Cryptocurrency asset supervisor Grayscale not too long ago acknowledged that the Bitcoin mining business is crucial for sustaining the Bitcoin community’s transparency and long-term safety.

Though miners play a vital position within the development of Bitcoin, lots of danger and operational bills are concerned. Buying mining {hardware} and buying land for amenities is dear.

Miners additionally battle to keep up income because of the volatility of Bitcoin (BTC).

Hashrate By-product Merchandise Achieve Curiosity

Bitcoin miners at the moment are due to this fact exploring new methods to make sure that their operations stay worthwhile. One in every of these methods is thru the financialization of Bitcoin mining hashrate.

For this week's Forwards Market replace, each USD and BTC contracts are buying and selling in backwardation.

The hashrate ahead market is pricing in a median hashprice of $55.25 (0.00054 BTC) over the subsequent six months. pic.twitter.com/rVlYs5M7G2— Luxor Know-how

(@luxor) February 3, 2025

Andy Fajar Handika, CEO of Loka Mining, informed Cryptonews that “hashrate derivatives” enable Bitcoin miners to hedge in opposition to fluctuations in mining income by locking in a set worth for his or her future hashrate.

“Which means that miners can safe predictable money flows no matter Bitcoin’s worth volatility or adjustments in community problem,” Fajar Handika stated.

How Miners Can Promote Future Hashrate

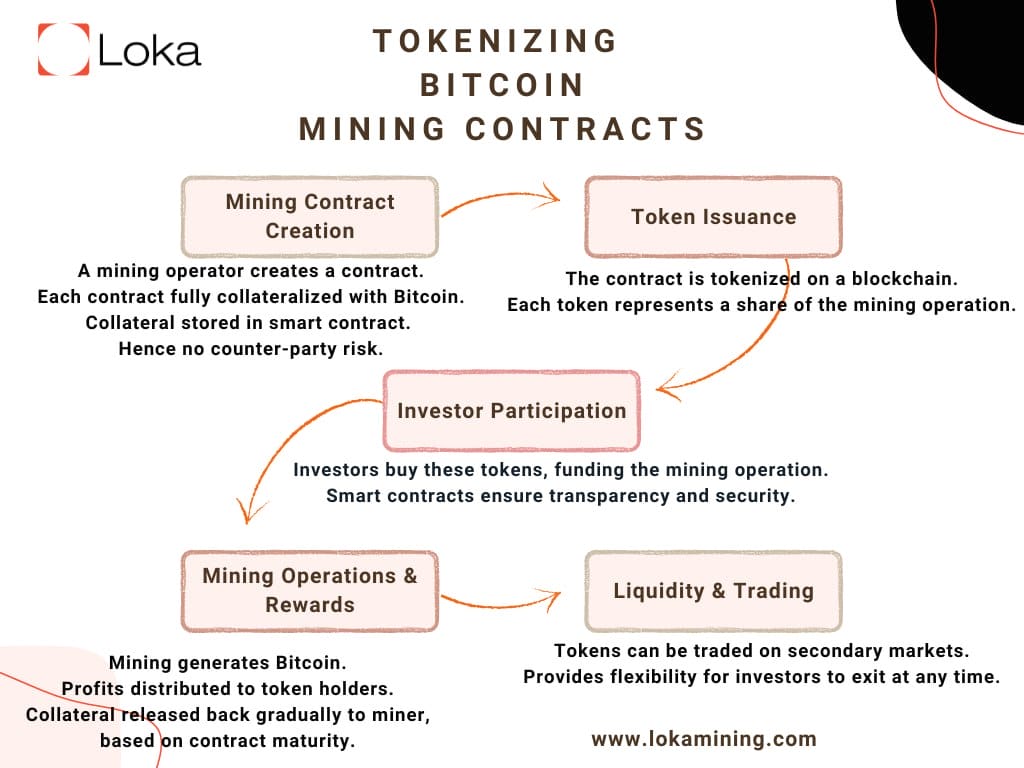

For instance, Loka Protocol is a platform that allows Bitcoin miners to promote their future hashrate within the type of tokenized mining contracts.

Fajar Handika defined that these contracts operate equally to commodity futures in conventional markets.

“Similar to corn farmers hedge in opposition to crop worth fluctuations, Bitcoin miners can promote hashrate contracts upfront to safe capital whereas buyers achieve publicity to mining rewards with out working {hardware},” he stated.

This idea reduces danger for each events, whereas making mining financing extra accessible.

Ryan Condron, CEO of Titan.io, informed Cryptonews that hashpower market Lumerin affords a decentralized ecosystem for miners to dump their hashpower for as much as 7 days sooner or later.

Bitcoin mining hashpower can then be traded by Lumerin customers on-chain.

Aaron Foster, director of enterprise improvement at Luxor Know-how, informed Cryptonews that Luxor additionally affords a “Non-Deliverable Ahead” (NDF) product that permits miners to take a place on hashprice.

“This lets miners successfully lock in 1-12 month income certainty for his or her mining operations (this product can also be out there to non-miners as nicely),” Foster stated. “Miners are naturally lengthy Bitcoin (hashprice), so taking a place and locking in a worth to create income certainty is smart.”

Foster believes that hashrate derivatives will possible lengthen the lifetime of mining operations by lowering publicity to short-term downturns.

Bitcoin Mining Hashrate Derivatives Vital With Rising Bitcoin Worth

It’s additionally fascinating to level out that as the worth of Bitcoin rises, hashrate derivatives have gotten extra vital.

Fajar Handika defined that as extra miners enter the market, the Bitcoin community faces rising problem. This makes it more durable for current miners to keep up profitability.

“Hashrate derivatives present upfront liquidity that permits Bitcoin miners to purchase new {hardware} and increase operations,” he stated.

Financializing hashrate may scale back the necessity for miners to dump their BTC over time.

“As a substitute of promoting mined Bitcoin at decrease costs to cowl operational prices, miners can use ahead hashrate contracts to safe capital with out giving up their BTC holdings,” Fajar Handika remarked.

Echoing this, Foster famous that miners who hedge their publicity to hashprice volatility as a share of their operational prices will lock in longer-term revenue margins earlier than a depressed hashprice market develops.

“These devices enable miners to hedge in opposition to hashprice volatility, making mining extra predictable and financing simpler,” he commented.

Hashrate By-product Merchandise Achieve Traction

Whereas hashrate derivatives have been a identified idea for a couple of years, business consultants consider that that is lastly catching on for each Bitcoin miners and establishments.

Talking concerning the subject at The North American Blockchain Summit (NABS) in November final 12 months, Condron acknowledged, “That is very a lot the subsequent stage on this marketplace for evolution and maturity. The financialization of hashpower must be handled extra as a commodity than a pastime.”

Foster – who was additionally on the derivatives panel at NABS – additional remarked that establishments need to purchase hashrate to get publicity to this asset class. He defined that for this reason Luxor created its NDF product.

“We created that product to service the institutional aspect to permit them entry to the product with out having to undergo the hurdles of establishing on the bodily aspect,” he stated.

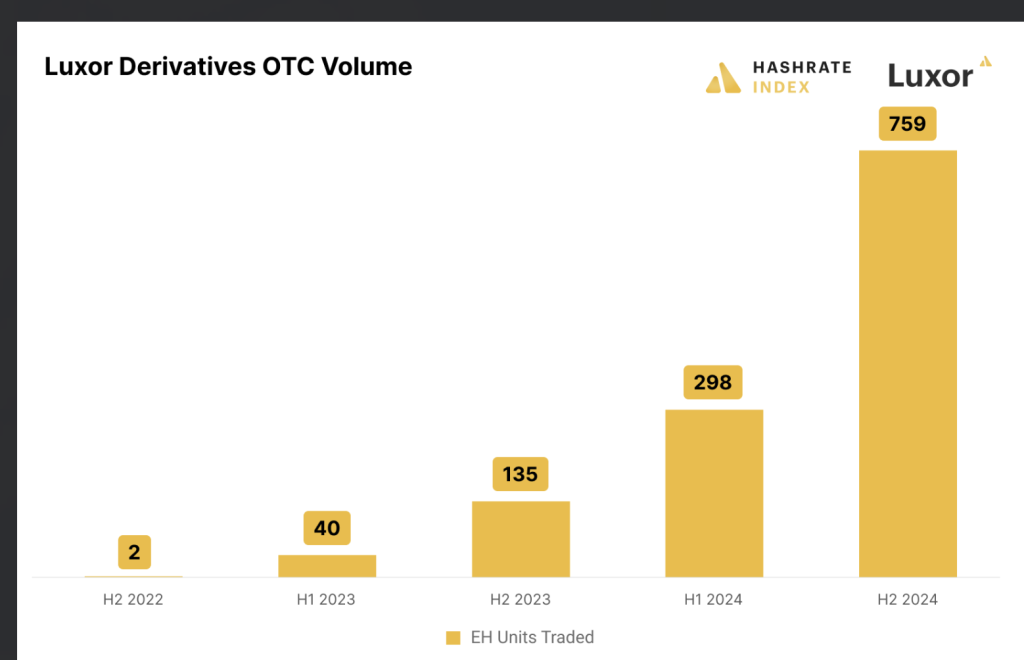

Luxor’s finish of 12 months abstract report for 2024 notes that its hashrate spinoff product witnessed exponential development.

The report states that final 12 months Luxor’s hashrate derivatives have been utilized by private and non-private miners, prop buying and selling funds, financiers, market makers, internet hosting suppliers, hashrate marketplaces, and ASIC brokers.

“On the enterprise aspect, we onboarded 30 new shoppers into our markets and traded $65 million in notional USD, settling about 1.2EH per day on common,” the report states.

It’s additional documented that curiosity from miners and conventional finance communities reached a document excessive on the finish of 2024.

Consequently, Luxor has continued to increase its product providing by rising its tenures to 12 months in length. The corporate additionally not too long ago launched hashrate exchange-traded futures.

Moreover, final week Grayscale introduced the launch of a brand new exchange-traded fund (ETF) providing publicity to Bitcoin mining.

Referred to as “Grayscale Bitcoin Miners ETF” (MNRS), the fund particularly invests in corporations that comprise the Indxx Bitcoin Miners Index.

This can be a proprietary index designed to measure the efficiency of worldwide Bitcoin mining corporations that generate the vast majority of their income from Bitcoin mining or mining-related {hardware}, software program, providers, and tasks.

Key Hurdles for Miners and Establishments

Whereas hashrate derivatives are rising in popularity, challenges might stop some miners and establishments from utilizing these merchandise.

Fajar Handika identified that that is possible as a consequence of an absence of training round these choices.

“Many miners are unfamiliar with these merchandise and should hesitate to make use of them,” he stated.

Liquidity considerations additionally stay, as Fajar Handika famous that buyers have to be keen to purchase hashrate contracts, but when demand is low, pricing will not be favorable for miners.

Furthermore, decentralized spinoff options – just like the product providing from Loka Protocol – are topic to good contract dangers.

But whereas challenges stay, Condron believes that every one miners will finally begin to promote their hashpower.

“This can be to a world hashpower ‘grid’ or mining pool. Nations, banks, and huge companies will bid in opposition to one another to purchase up the hashpower as a way to mine blocks and course of transactions on the BTC community,” he stated.

Condron added that whereas hashrate derivatives could also be a “much less horny” a part of the ecosystem, miners want to begin hedging methods to generate predictable income no matter market volatility.

“It will assist stabilize your complete ecosystem as Bitcoin continues to turn out to be a part of the world’s core financial structure,” he stated.

The put up Bitcoin Miners Contemplate Hashrate Derivatives as BTC Worth Rises appeared first on Cryptonews.