Nasdaq-listed Bit Digital has completed its transformation into an Ethereum treasury powerhouse, selling 280 BTC and deploying $172 million in fresh capital to accumulate over 100,000 ETH.

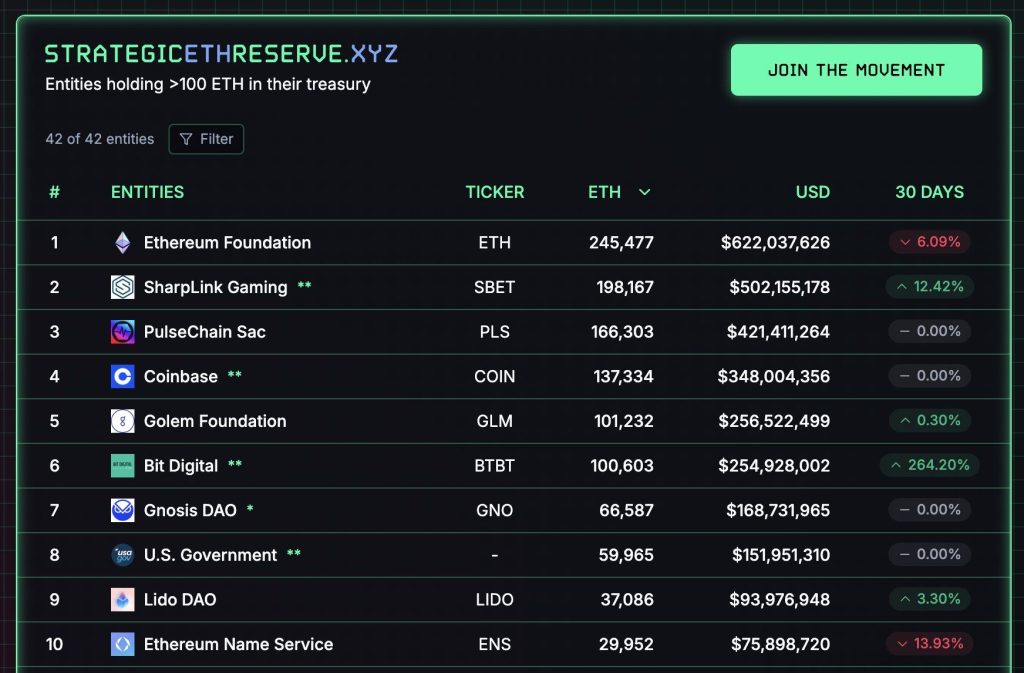

Following the close of its underwritten public offering, Bit Digital now controls approximately 100,603 ETH, positioning the company among the largest public Ethereum holders globally, alongside existing institutional players such as SharpLink Gaming.

As of today, Bit Digital has accumulated over 100,000 ETH.

But we are not new to Ethereum, nor to our conviction in its opportunity. Since 2022, Bit Digital has been holding, accumulating, and staking ETH, with a belief from day 1 that it can become the dominant infrastructure…— Bit Digital, Inc. NASDAQ:BTBT (@BitDigital_BTBT) July 7, 2025

This strategic shift comes as CEO Sam Tabar doubles down on Ethereum’s long-term potential, describing the network’s programmable nature and staking yield model as foundational to the future of digital assets.

The company has converted all of its BTC holdings into ETH, rather than maintaining a diversified crypto portfolio with a complete exit from its Bitcoin holdings as part of its new treasury approach.

From Mining Struggles to ETH Accumulation Strategy

Bit Digital’s journey to becoming an Ethereum treasury company began with mounting challenges in its traditional Bitcoin mining operations throughout 2024 and early 2025.

Prior to the offering, the company held 24,434 ETH as of March 31, 2025, representing an early commitment to Ethereum that predated its current all-in strategy.

Bit Digital plans to sell its Bitcoin mining assets and to redeploy net proceeds into Ethereum, as a part of its transition to become a “pure play” ETH staking firm.#EthereumStaking #BitcoinMining #BitDigitalhttps://t.co/PEbFYrdKDp

— Cryptonews.com (@cryptonews) June 26, 2025

B. Riley Securities led the underwritten public offering, which raised approximately $172 million in gross proceeds specifically earmarked for Ethereum purchases rather than traditional business expansion.

“We believe Ethereum has the ability to rewrite the entire financial system,” Tabar stated in the company’s announcement.

Beyond simple price speculation, Bit Digital’s strategy centers on Ethereum’s staking capabilities, allowing the company to generate yield on its treasury holdings while supporting network security.

Company data shows Bit Digital already operates approximately 21,568 ETH in native staking protocols, earning 211 ETH in staking rewards during Q1 2025 alone.

Meanwhile, Bitcoin mining revenue plummeted 64% year-over-year in Q1 2025, with the company earning just 83.3 Bitcoin during the quarter, an 80% decline that accelerated management’s strategic pivot away from proof-of-work operations.

Tabar’s vision extends beyond current holdings, with plans to “aggressively add more” ETH to establish Bit Digital as “the preeminent ETH holding company in the world.“

Corporate Ethereum Adoption Gains Institutional Momentum

Bit Digital’s strategic treasury reallocation contributes to a broader institutional momentum that is gearing toward Ethereum, as companies recognize the network’s programmability and staking capabilities as superior to Bitcoin’s store-of-value proposition.

SharpLink Gaming currently holds the title of world’s largest publicly traded Ethereum holder with 188,478 ETH worth approximately $457 million, accumulated through a similar equity-to-crypto conversion strategy.

SharpLink Gaming has emerged as the world’s largest publicly traded holder of Ethereum (ETH), after acquiring 176,271 ETH for $463 million. #ETH #Sharplinkhttps://t.co/ynahjYt7Hd

— Cryptonews.com (@cryptonews) June 13, 2025

BlackRock’s iShares Ethereum Trust recently recorded 23 consecutive days of inflows, while Fidelity and other institutional managers poured over $21 million into Ethereum ETFs in recent weeks.

Ethereum staking rewards provide a more compelling yield advantage over Bitcoin’s primarily store-of-value proposition, with over 35 million ETH currently staked, representing more than 28% of the total supply locked in smart contracts.

Corporate adoption also appears to be concentrated among companies seeking alternatives to traditional cash management, and potential SEC guidance on staking components within ETF products could unlock additional institutional capital.

Thomas Lee of Fundstrat Global Advisors describes Ethereum as a “higher beta” asset compared to Bitcoin, due to its foundational role in stablecoin transactions and decentralized finance applications.

Stablecoin transaction volume, which primarily occurs on Ethereum’s network, could further drive significant demand for ETH as the market grows from $250 billion to a projected $2 trillion by 2028.

The post Bit Digital Goes All-In on Ethereum, Dumping 280 BTC to Build 100K+ ETH Treasury appeared first on Cryptonews.