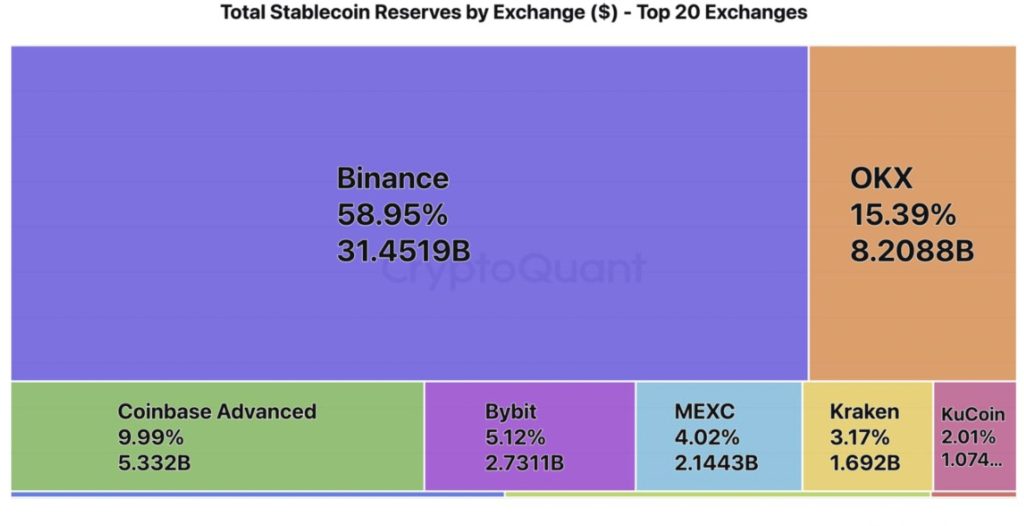

The latest CryptoQuant data shows Binance holding the largest stash of stablecoins among major exchanges, giving it an edge in overall liquidity.

Binance holds 59% of all stablecoin reserves, with $31B in USDT and USDC.

It leads 2025 inflows with $180B and sees the highest average BTC deposits. pic.twitter.com/p0ipDA97tN— CryptoQuant.com (@cryptoquant_com) June 3, 2025

Binance’s wallets hold roughly $31 billion in USDT and USDC—more than any other centralized exchange. That stash makes up about 59% of all stablecoin reserves industry-wide, showing how much trading liquidity is parked on the platform.

Traders use stablecoins much like ready cash, making them a vital part of an exchange’s liquidity, so Binance’s large share demonstrates how effectively it draws in capital that’s primed to trade.

In May alone, Binance received $31 billion in USDT and USDC deposits, narrowly edging out Coinbase, which reported $30 billion in the same period.

For the year so far, Binance has attracted $180 billion in cumulative stablecoin inflows, compared to Coinbase’s $195 billion, demonstrating the consistent magnetism of both platforms for institutional and retail capital.

Transparency as a Strategic Advantage

In total exchange reserves, Coinbase ranks first with $129 billion, followed by Binance with $110 billion. Combined, they account for 60% of total reserves across the top 20 centralized exchanges, with holdings spread across Bitcoin, Ethereum, and major stablecoins, reports CryptoQuant.

While both exchanges dominate in scale, they diverge in transparency. Binance sets itself apart by publishing comprehensive Proof-of-Reserves (PoR) reports, including wallet addresses that verify its on-chain holdings.

This level of transparency enhances Binance’s credibility among crypto-native users who prioritize decentralization and verifiability. In contrast, Coinbase does not provide public PoR reports, instead relying on traditional financial disclosures to build institutional trust, reflecting a more regulated approach to exchange operations.

Binance Attracts Larger Bitcoin Players

Beyond stablecoins, Binance continues to demonstrate its appeal to large market participants through Bitcoin inflows. On May 22, when Bitcoin surged to an all-time high of $112,000, the average Bitcoin deposit to Binance spiked to 7 BTC, the highest among all exchanges.

For comparison, Bitfinex saw an average of 5 BTC, while OKX, Kraken, and Coinbase recorded lower figures—1.23, 0.7, and 0.8 BTC, respectively. These numbers suggest Binance is the preferred venue for whales and high-volume traders.

The broader capital inflow trends for 2025 further reinforce the leadership of Binance and Coinbase. Binance has drawn $335 billion in cumulative USD inflows this year, slightly behind Coinbase’s $344 billion.

These volumes are not only evidence of user trust but also serve as indicators of liquidity depth, platform stability, and the perceived security of each exchange, says CryptoQuant.

In sum, Binance’s dominant position in stablecoin reserves, coupled with its public Proof-of-Reserves and appeal to large Bitcoin holders, positions it as a cornerstone of global crypto liquidity.

While Coinbase maintains a lead in overall reserves and capital inflows, Binance’s transparency and consistent performance in attracting capital inflows suggest it remains a formidable leader in the competitive exchange sector.

The post Binance Dominates Crypto Liquidity with Largest Stablecoin Reserves: CryptoQuant appeared first on Cryptonews.