A flood of fresh cash might about to land in crypto. Roughly $150 billion in tax refunds will hit U.S. consumer accounts by the end of March.

Some analysts think part of that money could drift straight into risk assets. Including crypto. Wells Fargo strategists say this refund wave, boosted by 2026 tax incentives, may quietly fuel retail participation again.

And the timing is interesting. Markets are sitting at key technical levels. If even a fraction of that capital rotates into digital assets, the retail bid could show up right when it matters most.

Key Takeaways

- $150B Liquidity Wave: Wells Fargo analysts project roughly $150 billion in refunds will be distributed by late March.

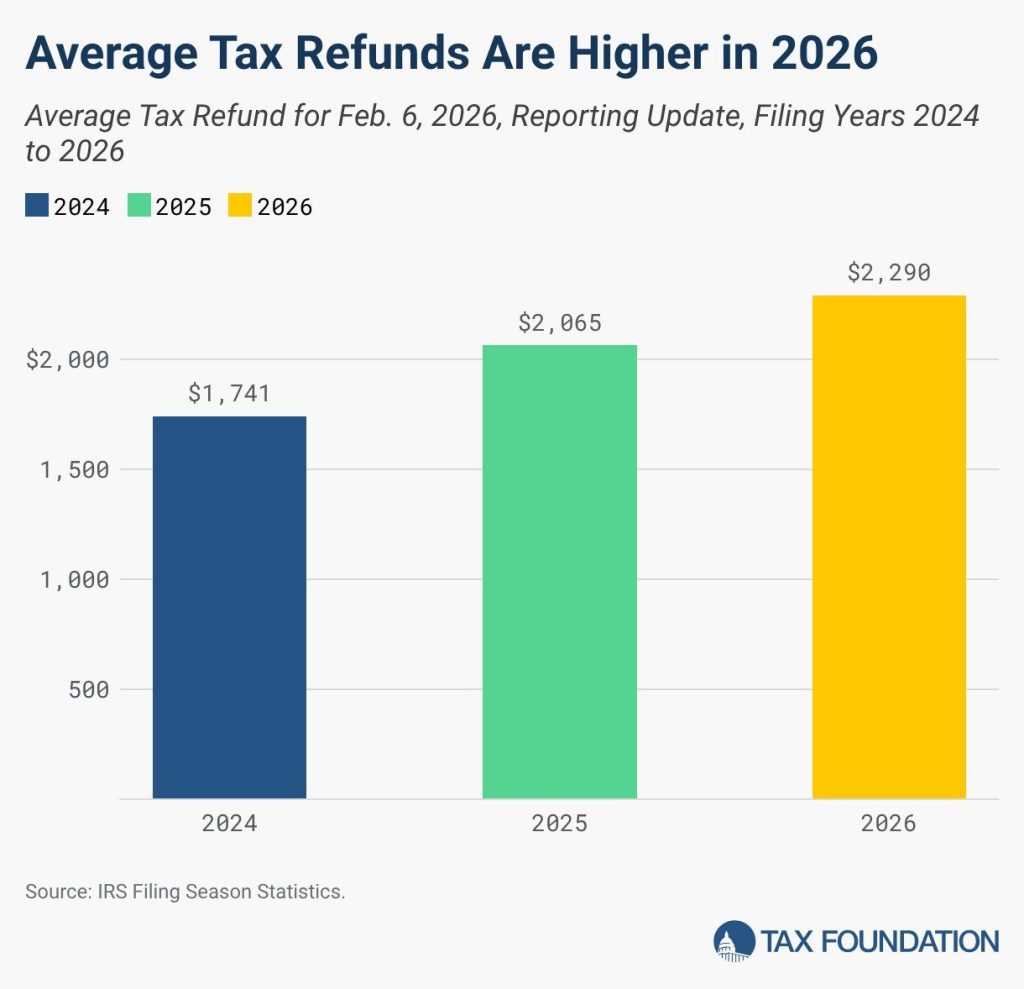

- Refunds Are Up 11%: Early IRS data shows the average refund size has jumped to $2,290, increasing retail purchasing power.

- Retail Catalyst: Historical data suggests the “refund effect” correlates with increased inflows into retail-heavy crypto assets.

Why Does Refund Season Matter for Crypto?

Liquidity moves markets. And right now, the U.S. Treasury is about to inject a wave of it. After the One Big Beautiful Bill passed in July 2025, tax cuts boosted refund sizes for a lot of Americans.

Treasury Secretary Scott Bessent has already hinted that refunds this season could be “very large.” That means more disposable cash landing in bank accounts.

Average tax refunds are projected to jump by $1,000 this year — returning $91 BILLION back to the American people.

The largest tax refund season in U.S. history is here thanks to @HouseGOP’s Working Families Tax Cuts.

More money back in your pocket.pic.twitter.com/U3hktiKsq7

— Congressman Gabe Evans (@repgabeevans) February 7, 2026

Historically, lump sum payouts like this do not just go toward bills. A slice often flows into investments. And in recent cycles, that has included digital assets. Retail participation tends to rise when people feel flush.

Refund averages usually peak around mid February. That timing lines up with the current surge in activity across several altcoins. When fresh cash meets technical breakout zones, the reaction can be sharper than most expect.

The Data: Bigger Checks, Faster Deposits

The early numbers for the 2026 filing season are already coming in hot. By February 6, the IRS had processed more than 20.6 million returns and sent out nearly $16.954 billion in refunds.

The average check is now around $2,290, up roughly 10.9% from last year.

Direct deposits are even higher, averaging about $2,388. And the money moves quickly. Most e filers see funds within about 21 days, which means that cash is ready to be deployed almost immediately.

Another wave is coming too. Once PATH Act restrictions lift after February 15, refunds tied to the Earned Income Tax Credit start flowing. Historically, that second wave is larger and hits later in February.

Fresh liquidity entering an already concentrated exchange environment can have an outsized effect. Especially if even a small slice finds its way into risk assets.

Will This Trigger the Next Leg Up?

Tax refund season hitting at the same time as improving regulatory tone is not random timing. It creates a strong backdrop for risk assets. Funding rates are already flashing extremes, which tells you shorts are crowded.

If even a fraction of retail refund money rotates into spot crypto, that buying pressure could trigger a fast short squeeze.

Bitcoin (BTC)24h7d30d1yAll time

The macro tone adds fuel. Political signals around clearer crypto legislation are improving sentiment. When retail feels regulatory risk is fading, confidence returns quicker.

Over the next six weeks, roughly $150 billion will move into consumer accounts. Not all of it will hit crypto, but it does not need to. Even a small percentage can shift momentum in a leveraged market.

Keep an eye on the weekly IRS updates toward the end of February. That data will show whether the liquidity wave is building or already peaking.

The post $150B in US Tax Refunds Could Fuel Fresh Crypto Inflows, Historical Data Suggests appeared first on Cryptonews.