Bitcoin is again near another critical on-chain inflection point as a key profitability indicator goes back to the levels that last occurred during one of the most painful downtrends in the history of the market.

CryptoQuant analyst Adler AM data shows that the Net Realized Profit and Loss of Bitcoin has dropped by approximately 97% after it achieved its recent high and is now approaching the levels of near-zero territory.

The situation is similar to those observed in June 2022 before BTC plummeted from about 30,000 to almost 16,000.

Net Realized P/L has dropped by 97% and returned to zero. The last time this happened was in June 2022 – right before the drop from $30K to $16K. Whales are still in profit (a 25-80% buffer), so there is no panic yet. But the market is being supported not by buyers – but by the… pic.twitter.com/ooQsnaGTCA

— Axel

Adler Jr (@AxelAdlerJr) January 26, 2026

Net Realized P/L tracks the balance between realized profits and losses on the Bitcoin network based on on-chain cost basis. Positive readings signal dominant profit-taking, while negative values reflect loss-driven selling.

Readings near zero suggest trades are occurring close to cost basis, indicating profit exhaustion and a balance between buyers and sellers.

Bitcoin Selling Pressure Fades, but Buyers Stay on the Sidelines

The analyst pointed out that the current setup resembles the period just before Bitcoin’s main capitulation leg in 2022. In late 2024 and early 2025, Net Realized P/L surged above $1.5 billion, reflecting an overheated profit-taking phase.

By January 26, 2026, that figure had collapsed to roughly $60 million, effectively flattening at the zero line. In 2022, a similar return to zero did not mark a bottom.

Instead, the metric continued lower into deeply negative territory, falling to around minus $350 million as the price slid another 50%.

Adler noted that the present zero reading should not be interpreted as a bullish reversal signal. Instead, it represents a pause where selling pressure from profit-takers has largely dried up, but fresh demand has not stepped in.

On-chain data suggests the market is currently being supported more by the absence of sellers than by strong buying interest, a fragile equilibrium that has historically broken lower during risk-off environments.

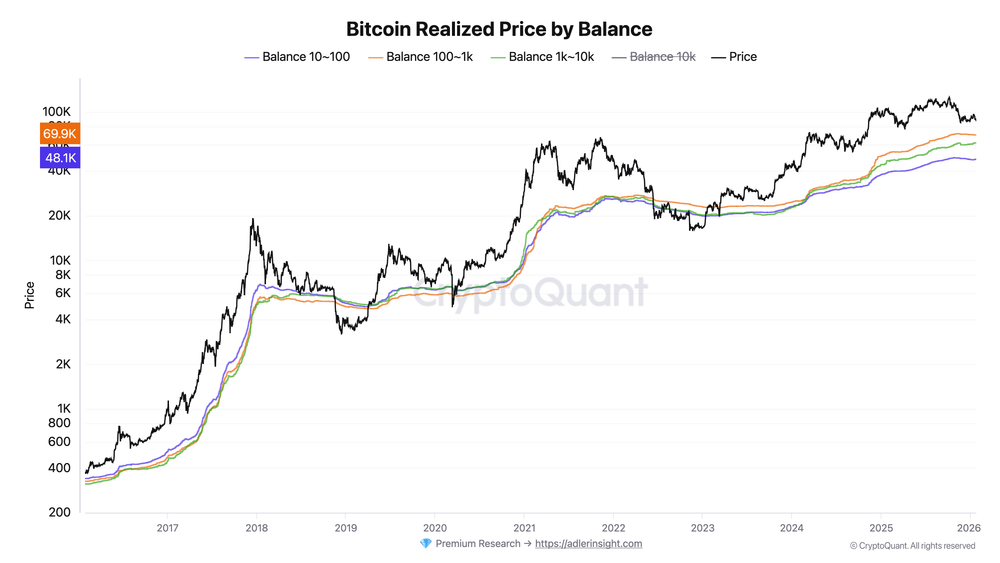

Despite the warning signals, large Bitcoin holders remain in profit, as realized price data segmented by balance size shows that all major whale cohorts are still comfortably above their average acquisition costs.

Holders with balances between 100 and 1,000 BTC have the highest realized price, near $69,900, giving them an estimated profit buffer of about 25% at current prices.

Other large cohorts, including wallets holding 10–100 BTC and those with more than 10,000 BTC, have average entry prices closer to $48,000 and $51,000, translating to unrealized gains of 70% to 80%.

This helps explain the lack of panic selling, even as price has pulled back sharply from recent highs.

Bitcoin Slips Below $88K as Volatility Picks Up

At the time of writing, Bitcoin was priced at approximately $87,756, having fallen by approximately 1.1% in the last 24 hours and 5.7% in the last week.

Trading volume, however, surged more than 160% day over day to $53.1 billion, pointing to heightened activity as traders reposition amid volatility.

Macro pressure has contributed to the discomfort because U.S. President Donald Trump threatened to impose 100% tariffs on any Canadian products in case Ottawa strengthens trade relations with China, and the rumors of a potential American government shutdown resurfaced.

The move triggered more than $320 million in liquidations of leveraged long positions in a matter of hours.

Also, CoinShares reported $1.73 billion in outflows from digital asset investment products last week.

Digital asset investment products saw sharp outflows last week, with investors pulling $1.73B — the largest weekly decline since mid-November 2025, according to CoinShares.#BTC #ETPs https://t.co/2ni4w83evG

— Cryptonews.com (@cryptonews) January 26, 2026

Bitcoin-linked products accounted for $1.09 billion of those outflows, with the bulk coming from U.S.-based funds.

Exchange order book data shows sell-offs were absorbed with modest volume delta, indicating controlled selling.

Analysts say liquidity remains stable, with no signs yet of cascading capitulation.

The post Bitcoin’s Net Realized P/L Hits Zero Again — Is a June 2022-Style Capitulation Next? appeared first on Cryptonews.