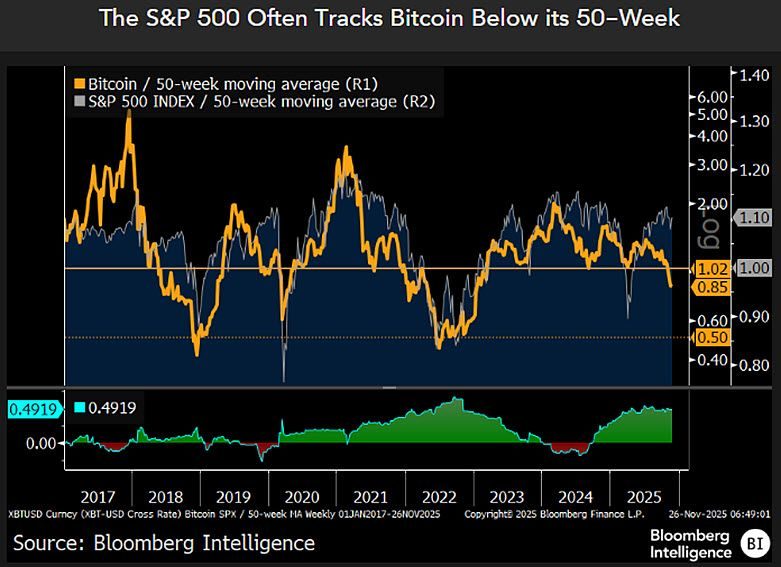

Bitcoin’s overnight plunge below $86,000 has sparked fresh warnings from Bloomberg Intelligence, with senior commodity analyst Mike McGlone cautioning that the 7% drop marks only the opening chapter of a deeper bear market correction.

The stark forecast comes as crypto markets reel from their worst monthly decline since February, with exchange volumes collapsing to $1.59 trillion and bitcoin ETFs bleeding $3.48 billion in net outflows during November alone.

McGlone projects Bitcoin could tumble more than 35% from current levels, potentially revisiting the $50,000 threshold last seen in 2024.

His analysis cites normal market reversion, record-setting gold prices, suppressed stock market volatility, and the unlimited supply of competing cryptocurrencies as key factors supporting this bearish outlook.

Yen Carry Trade Unwind Could See Bitcoin Drop Below $75k

The immediate catalyst for Bitcoin’s bearish market structure emerged from Tokyo, where mounting speculation around a December rate hike by the Bank of Japan has impacted leveraged positions.

Polymarket bettors now assign a 52% probability to a 25-basis-point increase at the BOJ’s December 18-19 meeting, while bond investors place those odds even higher at 76%.

“Bitcoin dumped cause BOJ put Dec rate hike in play,” BitMEX co-founder Arthur Hayes wrote Monday, noting that a USD/JPY rate between 155 and 160 “makes BOJ hawkish.”

$BTC dumped cause BOJ put Dec rate hike in play. USDJPY 155-160 makes BOJ hawkish. pic.twitter.com/lG47l5cbCA

— Arthur Hayes (@CryptoHayes) December 1, 2025

The connection runs deeper than surface correlation; conservative estimates peg the yen carry trade at $3.4 trillion, though realistic figures approach $20 trillion.

For three decades, global markets borrowed near-zero Japanese money to fund everything from tech stocks to treasuries to Bitcoin itself.

That era ended last month, which triggered a sell-off in markets.

Traders are now increasingly reluctant to take directional risk without downside protection, hedging, and additional clarity about macroeconomic liquidity conditions.

Data from Glassnode reveals a massive overhead supply block sitting between $93,000 and $99,000, with a second resistance layer at $101,000 to $105,000.

“Every bounce into this zone faces sell-pressure from trapped buyers,” warned Laqira Protocol CEO Sina Osivand.

Meanwhile, the $83,000 to $86,000 band is emerging as the new cost basis for fresh demand; if this level fails to hold, liquidity hunts toward $78,000 to $75,000 become likely.

Analyst Warns Bitcoin Could Test $60-65k Support.

“Bitcoin’s drop below $90,000 is the result of a collision between the fragile market structure and weak liquidity conditions observed over the weekend,” VALR CEO Farzam Ehsani told Cryptonews.

MSCI’s anticipated decision to potentially exclude companies holding over half their assets in cryptocurrency also intensified selling pressure.

The rule change would affect issuers collectively holding over $137 billion in digital assets and approximately 5% of all Bitcoin in existence, including Strategy, Marathon, Riot, Metaplanet, and American Bitcoin.

“Since index funds are required to adhere to a strict basket-forming methodology, any rule change automatically triggers a review of their holdings, potentially leading to forced sell-offs,” Farzam Ehsani added.

December sentiment and the crypto market’s dynamics heading into the New Year will depend partly on whether Michael Saylor’s company reaches an agreement with regulators and index firms.

Strategy executives appear frustrated that their company hasn't been chosen to join America's flagship S&P 500#Bitcoin #MichaelSaylorhttps://t.co/RRkYgzJC0N

— Cryptonews.com (@cryptonews) November 30, 2025

Traders on Kalshi have slashed odds of Bitcoin reclaiming $100,000 this year to just 29%.

Ehsani warned that if the market continues declining, Bitcoin could test the $60,000 to $65,000 range, though he noted that major institutional players might view those levels as accumulation opportunities.

“Strategy is a key player in the crypto market, and its potential problems could cause Bitcoin’s price to drop by another 30%,” he added.

The December 18 BOJ policy decision now stands as the critical pivot; a hike with hawkish stance could push Bitcoin toward $75,000, while a pause might trigger a short squeeze back toward $100,000 within days

The post Bloomberg Analysts Warn Bitcoin’s Slide Below $86K Is Just the Beginning appeared first on Cryptonews.