Key Takeaways:

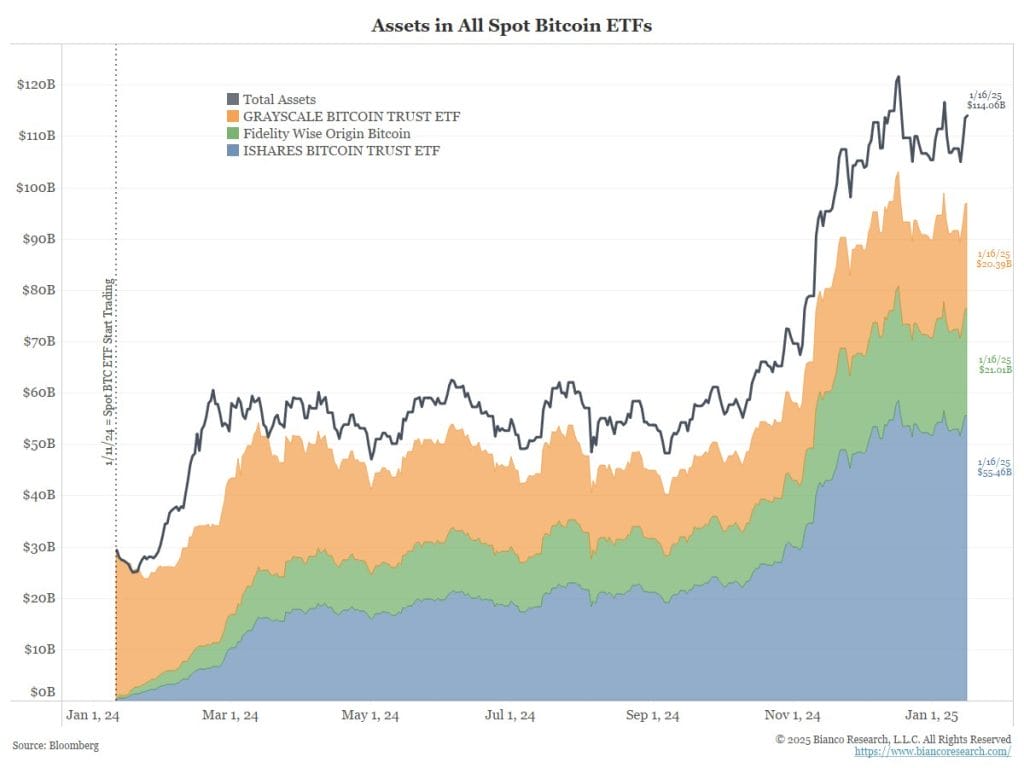

- Bitcoin ETFs have accrued $121 billion in complete belongings since their launch one yr in the past.

- The majority of the belongings are held by solely three funds – BlackRock’s IBIT, Constancy’s FBTC, and Grayscale’s GBTC.

- Almost $40 billion in new cash has flowed into all of the 12 spot Bitcoin ETFs.

As crypto ETFs filings surged within the first week post-Gary Gensler’s pre-emptive exit, it’s value reflecting on the efficiency of Bitcoin (BTC) exchange-traded funds one yr after their approval by the SEC.

Gensler is the quick previous Chair of the U.S. Securities and Trade Fee (SEC), notorious for his hostility towards crypto. However he was compelled to greenlight the ETFs after dropping a lawsuit introduced by Grayscale Investments.

On Jan. 11, 2024, the first-ever spot Bitcoin exchange-traded funds in America started buying and selling, with Gensler issuing a last-gasp warning that Bitcoin stays a “risky asset” and buyers must be cautious. Many ignored his recommendation.

The launch was celebrated as a coming of age for the benchmark crypto asset, paving the way in which for Bitcoin’s mainstream acceptance on Wall Avenue in addition to the launch of different crypto-based exchange-traded funds.

The merchandise sometimes enable buyers to achieve publicity to Bitcoin with out really holding the asset themselves. Thus far, there are 12 Bitcoin funds together with Blackrock’s iShares Bitcoin Belief (IBIT), Grayscale’s GBTC, and Constancy’s FBTC.

Bitcoin ETFs See File Inflows

The Bitcoin ETFs began buying and selling one yr in the past with a complete of $29 billion in belongings, because of the conversion of Grayscale’s GBTC. As of Jan. 29, the overall belongings beneath administration (AUM) throughout all of the funds had climbed to $121 billion, in response to Sosovalue information.

In early September, the overall belongings plunged 26% to a three-month low of $46 billion, elevating issues that BTC ETFs had not turn out to be the autos for conventional finance or “boomer” adoption that many had hoped for.

On the time, internet outflows averaged greater than $1 billion in only one week. “It’s not an adoption car,” crypto analyst and macro funding researcher Jim Bianco wrote on X then. “As a substitute, [it is] a small vacationer device and on-chain is returning to TradFi.”

Ever since, the ETFs have seen a pointy enhance in new cash invested, with complete internet inflows of almost $40 billion as of this writing. Notable day by day internet inflows of $987 million and $908 million have been reported on Jan. 6, 2025, and Jan. 3, 2025, respectively.

As Bitcoin breached the psychological $100,000 mark in December, the rally triggered a 16-day streak of internet inflows between Dec. 2 and Dec. 18.

On-chain holdings are additionally chasing file highs. Because the September lows, on-chain holdings of all of the spot Bitcoin ETFs have risen from about 933,000 BTC to 1,197,000 BTC as of Press time, in response to information from Dune Analytics.

That’s a rise of over 28% inside 5 months, displaying that buyers accrued Bitcoin as costs fell. The on-chain holdings additionally signify roughly 6% of Bitcoin’s complete market capitalization.

Matteo Greco, analysis analyst at Canada Inventory Trade-listed crypto enterprise agency Fineqia, believes the elevated inflows are a sign of renewed investor confidence in Bitcoin.

“The sturdy inflows in 2024 [~ $36 billion] created a self-reinforcing cycle – rising demand contributed to cost appreciation, which in flip generated additional inflows,” Greco advised Cryptonews, including:

“These exchange-traded funds have performed a vital position in accelerating digital asset adoption, increasing the investor base, and enhancing market transparency, safety, and liquidity.”

Tidy Income

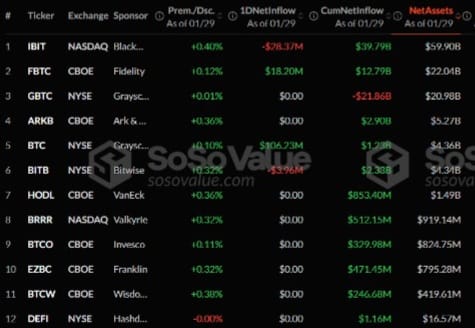

The majority of the $121 billion belongings beneath administration are held by solely three funds – BlackRock’s IBIT (~$59.9 billion), Constancy’s FBTC (~$22 billion), and Grayscale’s GBTC (~$21 billion).

When it comes to complete internet inflows, IBIT additionally dominates, with over $39.8 billion in new cash invested within the product since January 2024, in response to Sosovalue. BlackRock’s Bitcoin ETF is especially attention-grabbing.

As Greco identified, IBIT reached $10 billion in complete belongings in file time, attaining the milestone in simply 37 buying and selling days. By the top of December, it had grown to greater than $50 billion in belongings. No exchange-traded fund has ever had a greater debut, specialists say.

Rivals FBTC and GBTC have reported complete internet inflows of $12.8 billion and $21.9 billion, respectively since buying and selling began one yr in the past.

Bloomberg senior ETF analyst Eric Balchunas referred to as the BTC exchange-traded funds the “most profitable ETFs in historical past.”

In a earlier put up on X, Balchunas stated the rise in internet inflows is an indication that institutional buyers have faith in Bitcoin, opposite to claims the funds had failed to draw Wall Avenue wealth advisors.

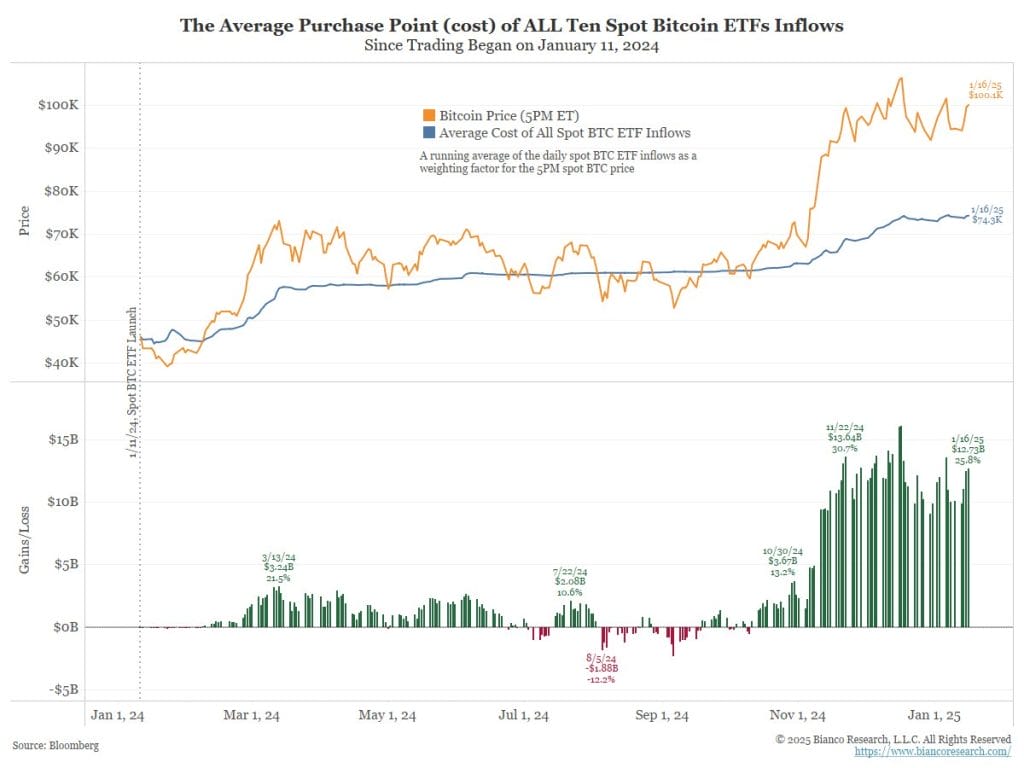

Furthermore, buyers who put their cash into the Bitcoin ETFs have returned some tidy income. Bianco, stated the dollar-cost common buy value of the ETFs is $74,300 (seen within the chart beneath as a blue line), an unrealized acquire of $12.7 billion (backside panel).

“All these positive factors got here after the [U.S. presidential] election,” Bianco, who can also be the founding father of Bianco Analysis, posted on X. However he warned that the unrealized positive factors might be “worn out” ought to the BTC value fall to $68,000. BTC is at present buying and selling at $105,000.

Balchunas, the Bloomberg analyst, stated the spot Bitcoin exchange-traded funds began 2025 “on fireplace,” with $4.2 billion in inflows through the first three weeks of January. On the time, that was about 6% of all ETF flows within the U.S., he detailed.

He famous that BTC ETFs have posted a return of over 127% since their launch one yr in the past. The merchandise have additionally surpassed Environmental, Social, and Governance ETFs in belongings ($117 billion) and had about the identical AUM as gold spot ($121 billion) on Jan. 24.

Institutional Bitcoin ETF Adoption Stumbles—Or Does It?

Bianco’s evaluation hasn’t all the time endeared him with Bitcoin die-hards.

For instance, when the ETFs noticed large outflows within the eight days to Sept. 9 – a complete of $1 billion – with TradFi gamers pacing the gross sales, he described this as an indication of failure by the ETFs to draw institutional capital.

He backed up his claims with information. Bianco pointed to the common commerce dimension of the ETFs, which dropped to a six-month low of $12,000 on the time. He stated that the information reveals that the first patrons of Bitcoin ETFs are small retail buyers, not institutional ones.

In comparison with different exchange-traded funds, the common commerce dimension of the Bitcoin ETFs “is a small fraction” of their sizes. For instance, the common commerce dimension of the GLD exchange-traded fund, which tracks a gold index, is about $70,000, per information from Bianco Analysis.

One of many key indicators of the supposed failure of Bitcoin ETFs to draw mainstream TradFi adoption is the composition of their holdings. Bianco stated funding wealth advisors maintain solely 9% of the Bitcoin ETFs’ shares excellent, with one other 12% held by hedge funds. Because of this 80% of the holdings will not be from conventional finance shoppers.

80% of the shopping for is coming from self-directed on-line brokerage accounts.

It’s not coming from boomers by way of wealth managers.— Jim Bianco (@biancoresearch) January 17, 2025

He stated that is backed by information from asset supervisor BlackRock, which revealed that 80% of inflows into its IBIT exchange-traded fund “are from self-directed on-line accounts.”

Nonetheless, Balchunas dismissed the fears. In response to the analyst, 1,000 establishments held Bitcoin ETFs on their books on the finish of September, which was “unprecedented.”

Blackrock’s IBIT alone had over 660 holders, the analyst stated, with 20% of its shares reportedly held by massive advisors and establishments. Balchunas expects IBIT’s institutional holders to double this yr.

Another factor re the holders. Bitcoin ETFs collectively have over 1,000 institutional holders after simply two 13F intervals. That's past unprecedented. $IBIT alone has 661 holders with 20% of its shares reported held by establishments and huge advisors, probably headed to 40% in…

— Eric Balchunas (@EricBalchunas) September 9, 2024

Greco, the Fineqia analysis analyst, stated whereas the outlook for “spot Bitcoin exchange-traded funds and different digital asset ETFs stays optimistic, forecasting the subsequent section is all the time difficult.”

“As with all risk-on markets, downturns are inevitable,” Greco advised Cryptonews. “A broader market correction in equities or different asset lessons would impression BTC ETFs, inflicting momentary unfavourable flows.”

He added that regardless of short-term volatility, the long-term trajectory for merchandise “stays promising, with the trade persevering with to develop and institutional involvement steadily growing.”

The put up Bitcoin ETFs: One Yr On, Have They Lived As much as the Hype? appeared first on Cryptonews.