MicroStrategy’s Bitcoin investment has soared beyond the $10 billion mark, owning over 190,000 BTC as Bitcoin’s value climbs past $50,000. This achievement underscores MicroStrategy’s confidence in Bitcoin’s long-term prospects and its utility as an inflation hedge.

Since joining the Bitcoin market in August 2020, MicroStrategy’s BTC portfolio has expanded significantly, even amidst the bear market’s challenges in early 2022.

Despite experiencing a downturn in its fourth-quarter revenue and profit, MicroStrategy, under Michael Saylor’s leadership, continued to bolster its Bitcoin holdings, purchasing an additional 850 BTC for $37.2 million in January alone.

MICROSTRATEGY'S BITCOIN HOLDINGS SURPASS $10 BILLION

As Bitcoin’s price nears $53,000, Michael Saylor-led MicroStrategy’s position of 190,000 BTC is valued at over $10B with unrealized profits of $4B.

Michael Saylor recently announced the firm’s acquisition of an additional 850… pic.twitter.com/FhB1twtdA6

— Crypto Town Hall (@Crypto_TownHall) February 16, 2024

This move came even as MicroStrategy’s stock (MSTR) saw a 16% drop following the introduction of Bitcoin ETFs. Saylor, demonstrating his commitment to Bitcoin, expressed willingness to sell his MSTR shares to acquire more BTC.

MicroStrategy’s pivot from government securities and bonds to Bitcoin was motivated by the cryptocurrency’s superior return potential.

Saylor has been a vocal advocate for Bitcoin’s ability to maintain purchasing power amidst inflation.

Notably, MicroStrategy’s Bitcoin stash surpasses the holdings of all nine recently launched Bitcoin ETFs, accounting for nearly 1% of the total BTC in circulation, illustrating the company’s significant stake in the cryptocurrency landscape.

Bitcoin Price Prediction

Bitcoin’s market position remains robust, with the cryptocurrency trading at $51,818. The slight 0.08% increase over the last 24 hours reflects a cautious yet optimistic market sentiment. With a market capitalization exceeding $1 trillion, Bitcoin solidifies its dominance in the digital currency space.

Currently, the circulating supply nears its maximum, highlighting the asset’s scarcity and potential value appreciation.

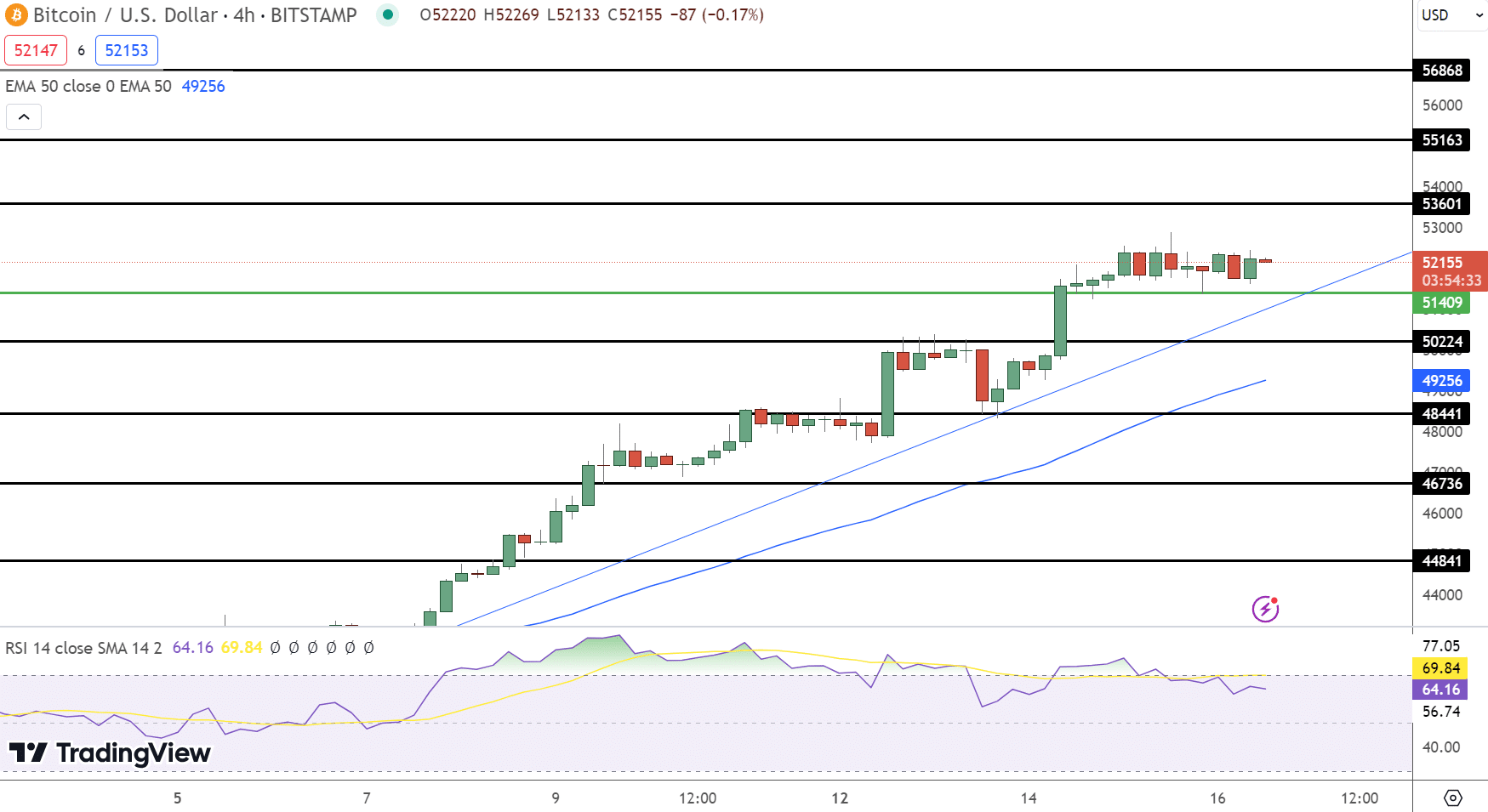

Technical analysis reveals critical levels for Bitcoin’s trajectory. The pivot point at $51,409 serves as a foundation for its current stability.

Resistance levels at $53,601, $55,163, and $56,863 outline potential hurdles for upward movement. Conversely, support at $50,224, $48,441, and $46,736 provides safety nets against price declines.

The Relative Strength Index (RSI) at 64 signals a nearing overbought condition, suggesting a cautious approach for traders. The 50-day Exponential Moving Average (EMA) at $49,020 reinforces a bullish outlook, indicating sustained buying pressure.

Chart patterns, including an upward trendline and a sideway trading channel, suggest a bullish momentum with Bitcoin’s price finding support near the $51,800 level. The 50 EMA crossing near $49,450 further validates this positive trend.

In conclusion, Bitcoin’s market trend is bullish above the $51,410 pivot point, hinting at continued growth potential.

Short-term expectations lean towards testing higher resistance levels, affirming the prevailing optimistic market view. Investors and traders should watch these key indicators and levels closely, as they navigate Bitcoin’s dynamic market landscape.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

See the 15 Cryptocurrencies

The post Bitcoin Price Prediction as Michael Saylor’s BTC Holdings Reach $10 Billion – Will He Sell? appeared first on Cryptonews.