Bitcoin’s price dynamics are drawing attention as BlackRock’s iShares Bitcoin Trust ETF begins trading options on Nasdaq. With 73,000 contracts exchanged in the first hour, this launch marks a significant step in expanding Bitcoin’s financial ecosystem.

These options provide tools to manage Bitcoin price volatility, offering investors opportunities to speculate and hedge effectively.

Analysts suggest this development could strengthen Bitcoin’s demand and stabilize its price, reinforcing its role in the broader financial markets.

Bitcoin ETF Options Launch Strong with 73,000 Contracts on Nasdaq

BlackRock’s iShares Bitcoin Trust ETF debuted its options trading on Nasdaq with 73,000 contracts exchanged in the first hour. These options give investors tools to manage Bitcoin’s volatility, allowing them to speculate on price fluctuations while hedging risk.

Experts believe the launch will attract more investors and expand the U.S. Bitcoin derivatives market, boosting confidence in BTC. This development may encourage new funds to adopt strategies like trend-following or covered calls.

Gemini Expands to France After Securing DASP Approval

Gemini, the US-based crypto exchange founded by Cameron and Tyler Winklevoss, has officially launched in France after receiving DASP registration from AMF, the country’s financial regulator.

The platform now offers French users access to over 70 cryptocurrencies for trading, storing, and depositing, with local payment options in euros and British pounds.

Gemini also caters to institutional clients with advanced trading tools and an over-the-counter desk for large transactions.

JUST IN: GEMINI, THE U.S.-BASED CRYPTO EXCHANGE, EXPANDS TO FRANCE AFTER RECEIVING VASP LICENSE

— BSCN Headlines (@BSCNheadlines) November 19, 2024

The company views France as a key market, citing supportive regulations under the EU’s MiCA framework and the growing adoption of cryptocurrencies.

Gemini’s entry into France could boost Bitcoin’s adoption, leveraging the country’s favorable regulatory environment to enhance trust and demand.

Key Highlights:

- Over 70 cryptocurrencies now accessible in France.

- Support for institutional trading and local currency options.

- France’s regulatory framework seen as pivotal for crypto adoption.

Howard Lutnick Appointed Commerce Secretary, Advocates for High Tariffs and Pro-Crypto Policies

President-elect Donald Trump has selected Howard Lutnick, CEO of Cantor Fitzgerald, as Commerce Secretary. Lutnick will oversee U.S. trade and tariff policies, emphasizing reshoring manufacturing and financial innovation, including cryptocurrency adoption.

A strong advocate for tariffs, Lutnick proposes a 10%-20% levy on imports and a 60% tariff on Chinese goods, aligning with Trump’s hardline trade agenda.

TRUMP SAYS HE PICKS WALL STREET FIRM CANTOR FITZGERALD CEO HOWARD LUTNICK TO LEAD THE COMMERCE DEPARTMENT pic.twitter.com/buf8TQ5eZU

— FSMN (@faststocknewss) November 19, 2024

His leadership is expected to shape policies impacting delicate technologies like semiconductors and manage trade tensions, particularly with China.

Lutnick’s pro-crypto stance could boost Bitcoin, as it supports Trump’s vision of promoting cryptocurrencies and modern financial systems.

Key Highlights:

- Lutnick plans to impose a 60% tariff on Chinese imports.

- Advocates reshoring manufacturing and leveraging cryptocurrencies.

- Commerce Department to focus on export controls and trade disputes.

Bitcoin Price Forecast: Symmetrical Triangle Breakout Hinges on $93,450

Bitcoin (BTC/USD) trades within a symmetrical triangle, consolidating near key resistance at $93,450. A recent bounce off $91,379, supported by the 50-day EMA at $91,085, maintains a bullish outlook.

The RSI at 58.45 reflects moderate bullish momentum, suggesting potential gains if $93,450 is breached. Further resistance lies at $94,873 and $96,177.

On the downside, critical supports include $91,379, $89,760, and $88,401.

A break above $93,450 could confirm a bullish breakout, targeting $96,177. Conversely, a failure to hold $91,379 may shift momentum to the downside.

Key Insights:

- Resistance Levels: Immediate resistance at $93,450; next hurdles at $94,873 and $96,177.

- Support Levels: Immediate support at $91,379; deeper levels at $89,760 and $88,401.

- Indicators: RSI at 58.45 signals moderate bullish momentum; 50-day EMA at $91,085 supports a bullish bias.

–

You might also like Bitcoin Price Prediction 2024 – 2034

Why Pepe Unchained ($PEPU) Could Be Your Next Crypto Portfolio Boost

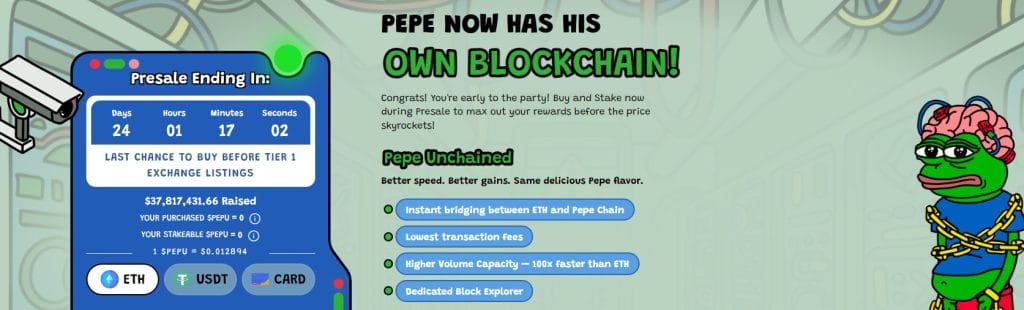

As meme coins gain momentum, Pepe Unchained ($PEPU) has emerged as a standout contender, capturing attention with its lucrative features and strong presale performance.

Key Highlights

- Presale Closing Soon: With $37.80 million raised, the $PEPU presale is in its final stretch. At just $0.012894 per $PEPU, prices are expected to surge post-listing on tier-1 exchanges.

- High APY Staking: Offering a 499% APY, $PEPU allows investors to earn substantial passive income. Over 321 million tokens have already been staked, demonstrating high investor confidence.

- Smart Contract Security: Audited by Coinsult and SolidProof, $PEPU provides investors with added assurance of a secure platform.

Act Fast on the Presale

Time is running out—just 23 days remain until the presale closes. Early investors have a limited opportunity to secure $PEPU at presale prices before it hits tier-1 exchanges.

Buy PEPU Here

The post Bitcoin Price Analysis: Will BTC Break $95,000 as ETF Options Surge with 73,000 Contracts on Nasdaq? appeared first on Cryptonews.