options, reached record sales during the third quarter.

Supporters frame the strategy as a calculated bet on Bitcoin’s long-term strength. The company has positioned BTC as its financial backbone, using it as a hedge against Japan’s weakening yen and employing a model similar to Strategy’s.

Critics, however, warn that leveraging a volatile asset could trigger forced sales.

A sharp price drop could trigger margin calls and force liquidations, while Metaplanet’s stock performance hasn’t consistently reflected its growing BTC reserves, showing investor skepticism.

Bitcoin Dip Hits Corporate Treasuries; Metaplanet Launches Preferred Share Program

Metaplanet’s loan comes as the Tokyo-listed firm restructures its capital base and seeks alternatives to issuing more common equity.

Last week, the company unveiled plans for two classes of preferred shares, known internally as “Mars” and “Mercury,” designed to raise capital while limiting shareholder dilution.

Metaplanet approves the issuance of new Class B shares via a third-party allotment.#Bitcoin #Metaplanethttps://t.co/p8fYF0FyZt

— Cryptonews.com (@cryptonews) November 20, 2025

The initial sale of 23.6 million Mercury shares raised ¥21.2 billion ($135 million), with a 4.9% annual dividend and optional conversion to common stock if Metaplanet’s share price triples from current levels.

The Mars class offers a variable dividend and no conversion feature, giving it higher seniority than common shares.

Metaplanet said the preferred share program is key after its stock began trading below its Bitcoin reserves.

Its market-to-net-asset-value ratio sits at 0.99, a rare discount that led to approval of a ¥75 billion share repurchase program. In October, Metaplanet became the first major Bitcoin-holding company to consistently trade below its net asset value.

Metaplanet's mNAV hits 0.99, trading below $3.4B Bitcoin reserves as one in four treasury firms are trading at discount, with corporate buying down 95% since July.#Metaplanet #Bitcoinhttps://t.co/1KgbHxWGf5

— Cryptonews.com (@cryptonews) October 14, 2025

The pressure comes amid crypto market losses, with Bitcoin falling 10% in a single session and Ethereum and Solana also sliding.

Across the sector, 26 of 168 Bitcoin-holding companies now trade below the value of their crypto reserves. Corporate accumulation has collapsed as well, dropping to 1,428 BTC in September, a 95% decline from July.

Rival firms are reporting similar stress, with major unrealized losses reported by Marathon, Bitmine, and Galaxy Digital.

Despite the market strain, Metaplanet says it remains committed to its long-term goal of acquiring 210,000 BTC by 2027, adding 17,000 BTC in Q3, ahead of its annual target.

The firm also reported a ¥13.5 billion net profit for the quarter, supported by a rebound in Bitcoin prices after September.

The post Metaplanet Doubles Down: $130M Loan to Buy More BT Despite $643M Loss – Bold or Reckless? appeared first on Cryptonews.