Binance Poland introduced plans on Thursday to implement new procedures for cryptocurrency deposits and withdrawals, efficient January 20, 2025, in response to evolving EU regulatory requirements.

The modifications are designed to align with native steering and meet stringent EU necessities for cryptocurrency transactions.

These updates will primarily have an effect on Polish and Belgian customers of the platform, who might want to present extra info for sure transactions.

Binance Poland Implements Enhanced KYC Procedures for EU Compliance

To fulfill EU regulatory obligations, Binance Poland will implement stricter procedures for customers conducting cryptocurrency deposits and withdrawals.

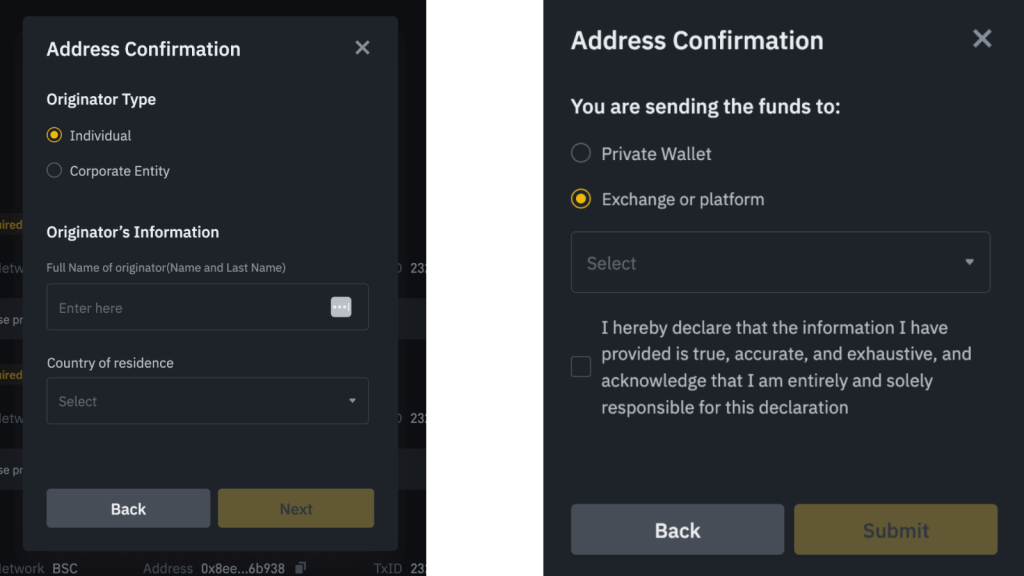

Deposits exceeding €1,000 (or its equal in different currencies) would require customers to offer detailed details about the sender.

All cryptocurrency withdrawals, whatever the quantity, would require customers to offer beneficiary particulars.

Customers depositing funds shall be prompted to provide the sender’s full identify, nation, and, if relevant, the identify of the originating crypto trade.

These initiating withdrawals might want to furnish the beneficiary’s full identify, nation, and trade identify (if related).

In accordance with Binance’s announcement, this dual-layered verification intends to enhance transparency and cut back dangers of illicit monetary actions resembling cash laundering and fraud.

If customers fail to offer the required info, transactions could also be delayed or canceled, with Binance doubtlessly returning the funds to the sender.

To keep away from disruptions, Binance has suggested its customers to stick to the up to date procedures promptly.

Binance Tightens Compliance Measures Amid Regulatory Adjustments

The updates aren’t restricted to inter-exchange transfers however prolong to transactions involving self-hosted wallets as nicely.

The initiative is a part of the EU’s broader initiative to tighten digital asset rules by MiCA, which grew to become totally efficient this 12 months.

These measures could introduce extra steps in customers’ transaction processes however promise a safer and clear ecosystem in the long term.

Binance has assured its customers of a easy transition and has inspired them to seek the advice of its privateness discover for extra info on information dealing with practices.

Equally, in keeping with a report in Dec, Binance.US plans to revive USD companies by early this 12 months.

You may additionally like Binance.US Plans to Resume USD Companies by Early 2025

Binance initially stopped as a result of the corporate confronted authorized challenges final 12 months, together with allegations of securities legislation violations, the lack of cash transmitter licenses in seven states, and a $50 million settlement over cash laundering expenses. These led to Changpeng Zhao’s resignation as CEO.

In response, Binance.US suspended USD transactions in mid-2023, transitioning to a crypto-only platform whereas urging customers to transform USD to stablecoins like USDT. Moreover, Binance can also be planning to rebrand Binance Labs.

Cryptocurrency trade Binance enterprise capital arm spin-off @BinanceLabs has introduced plans to rebrand in 2025, with @CZ_Binance main and fascinating with funding tasks on a private stage.#BinanceLabs #CZhttps://t.co/4tXh47sHm8

— Cryptonews.com (@cryptonews) December 31, 2024

Binance Lab, the enterprise capital arm spun off from Binance earlier this 12 months, is about to rebrand in 2025 to mirror its independence and evolving imaginative and prescient.

As a part of the brand new reform, it’s going to now be led by former Binance founder Changpeng Zhao (CZ). The entity will broaden its funding focus to incorporate secondary markets and OTC offers.

CZ, completely banned from Binance management as a result of regulatory points, will think about investing in and instantly partaking with tasks.

In 2024, Binance Labs invested in 46 tasks in various sectors, resembling DeFi, AI, Bitcoin, and gaming.

These investments contributed to the expansion of the BNB Chain ecosystem and advancing fields like decentralized science (DeSci) and ZK applied sciences.

The put up Binance Poland to Regulate Deposit and Withdrawal Procedures for EU Compliance appeared first on Cryptonews.