Australia’s securities regulator has declared stablecoins, wrapped tokens, tokenized securities, and digital asset wallets as financial products under existing law, requiring service providers to obtain licensing while granting the industry an eight-month transition period.

The Australian Securities and Investments Commission (ASIC) announced updated guidance on Wednesday, alongside a sector-wide no-action position that runs until June 30, 2026.

ASIC Commissioner Alan Kirkland said, “distributed ledger technology and tokenization are reshaping global finance,” and that the guidance provides regulatory clarity that enables firms to innovate confidently in Australia.

The regulator granted an in-principle decision to provide relief for distributors of certain stablecoins and wrapped tokens, with feedback invited on draft relief instruments until November 12.

Licensing Requirements

The updated Information Sheet 225 clarifies that many widely traded digital assets constitute financial products under current law and will remain so under proposed government reforms.

Service providers dealing with these assets must hold Australian Financial Services licenses, ensuring consumers receive full legal protections and allowing ASIC to act against harmful practices.

ASIC will factor in the current no-action position when considering historical conduct, but will continue pursuing egregious behavior involving significant consumer harm or widespread systemic misconduct.

The regulator also proposed extending omnibus account structures for digital assets under specified conditions, amending existing custody standards to accommodate blockchain-based holdings.

The framework builds on practical relief ASIC provided this year to facilitate the Reserve Bank of Australia’s Project Acacia, a research project examining wholesale tokenized asset markets.

Australia's central bank progresses Project Acacia CBDC testing with 24 industry participants conducting real-money transactions as potential economic gains reach AU$19B annually.#CBDC #Australiahttps://t.co/r5LIhbazpc

— Cryptonews.com (@cryptonews) July 10, 2025

Government Reforms Drive Comprehensive Digital Asset Framework

The guidance aligns with the Australian government’s broader digital asset platform reforms, with draft legislation released in September proposing penalties of up to 10% of annual turnover for platforms breaching new rules.

The proposal requires exchanges and operators to secure Australian Financial Services licenses, with firms facing fines of A$16.5 million, three times the benefit gained, or 10% of annual turnover for misleading conduct and unfair contract terms.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.#Australia #CryptoRegulation https://t.co/eVdrLlJgnd

— Cryptonews.com (@cryptonews) September 25, 2025

The consultation period for the draft law closed on October 24, which was one of the most significant moves yet to regulate an industry that includes major global players such as Coinbase and Kraken.

Smaller platforms holding less than A$5,000 per customer and processing under A$10 million in annual transactions will be exempt from full licensing requirements.

Treasury officials said the new regime will bring digital asset and tokenized custody platforms under the Corporations Act, extending consumer protections and formal licensing requirements.

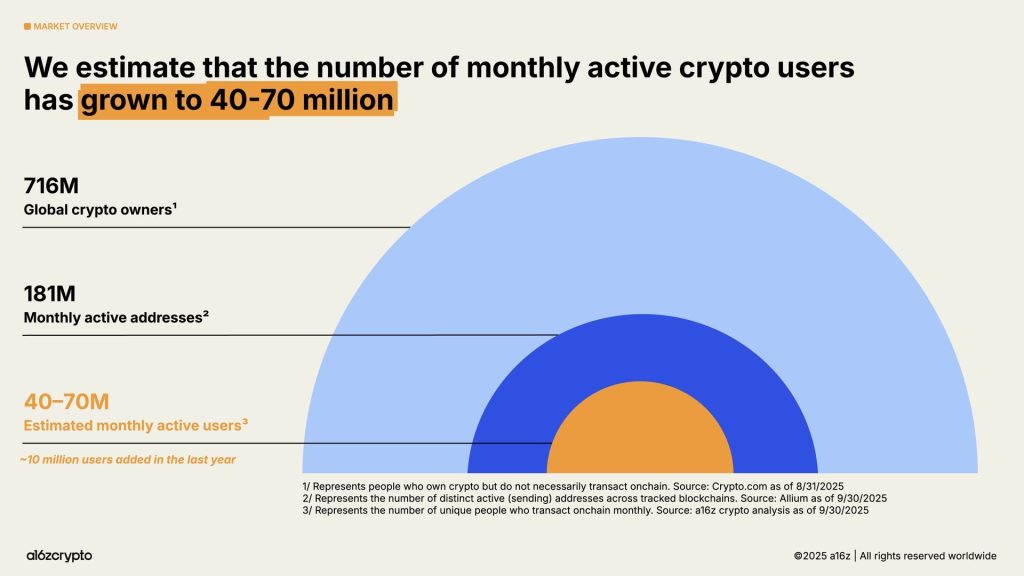

Regulators’ efforts are a balancing act as they seek to protect investors without stifling innovation in a market where Australia’s crypto adoption rate reached 31% in 2025, up from 28% in 2024, according to a16z’s State of Crypto 2025 report.

Stablecoin Market Expansion

ASIC granted class relief in September for intermediaries distributing stablecoins issued by licensed Australian Financial Services providers, exempting them from the need for separate market, clearing, and settlement licenses until June 2028.

Catena Digital Pty Ltd became the initial qualified issuer for its AUDM stablecoin, with ASIC planning to extend relief to additional licensed issuers addressing commercial viability concerns raised during consultation.

The temporary relief responds to industry feedback warning that stablecoin distribution faced significant barriers under existing licensing regimes, with issuers indicating operations would lack commercial viability without intermediary exemptions.

Distributors must provide Product Disclosure Statements to retail clients as the sole condition for accessing relief, while maintaining consumer protection standards and reducing operational barriers.

Australia's crypto adoption hits 31% outpacing other developed nations as stablecoins power $46T in transactions and crypto market cap crosses $4T globally.#Australia #Crypto #Adoptionhttps://t.co/ujNdEiEQDn

— Cryptonews.com (@cryptonews) October 24, 2025

Australia is growing rapidly in adoption. According to a16z’s State of Crypto 2025 report, Australia and South Korea lead developed nations in token-related web traffic, with the country’s adoption indicators showing activity focused more on trading and speculation than in other markets.

Self-managed superannuation funds now account for a quarter of the pension system, with crypto exposure jumping sevenfold since 2021 to A$1.7 billion across Australia’s $2.8 trillion pension pool.

Major exchanges have accelerated their push into Australia’s retirement sector, with Coinbase preparing to launch a dedicated SMSF service that already has over 500 investors on its waiting list.

The post Australia Might Reclassify Stablecoins as Financial Products Requiring Licensing appeared first on Cryptonews.