A Satoshi-era holder was recently confirmed to have offloaded their Bitcoin (BTC) stack for $9 billion – a move that, to some, has stirred fresh FUD about the long-term fate of the top crypto.

For certain early holders, the growing wave of institutional involvement appears to clash with Bitcoin’s original ethos, and that tension may be behind the sell-off. But the truth is, Bitcoin, regardless of who holds it, will continue to live on, powered by the security of its network and the neutrality it was built on.

Now that same security is getting a serious upgrade, and it’s coming from a new project called Bitcoin Hyper (HYPER). In just 53 days, it has already raised over $5.4 million in presale funding.

Investors see this project as the next step: a way to harness Bitcoin’s security while making it programmable, scalable, and capable of operating with Solana-level speed.

In other words, it wants to make the most secure blockchain become the fastest too. But the time to get in could end just as quickly. Most presales operate with set funding goals, and although Bitcoin Hyper hasn’t specified a hard cap, the amount it has raised is already substantial enough to push its Layer-2 vision forward.

Even the current presale round is ending in less than 10 hours, and the price of $0.012425 per HYPER is about to increase.

Whale Exit Sparks Debate Over Bitcoin’s Future

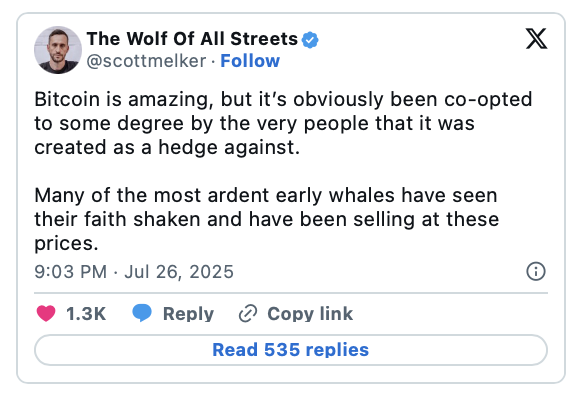

Analyst Scott Melker raised the alarm after Galaxy Digital (GLXY) confirmed the sale of 80,000 Bitcoin from a Satoshi-era wallet—a $9 billion move that quickly stirred debate across crypto circles.

Melker, better known as The Wolf of All Streets on X, shared the news on the social media platform, suggesting that rising institutional influence may have prompted one of Bitcoin’s earliest holders to finally cash out.

And there’s no denying institutional eyes are on BTC. Earlier this month alone, Bitcoin ETFs recorded over $1 billion in net inflows across just two days, with only three days of net outflows so far.

Source: https://coinmarketcap.com/etf/bitcoin/

Among institutional investors, Strategy is evidently the clear leader. Its recent act is a money market-style maneuver to extend its Bitcoin accumulation plan: a $2 billion “Stretch” Preferred Stock offering with a variable 9% dividend.

From Melker’s view, these examples of institutional control may be what’s making some OGs nervous. Still, he acknowledges that motivations for selling can vary and not all are rooted in ideology.

Kyle Samani, managing partner at Multicoin Capital, also weighed in, arguing that institutional involvement doesn’t betray Bitcoin’s core ethos.

The truth is, Bitcoin’s strength lies in its decentralization – the very trait that also grants it censorship resistance, as Samani points out. Holders can come and go, yet the protocol doesn’t bend. Because it’s not run by a company or even its original creator who remains anonymous and inactive to this day.

That’s why BTC survives. But one user raised a fair question: What happens when mining rewards dry up if no one transacts because everyone’s holding? Where will the fees come from?

And this is perhaps the role that Bitcoin Hyper is here to play and that is to elevate Bitcoin beyond its status as a static asset.

Why Bitcoin Needs to Be Used – Not Just Held

Bitcoin Hyper’s premise has never been more urgent and that is to expand the utility of Bitcoin before the protocol’s long-term sustainability comes into question.

BTC has always been treated as something to accumulate and store. Hodlers wait for the next leg up, and that behavior has helped drive price appreciation. But the result is a network with limited real usage.

The X user who raised the question for Melker had a point because if no one’s transacting, there are no fees – and if there are no fees, what happens when block rewards shrink in the coming halvings?

While the year 2140, when all bitcoins are supposedly mined, is still a long way off, the 2028 halving and the ones that follow could gradually expose a serious flaw: Bitcoin’s design depends on usage, but its culture discourages it.

And moves like Strategy’s latest financial alchemy – designed to generate high yields without ever touching its BTC – only make things worse, as Bitcoin continues to be financialized in ways that bypass its own network.

Bitcoin Hyper is the first project to integrate the Solana Virtual Machine (SVM) with Bitcoin’s architecture, creating a high-speed Layer-2 where DeFi, gaming, and other dApps can thrive – all while anchored to the security of the Bitcoin network.

In short, it brings next-level applications that combine the best of both worlds. But more importantly, it helps drive activity back to the Bitcoin base layer.

And with that activity comes transaction fees, which, for the purpose of emphasis, is key to helping Bitcoin survive.

How the Bitcoin Hyper Bridge Works and Why It Matters

The Bitcoin Hyper is an innovatively straightforward solution, and it is based on a bridge that acts as the on-ramp between BTC and its Layer-2.

When a user wants to bring their BTC into the high-speed Bitcoin Hyper network, the BTC is first sent to that bridge and securely locked on the base chain.

From there, an equivalent amount of wrapped BTC is minted within the Layer-2 environment, which is the version that moves quickly across apps, powers trades, and supports activity like DeFi or gaming.

But the original BTC stays put. It doesn’t leave the Bitcoin blockchain. It’s locked, tracked, and still part of the base layer’s ledger, which means every deposit, withdrawal, and bridge-related event still touches Bitcoin’s network.

That’s the critical point. Even though the wrapped asset is what gets used on the faster side, the security guarantees and transactional anchors remain tied to Bitcoin. This design opens the door for new fees to flow through the base layer, especially as bridge usage grows, creating real miner incentives without changing Bitcoin’s core code.

In essence, Bitcoin Hyper powers a new version of BTC – it gives it new places to move. And every move could bring fees with it that are necessary for the orange coin to live on beyond the era of zero mining rewards.

Ready to Back Bitcoin’s Next Chapter?

Indeed, Bitcoin Hyper is a real attempt to solve one of Bitcoin’s biggest long-term risks while unlocking its full potential.

If you believe Bitcoin needs more than just passive holding to thrive, now’s the time to take part.

Join the presale by heading to the Bitcoin Hyper website and securing your HYPER tokens. You can purchase using SOL, ETH, USDT, USDC, BNB, or even a credit card.

For a smoother experience, use Best Wallet. HYPER is already featured under Upcoming Tokens, so it’s easy to track, manage, and claim once the token goes live.

Stay connected with the community on Telegram and X to follow the project’s next moves.

Visit Bitcoin Hyper and learn about how it can shape the future of programmable BTC.

The post Bitcoin Faces Doomsday Scenario as Whales Exit – Bitcoin Hyper (HYPER) Rewrites the Narrative, ICO Hits $5.4M appeared first on Cryptonews.