Paradigm co-founder Matt Huang has amplified research alleging that prediction market Polymarket may be inflating its reported trading volumes through a data aggregation error that causes double-counting across most third-party analytics platforms.

The findings, detailed by Paradigm research partner Storm Slivkoff, suggest the issue affects public datasets and dashboards that rely on Polymarket’s disclosed figures, potentially overstating the platform’s actual activity by approximately 100%.

The controversy emerged as Huang reshared Slivkoff’s analysis on X, sparking immediate pushback from Polymarket’s data team and criticism that Paradigm, an investor in rival platform Kalshi, was attempting to discredit a competitor through technical semantics.

Polymarket data bug: volumes are double-counted in most public data

Interesting find in diligence from @notnotstorm https://t.co/xuQ41JUVHf— Matt Huang (@matthuang) December 8, 2025

Technical Root of Volume Dispute

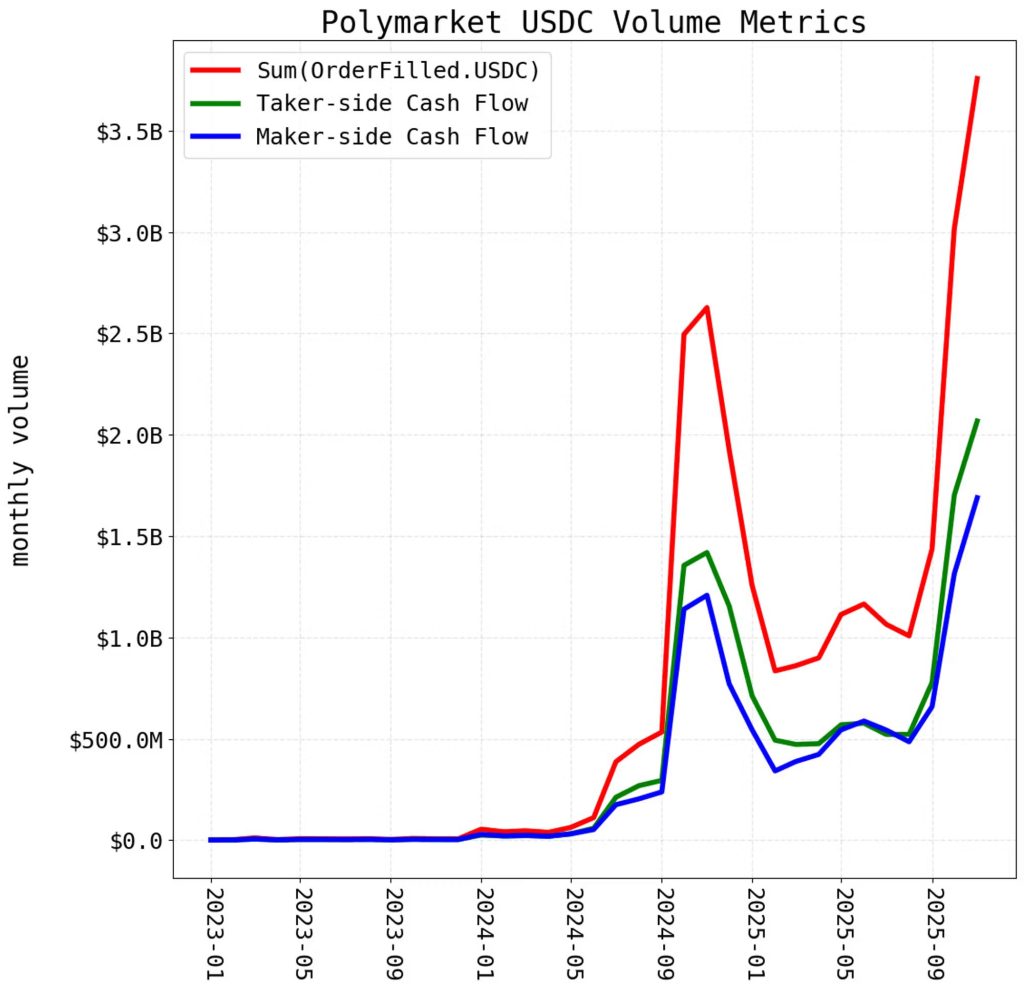

Slivkoff’s investigation reveals that Polymarket’s smart contracts emit separate OrderFilled events for the maker and taker sides of each trade, resulting in redundant representations of identical transactions.

Most analytics dashboards compute volume by summing these events, effectively counting the same trade twice.

A simple transaction involving YES tokens sold for $4.13 generates two OrderFilled events for that amount, causing dashboards to report $8.26 in volume rather than the actual $4.13 traded.

The complexity stems from Polymarket’s unique market structure, which supports eight distinct trade types, including conventional swaps and split-merge operations in which participants exchange USDC for opposing YES-NO positions.

While no individual event contains incorrect information, aggregating all OrderFilled events without distinguishing between maker and taker representations results in systematic double-counting of notional volume and cash flow metrics.

The issue extends across both Polymarket’s CTF Exchange and NegRisk exchange contracts, which share identical event emission patterns.

Slivkoff’s analysis, which included building a transaction simulator and auditing contract code, demonstrates that proper measurement requires using one-sided metrics, either taker-side or maker-side volume, rather than summing redundant event streams.

When calculated correctly, Polymarket’s actual monthly volumes for October and November 2024 were approximately $1.25 billion each, roughly half the $2.5 billion figures displayed on most public dashboards before corrections.

Industry Response and Competitive Tensions

Polymarket’s Primo Data quickly disputed the characterization, insisting that the platform’s official site displays notional taker volume without double-counting, in line with industry standards used by Kalshi.

“This post isn’t about Polymarket’s website, it’s about the common dashboards that people use for tracking Polymarket volume,” Slivkoff clarified, emphasizing the issue affects third-party analytics rather than Polymarket’s internal reporting.

This is not how prediction markets report volume, including your portfolio company Kalshi.

To be clear:

1. Our site does not double count volume. We show notional taker volume (same as Kalshi).

2. The primary dashboards that show both Polymarket & Kalshi show notional volume… pic.twitter.com/9Bu0zm0DS0— Primo Data (@primo_data) December 8, 2025

Major data providers, including DefiLlama, Allium Labs, and Blockworks, confirmed they are updating their Polymarket dashboards to eliminate double-counting after validating Slivkoff’s findings.

Meanwhile, some analysts defended existing practices, with Dragonfly data head Hildobby claiming sophisticated dashboards accounted for the distinction since 2024, though acknowledging the methodology remained undocumented until now.

The timing drew scrutiny, given Paradigm’s investment in Kalshi, Polymarket’s primary US competitor.

Will Sheehan of Parsec Finance criticized the research as reading “a bit like a hit piece when it’s just data being hard and Polymarket’s contracts being open/onchain,” while others questioned whether the disclosure of Paradigm’s competitive interest adequately addressed potential bias.

Storm defended the work as identifying honest mistakes resulting from data complexity rather than assigning blame, noting Polymarket itself bears no responsibility for how third parties interpret its event streams.

Beyond the immediate volume dispute, Nick Preszler of Melee Markets argued the controversy highlights broader measurement challenges in prediction markets, where low-priced contracts can generate disproportionate notional volume compared to actual capital at risk.

“If a user buys $10 worth of contracts at .1c each, they are risking $10, but get credited for $10,000 of volume,” Preszler noted, advocating for alternative metrics like open interest and fee revenue to provide more accurate industry comparisons.

Polymarket is building an internal trading desk to bet against customers as it relaunches in U.S. markets following CFTC regulatory clearance.#Polymarket #CFTChttps://t.co/mTAUebkNsV

— Cryptonews.com (@cryptonews) December 5, 2025

The debate comes as Polymarket prepares its full US relaunch following CFTC regulatory clearance and pursues a valuation of $12 billion to $15 billion.

Simultaneously, the company is facing criticism over plans to establish an internal market-making operation that would trade against customers, mirroring controversial practices already employed by Kalshi.

The post Polymarket Accused of Double-Counting its Trading Volume appeared first on Cryptonews.