The M1 money supply, a key economic indicator, represents the total amount of physical currency in circulation, including coins, notes, traveler’s checks, and demand deposits.

Essentially, it measures an economy’s liquidity and the public’s spending power.

In the context of the cryptocurrency market, comparing Bitcoin’s spot price to the M1 money supply provides an interesting insight into the digital asset’s relative worth and potential for future growth.

This comparison can serve as a tool for investors and economists to assess the scale of Bitcoin in relation to traditional money supply and its potential implications on global economic structures.

Moreover, tracking changes in Bitcoin’s value against the M1 money supply can potentially highlight shifts in public sentiment towards traditional fiat currencies and digital assets, offering a unique perspective on the evolving financial landscape.

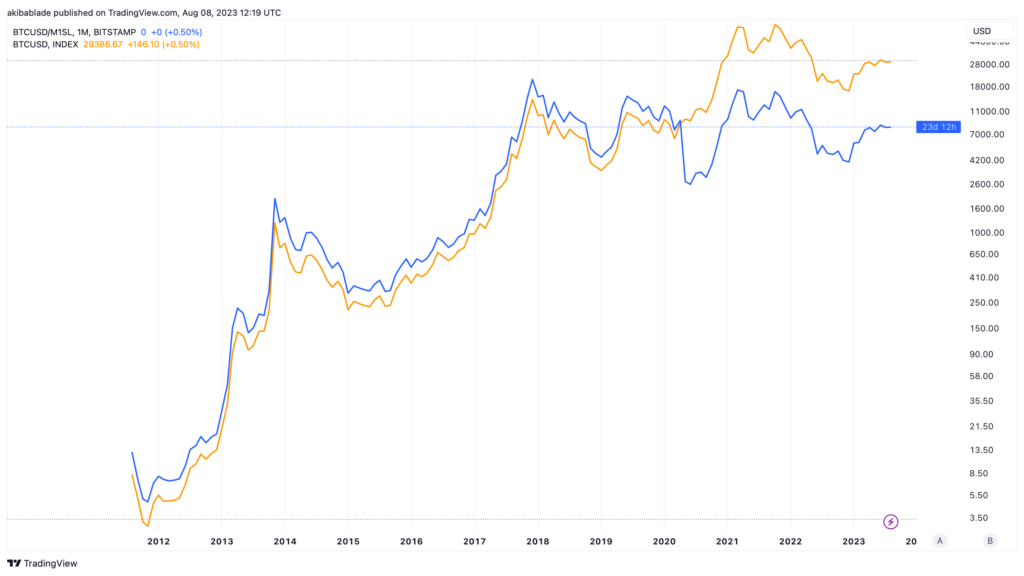

In the chart below, the ratio of Bitcoin’s spot price to the M1 money supply (BTCUSD/M1SL) is always higher than Bitcoin’s spot price until Q1 2020.

This trend has been observed on a logarithmic scale, emphasizing the relative growth rates and proportional changes between these metrics. Notably, Bitcoin’s price, when adjusted for the M1SL hasn’t reached an all-time high since 2017.

Presenting Bitcoin’s spot price as consistently lower than BTCUSD/M1SL indicates that the growth rate of Bitcoin’s price was lagging behind the growth rate of the M1 money supply or that the M1 money supply was growing at a higher rate than Bitcoin’s price.

This aligns with the macroeconomic analysis of the time, given that traditional fiat currencies and liquidity in the economy were expanding more rapidly than the demand or valuation of Bitcoin. Bitcoin was also less correlated with conventional financial markets and economic indicators during this period.

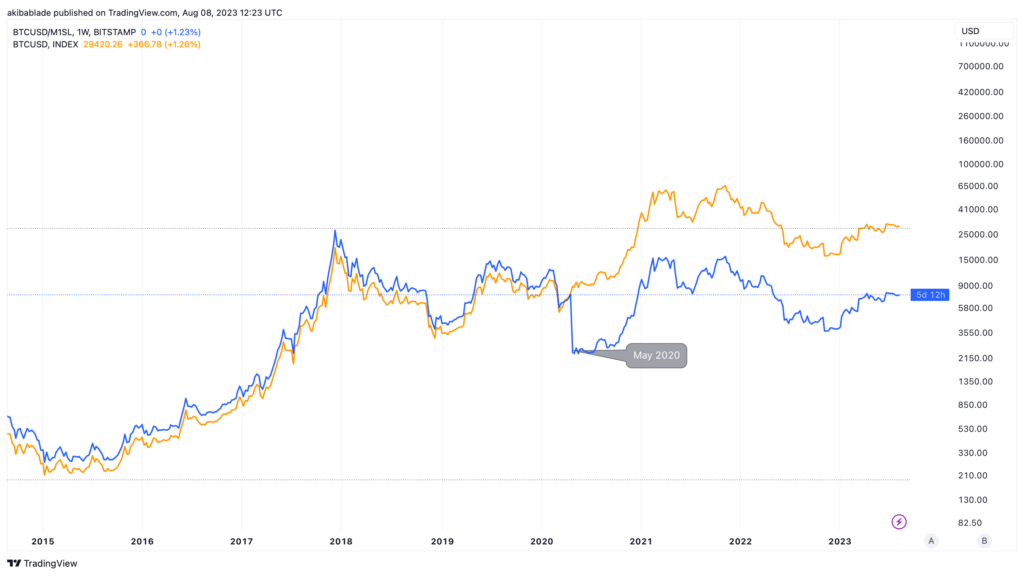

Then, the shift from May 2020, when Bitcoin’s price began to rise after the halving, appears to indicate that Bitcoin’s growth rate started to outpace the growth rate of other assets.

However, the BTCUSD/M1SL chart shows that the value of Bitcoin relative to the total amount of fiat money in circulation decreased. This could be attributed to a couple of factors.

One could be the result of the monetary policies enacted by the Federal Reserve. As the COVID-19 pandemic hit, central banks injected large amounts of liquidity into their economies to curb the anticipated economic downturn. This led to an increase in the M1 money supply, subsequently causing a decrease in the BTCUSD/M1SL ratio.

However, it’s important to note that this decrease in the BTCUSD/M1SL ratio doesn’t necessarily indicate a reduction in the intrinsic value or potential of Bitcoin. Instead, it reflects the changes in economic conditions and market sentiment at the time.

While the price of Bitcoin increased in dollar terms, the relative liquid worth of the dollar also declined as supply skyrocketed. The M1SL rose 426% over 700 days, increasing the M1 supply to $20.8 trillion from $3.95 trillion. The equivalent change in Bitcoin supply would be to go from 21 million coins to 88 million.

In the future, should the BTCUSD/M1SL chart flip the BTCUSD price again, it could signal an acceleration in Bitcoin’s actual dollar value. The current gap between the orange and blue lines on the chart essentially represents the excess liquidity in the US markets post2020. In this situation, either the Bitcoin price rises relative to the M1SL or the M1SL declines while Bitcoin holds steady.

However, if the M1SL declines in tandem with a decrease in Bitcoin’s price, it may signify a reduced perceived dollar valuation for the top cryptocurrency by market cap.

The observed trends between BTCUSD and BTCUSD/M1SL provide valuable insights, highlighting factors beyond simple price comparisons needed to gain a true sense of the value of digital assets such as Bitcoin.

It serves as a reminder that even in the rapidly evolving world of cryptocurrencies, traditional economic indicators like the M1 money supply still hold relevance and can provide valuable context for understanding crypto market dynamics.

The post Adjusting Bitcoin’s price for US liquidity reveals key indicator for bull run appeared first on CryptoSlate.