Bitcoin (BTC) is trading at $67,330.50, up 0.15% in the last 24 hours, with a trading volume of $16.3 billion. Retaining its top position on CoinMarketCap with a market cap of $1.33 trillion, Bitcoin’s current dynamics are fueling speculation.This Bitcoin price prediction explores whether Chinese whales are driving the recent surge amid the substantial trading volume.

Bitcoin Price Prediction

On the technical front, the 4-hour chart identifies the pivot point at $66,680, and BTC holding above this level, signals a bullish Bitcoin price prediction.

Immediate resistance is marked at $69,296, followed by $71,090 and $72,809. On the downside, immediate support lies at $64,662, with further support levels at $63,299 and $61,517.

The Relative Strength Index (RSI) is currently at 64, indicating that Bitcoin is neither overbought nor oversold. The 50-day Exponential Moving Average (EMA) is positioned at $64,739, reinforcing the overall bullish trend.

Bitcoin continues to trade with a bullish bias, holding above the pivot point support area of $66,680. The 50 EMA is supporting the buying trend in Bitcoin, and the RSI is also holding above 50, suggesting continued upward momentum.

The formation of Doji candles over the pivot point indicates a neutral sentiment, but the overall outlook remains positive as long as Bitcoin holds above this critical level.

If Bitcoin maintains its position above the $66,680 pivot point, it could drive prices higher towards the identified resistance levels at $69,296, $71,090, and $72,809. However, a break below this pivot point could trigger a sharp selling trend, pushing the price towards the support levels at $64,662, $63,299, and $61,517. The market’s reaction to these key levels will be vital in determining Bitcoin’s near-term direction.

In conclusion, Bitcoin’s technical outlook remains bullish above the $66,680 pivot point. The immediate resistance at $69,296 will be the first hurdle to overcome, followed by $71,090 and $72,809.

The RSI’s current level suggests that there is room for further gains, although caution is warranted if Bitcoin falls below the pivot point.

The 50-day EMA at $64,739 provides a solid base for the ongoing uptrend. Traders should monitor these key levels closely, as the market’s response will dictate the next phase of Bitcoin’s price movement.

You might also like Bitcoin Price Prediction 2024 – 2034

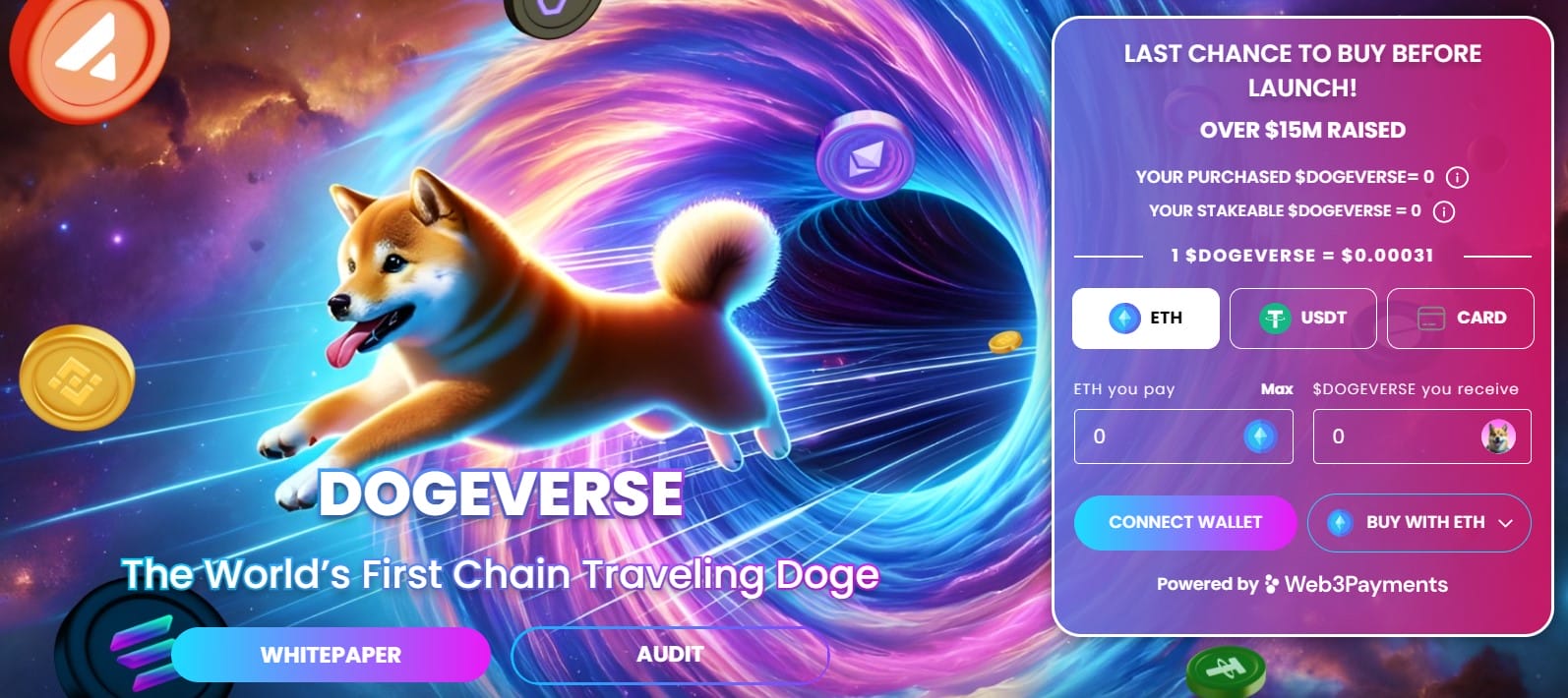

Last Chance to Buy Dogeverse Before Launch – Over $15M Raised

Dogeverse, the rapidly expanding meme coin network that spans multiple blockchains, including Ethereum, BNB Smart Chain, Polygon, and soon Solana, Base, and Avalanche, has made a notable splash in the cryptocurrency world.

The project has successfully raised over $15 million, surpassing its initial goal of just under $13 million. Currently priced at $0.00031, Dogeverse is set for a price increase in less than a day.

This broad expansion aims to blend the popular Doge appeal with superior blockchain capabilities, promising greater utility and wider adoption. With the launch imminent, this is your last chance to invest in Dogeverse at the current rate.

For more updates and to engage with the community, follow Dogeverse’s official channels on Twitter and Telegram.

Secure Your Dogeverse Today

The post Bitcoin Price Prediction as $17 Billion Trading Volume Comes In – Are Chinese Whales Buying? appeared first on Cryptonews.