As Bitcoin hovers around $69,400, up nearly 1.50% on Sunday, its journey beckons keen market watchers for a Bitcoin price prediction. This recent surge, hinting at potential market shifts, sets the stage for an examination of Bitcoin’s trajectory amidst the broader financial landscape.

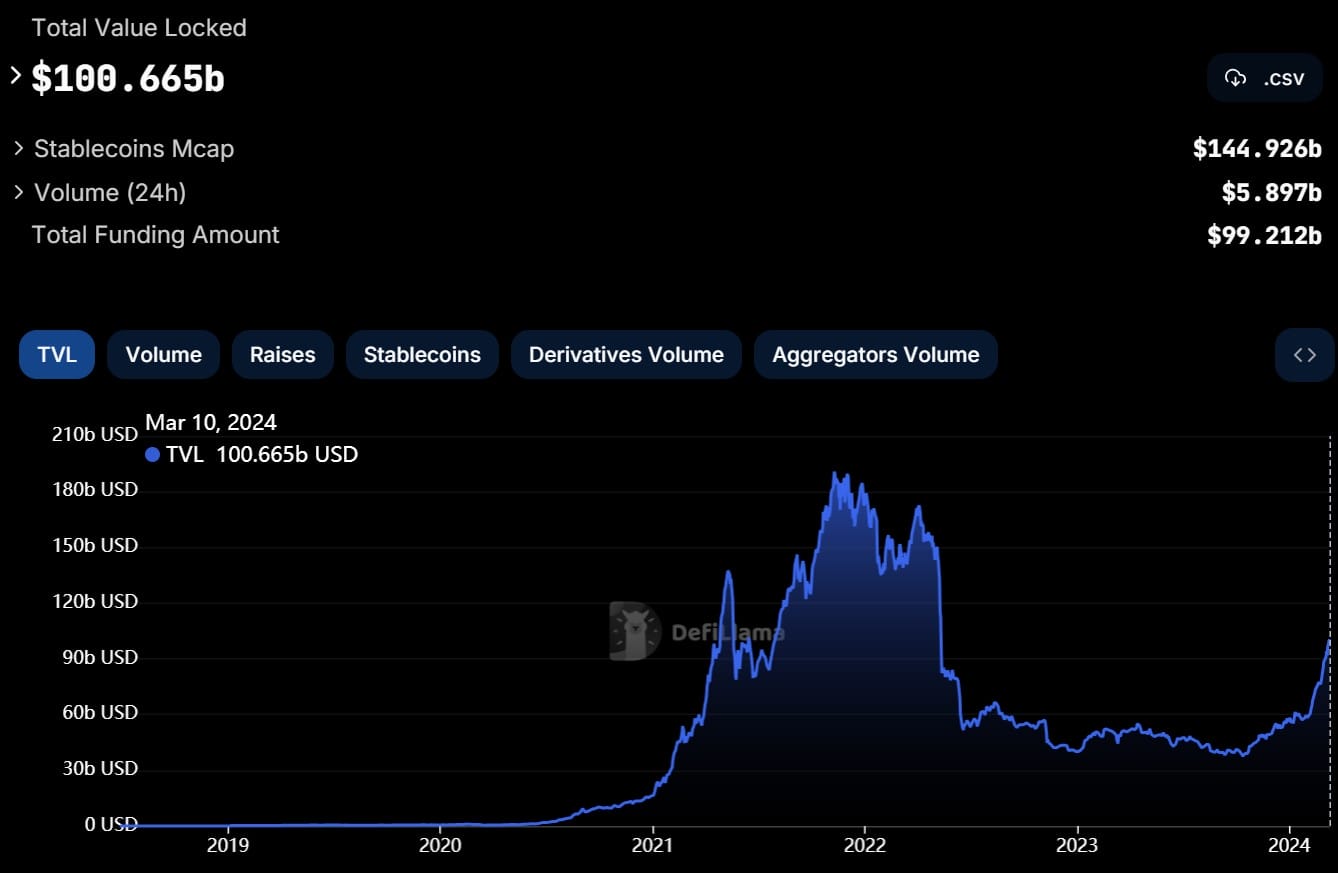

DeFi’s Total Value Locked Surpasses $100 Billion Amid Bitcoin Rally

March 9 marked a significant milestone for decentralized finance (DeFi) with its total value locked (TVL) reaching $100.1 billion, fueled by a wave of positive sentiment following Bitcoin’s rise.

Lido leads with $38.7 billion in TVL, while the market’s confidence was further lifted by the introduction of Bitcoin ETFs, attracting $28 billion.

Rumors of Bitcoin scarcity on OTC platforms caused trading disruptions on exchanges like Binance and Coinbase due to a surge in volume.

Memecoins such as Korra, Ribbit, and PUG AI also experienced price hikes alongside Bitcoin. Pepe and Shiba Inu stand out in the memecoin market, achieving a collective valuation of $61 billion.

This breakthrough in DeFi’s TVL, combined with Bitcoin’s performance, may bolster investor trust in cryptocurrencies and potentially elevate Bitcoin’s value.

Bill Ackman’s Skeptical Take on Bitcoin’s Economic Impact Simplified

Billionaire hedge fund manager Bill Ackman recently sparked conversations within the Bitcoin community with his humorous take on the potential economic consequences of rising Bitcoin prices.

Ackman’s playful scenario suggested that an increase in Bitcoin values could lead to more mining activity, consequently elevating energy costs, inflation, and further demand for the cryptocurrency, ultimately joking about Bitcoin “going to infinity” and potentially destabilizing the economy.

- Ackman humorously suggested that rising Bitcoin prices could disrupt the economy.

- MicroStrategy’s Michael Saylor responded, highlighting miners’ role in reducing electricity costs.

Despite his jest, Ackman, CEO of Pershing Square Capital Management and a casual cryptocurrency experimenter, remains largely detached from the market.

A scenario:

Bitcoin price rise leads to increased mining and greater energy use, driving up the cost of energy, causing inflation to rise and the dollar to decline, driving demand for Bitcoin and increased mining, driving demand for energy and the cycle continues.

Bitcoin… https://t.co/a5LzX69R7q

— Bill Ackman (@BillAckman) March 9, 2024

His comments, while not likely to sway Bitcoin prices directly, contribute to ongoing debates regarding the digital currency’s broader economic and energy implications, potentially influencing investor sentiment.

Microstrategy’s Bitcoin Portfolio Value Skyrockets by 116%

Microstrategy, a leading business intelligence firm, has seen its Bitcoin investment value soar by 116%, reaching an impressive $13.2 billion.

The firm’s strategic acquisition of 193,000 Bitcoins at an average price of $51,813 each has cemented its position as the top publicly traded company by Bitcoin assets, trailing only two U.S.-based spot Bitcoin ETFs.

This surge comes as Bitcoin’s market value hits nearly $69,015, driving a 9.66% increase in Microstrategy’s shares on Friday and an 18.8% rise over the last five days.

- Microstrategy’s Bitcoin assets now top $13.2 billion.

- Shares up by 9.66% on Friday, reflecting a positive market response.

Microstrategy’s bold move reflects a growing trend among public companies integrating digital assets into their financial strategies, underscoring a broader acceptance of cryptocurrencies within conventional financial systems.

This shift is likely to boost institutional demand and interest in Bitcoin, further integrating it into the mainstream financial landscape.

Bitcoin Price Prediction

Bitcoin (BTC/USD) showcases a robust uptrend, escalating by nearly 1.50% to a trading price of $69,400. Marking a significant pivot at $68,443, Bitcoin navigates through key resistances at $71,992, $75,598, and $79,296, hinting at potential milestones in its upward trajectory.

Support levels at $64,861, $62,872, and $59,380 provide a safety net against downturns. The Relative Strength Index (RSI) standing at 66, coupled with a bullish engulfing candle on the 4-hour chart, underscores a compelling buying trend.

Should Bitcoin sustain above $68,500, a bullish narrative prevails; conversely, dipping below this benchmark could trigger a sell-off.

Eco-Friendly Bitcoin: Revolutionizing Cryptocurrency with Gamified Eco-Staking

Green Bitcoin is leading a revolutionary shift in the cryptocurrency sphere by blending the urgency of environmental conservation with the innovative landscape of digital currency. Through its novel approach of Gamified Eco-Staking, this initiative not only entices participants with appealing rewards but also champions the cause of ecological preservation with each stake, backed by a distinct dual token reward mechanism.

Breakdown of Token Distribution:

- Initial Offering (40%): Launches the currency with significant momentum, setting the stage for sustained growth.

- Staking Incentives (27.50%): Allocates a major share to appreciate the enduring engagement of community members, vital for the ecosystem’s thriving.

- Promotional Activities (17.50%): Directs resources towards essential promotional strategies to build and broaden the currency’s worldwide recognition.

- Trading Fluidity (10%): Guarantees smooth trading experiences, bolstering the token’s availability across exchanges.

- Community Engagement Rewards (5%): Acknowledges and motivates the core community’s involvement, enhancing participation and dedication.

The ‘Eco Pathway’ charts a definitive course for Eco-Friendly Bitcoin, initiating with a value-centric initial offering and progressing through deliberate actions to energize the community and cement the token’s standing in the marketplace.

- Imminent Price Surge: Only 4 Days Away

- Current Funding: $2,321,140 of $2,247,631

- Current Exchange Rate: 1 $EFCB = $0.6882

Venture into the world of Eco-Friendly Bitcoin where your investment transcends mere profit to bolster a sustainable financial ecosystem. Invest today and join the movement towards a greener future.

Get Green Bitcoin Here

The post Bitcoin Price Prediction as On-Chain Metrics Reveal Whales are Holding Despite Recent Surge appeared first on Cryptonews.