Bitcoin and Ethereum exchange-traded funds (ETFs) recorded a combined $244 million in outflows on September 23, marking the second consecutive day of investor withdrawals.

This follows a sharp $439 million exit the previous day, as investors repositioned around the Federal Reserve’s recent rate cut and upcoming U.S. inflation data.

ETF Flows Highlight Investor Caution With Bitcoin and Ethereum Facing Daily

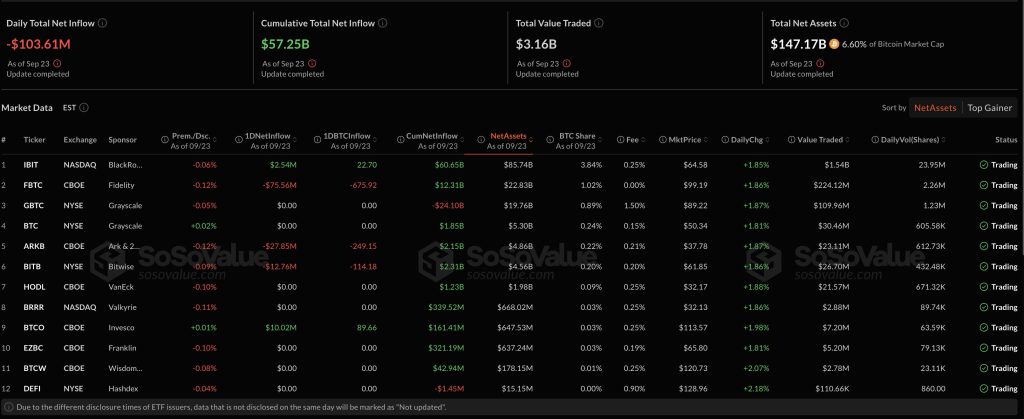

According to data from SoSoValue, Bitcoin spot ETFs saw net outflows of $103.6 million on Monday.

Fidelity’s FBTC led the withdrawals with $75.6 million, followed by ARK 21Shares’ ARKB, which shed $27.9 million.

In contrast, BlackRock’s flagship IBIT managed to secure a modest $2.5 million inflow, while Invesco’s BTCO recorded the highest inflow of the day at $10 million.

Grayscale’s GBTC, along with VanEck’s HODL and Valkyrie’s BRRR, reported no major net flows.

Ethereum ETFs, on the other hand, experienced even sharper redemptions, with $140.7 million flowing out in a single day. Fidelity’s FETH accounted for the bulk of losses with $63.4 million in outflows, followed by Grayscale’s ETH fund, which lost $36.4 million.

Bitwise’s ETHW also saw heavy withdrawals of $23.9 million, while Grayscale’s ETHE posted $17.1 million in redemptions.

BlackRock’s ETHA and VanEck’s ETHV remained flat, while smaller funds from Franklin, 21Shares, and Invesco showed no notable changes.

A day prior On September 22, Bitcoin products had lost $363 million in a single session, led by Fidelity’s FBTC with $276.7 million in redemptions.

Ethereum funds saw $76 million withdrawn the same day, led again by Fidelity’s FETH, alongside redemptions from Bitwise and BlackRock’s ETHA.

As of September 23, Bitcoin spot ETFs hold $147.2 billion in net assets, representing 6.6% of the cryptocurrency’s total market capitalization. Cumulative inflows stand at $57.25 billion.

Ethereum spot ETFs now hold $27.5 billion in net assets, representing 5.45% of the total ETH market, with cumulative inflows reaching $13.7 billion.

The outflows come just one week after digital asset products recorded nearly $1.9 billion in inflows, according to CoinShares data.

That surge followed the Federal Reserve’s first interest rate cut of 2025, which drew renewed investor demand for crypto exposure despite cautious signals from policymakers.

Bitcoin funds had attracted $977 million during the week, while Ethereum products recorded $772 million, setting a year-to-date record of $12.6 billion for Ether-backed products.

Market data shows that investor positioning remains sensitive to macroeconomic signals.

Analysts note that ETF flows and derivatives leverage remain key indicators to watch as markets absorb both the Fed’s policy outlook and upcoming inflation readings.

BlackRock’s Bitcoin ETFs Lead $260M Revenue Surge, Ethereum Adds $42M

Bitcoin and Ethereum ETFs have gained widespread success in the past few years.

BlackRock’s Bitcoin and Ethereum exchange-traded funds are now generating more than $260 million annually, showing that digital asset products have become a major profit engine for the world’s largest asset manager.

BlackRock generates $260 million annually from Bitcoin and Ether ETFs as Wall Street institutional adoption reaches new heights.#Bitcoin #Ethereumhttps://t.co/0dAGyws3jZ

— Cryptonews.com (@cryptonews) September 23, 2025

According to Leon Waidmann, head of research at the Onchain Foundation, BlackRock’s Bitcoin ETFs account for $218 million of that figure, while Ethereum products contribute $42 million.

“This isn’t experimentation anymore,” Waidmann said, noting that the firm has turned crypto ETFs into a revenue stream on par with established financial products.

Analysts suggest that BlackRock’s success will set a benchmark for pension funds, sovereign wealth funds, and insurance companies considering exposure to digital assets.

Bloomberg’s senior ETF analyst Eric Balchunas highlighted the structural advantages of crypto ETFs, which combine instant access, low costs, and yield potential with regulatory protection and anonymity, benefits not typically associated with direct token ownership.

ETFs have everything tokens offer: instant access, miniscule costs, flexibility, yield (you can totally lend out ETFs). But with added benefits that tokens don't have: regulatory protections (huge), anonymity and a 1-800 number *immediately mutes conversation lol* https://t.co/5wpM79aEmw

— Eric Balchunas (@EricBalchunas) September 24, 2025

Market conditions remain mixed. Bitcoin traded at $113,717 on Monday, up 0.9% in the past 24 hours but moving within a tight range between $111,369 and $113,301.

Ethereum slipped 0.4% to $4,173.88, marking a 7.1% decline over the past week. Despite short-term volatility, some industry leaders see rising institutional demand as a long-term price driver.

Strategy’s Michael Saylor told CNBC that ETFs and corporations are collectively buying far more Bitcoin than miners produce daily, creating sustained upward pressure. Citigroup, however, is cautious on Ethereum, projecting a year-end target of $4,300, well below its $4,953 all-time high reached in August.

The post Bitcoin and Ethereum ETFs Suffer Massive $244M Outflow Amid Second Straight Day of Outflows appeared first on Cryptonews.

![[LIVE] Crypto News Today: Latest Updates for July 17, 2025 – Altcoin Mania is Here, ETH Crosses $3.3K, XRP Holds Above $3](https://cryptomediaclub.com/wp-content/uploads/2025/07/1752727562-july-17.jpg)