Recent dips in the crypto market continue to show how volatile digital assets can be, yet this isn’t slowing institutional interest in blockchain. Even amid sharp price swings, liquidity rotations, and narrative churn, long-term investors are directing capital toward real-world asset (RWA) tokenization.

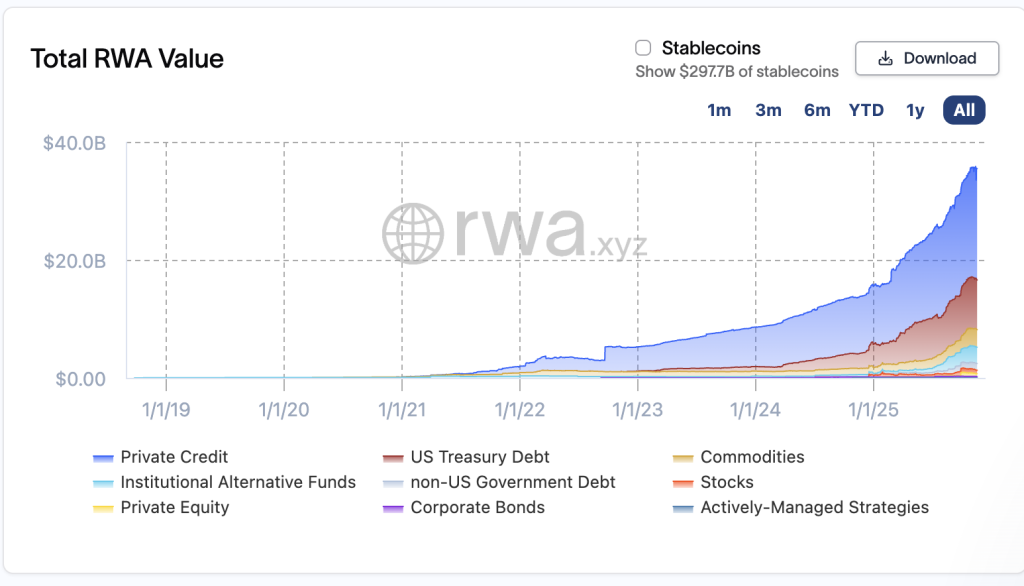

Data from analytics platform rwa.xyz shows that $35.67 billion worth of RWAs are currently on-chain (excluding stablecoins). Tokenized private credit and U.S. Treasury debt remain the most popular categories.

A spokesperson from BNB Chain further told Cryptonews that RWA total-value locked (TVL) on the network grew sharply from $5 million to $1 billion in TVL this year alone. The recent surge was led by USYC (Circle) and institutional traditional finance leaders like BlackRock (BUIDL), Franklin Templeton (BENJI), VanEck (VBILL), Qatari National Bank (QCDT), and China Merchant Bank (CMBMINT)—all of which now have RWA products available on BNB Chain.

RWAs adoption on BNB Chain is unstoppable.

USYC, @circle’s tokenized money market fund, soared past $1B in total supply, with over $900M living on BNB Chain.

As a yield-bearing collateral, USYC delivers predictable yield and settles 24/7, near-instant in USDC. It’s fully BEP-20… pic.twitter.com/y9CTlR1Zan— BNB Chain (@BNBCHAIN) November 19, 2025

The momentum isn’t slowing. A June 2024 McKinsey & Company report estimates that the global market for tokenized real-world assets could reach up to $4 trillion by 2030.

Short-Term Volatility Doesn’t Change Long-Term Adoption Trends

Industry experts believe that as the global push to upgrade financial infrastructure continues, crypto market turbulence will become less key.

Sarah Song, head of business development at BNB Chain, noted that on-chain RWA TVL has grown consistently since 2022, a trend she believes aligns with the rise of stablecoins and the desire for diversified, on-chain asset exposure.

“Investors can easily switch between different types of assets directly on-chain with a 24/7 trading and investing experience based on different risk preferences under different market conditions,” Song said.

This allows investors to directly invest in crypto-native assets, along with T-bills and private credit, which is becoming more appealing to large institutional players seeking efficiency.

Even when crypto markets cool, demand for tokenized, cash-flow–backed assets remains strong, making RWAs one of the most resilient growth segments in the industry. This makes tokenized RWAs a leading use case of blockchain technology.

Why Real-World Value Moves On-chain

Mike McCluskey, CEO of asset tokenization suite Sologenic, compared today’s RWA wave to the early internet era.

“What we’re actually starting to see is the beginning stages of an exponential growth curve of value moving on-chain. In the very near future, every asset will have a digital token that represents its real-world value,” McCluskey stated.

While tokenized government securities, like U.S. Treasuries and T-bills, are currently seeing the highest RWA demand, new use cases will certainly emerge. McCluskey noted this is due to friendlier regulations and clearer compliance.

This has allowed Sologenic to advance tokenized equities, making these accessible directly through crypto-native wallets. “The emerging credit-based and yield assets are more viable due to a combination of greater regulatory comfort and the expanded universe of necessary service providers like auditors,” he stated.

RWA is not a single asset class. It's a complete capital market stack.

This chart is your allocation map:

1. The Anchor (Safety): Tokenized Treasuries (Ondo/BlackRock). 4-5% yield. This is your on-chain cash.

2. The Engine (Growth): Private Credit (Maple/Goldfinch). 8-15%… https://t.co/5A0hOgh8ma pic.twitter.com/kabI5JK9jc— Pharos Research (@PharosResearch_) November 20, 2025

Bill Barhydt, founder and CEO of digital asset platform Abra, further told Cryptonews that new Layer-1 (L1) protocols, such as Solana and SUI, are proving that decentralized networks can scale and perform as well as traditional monolithic transaction processing systems.

Supporting this, crypto research firm Messari reported $418.1 million in RWA value on Solana, with yield-bearing assets—led by tokenized treasuries, such as OUSG and USDY from Ondo Finance—representing the fastest-growing segment.

Other new RWA use cases are starting to emerge. Dave Hendricks, CEO and founder of tokenization platform Vertalo, told Cryptonews that one of the most ground-breaking use cases Vertalo supports is “Venture Asset Treasuries” (VAT).

Unlike crypto-collateralized digital asset treasuries (DAT), Hendricks explained that VATs feature real-world underlying private assets that can be actively managed to grow in value. He added that VATs are more interesting than DATs in that their upside is the result of what would have previously tripped up issuers, namely, Howey violations.

Regulations Improve, But Challenges Remain

Whether markets are bullish or bearish, global regulators continue refining frameworks around tokenized assets, custody, disclosure, and stablecoin structures. This has helped the RWA sector mature over time.

“We finally have more clarity when it comes to tokenized RWAs, especially since the most recent administration appointed new leadership at The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC),” Hendricks said.

He pointed to several policy developments—including the Genius Act, the White House Digital Assets Working Group Report, and the expected passage of the Clarity Act and the Responsible Financial Innovations Act—as key tailwinds.

While important, Staci Warden, CEO of the Algorand Foundation, told Cryptonews that regulatory fragmentation will continue to create challenges for RWA growth. According to Warden, different rules across the U.S., Europe, and Asia make it difficult to scale a single product globally, especially for banks.

She added that interoperability between chains, along with existing custody, accounting, and risk systems, is still too bespoke and expensive. Finally, Warden added that risk management remains high:

“Supervisors are rightly worried about intraday liquidity, bank-run dynamics, and concentration if ‘all the collateral’ moves onto a handful of platforms faster than the safeguards do. Also, user experience and key management remain non-trivial until institutions are confident they can operate this safely at scale, many will remain in pilot mode rather than full production.”

The Future of RWAs Looks Bright

Challenges aside, the ongoing allocation toward RWAs shows that institutional capital is focused on real adoption, real utility, and long-term structural transformation. This will likely continue, regardless of crypto market volatility.

“Even if guidance moves slowly or markets take time to mature, institutional capital is already migrating on-chain through products like BlackRock’s BUIDL and Franklin Templeton’s funds, proving that the shift itself is structural and currently underway,” McCluskey stated.

It’s become clear that RWAs are no longer a theoretical use case, but are quickly becoming one of blockchain’s most credible pathways to mainstream adoption. As large institutions continue bridging traditional assets to digital rails, the sector’s long-term trajectory looks stronger than ever.

The post Beyond Volatility: Why Investors Are Doubling Down on Real-World Assets appeared first on Cryptonews.