The cryptocurrency market surged in the beginning of the 12 months, with Bitcoin ($BTC) reaching new all-time highs and the entire altcoin market surpassing $1.5 trillion for the primary time.

The launch of spot Bitcoin exchange-traded funds (ETFs) in the USA additional built-in the asset inside conventional finance.

Moreover, discussions round a possible U.S. strategic Bitcoin reserve have added legitimacy to the asset class.

Wash Trades On The Rise

Regardless of these market milestones, a brand new Chainalysis report highlights a regarding rise in market manipulation throughout choose blockchain networks.

The findings elevate severe issues in regards to the scale of market manipulation throughout the crypto business.

Diane Web optimization, an information scientist at Chainalysis, informed Cryptonews that the agency estimates wash trades involving ERC20 and BEP20 tokens account for as much as $2.57 billion in buying and selling quantity on decentralized exchanges (DEXs).

In our newest preview chapter for the 2025 Crypto Crime Report, we have a look at our methodologies for uncovering suspected wash buying and selling and pump-and-dump schemes, offering a clearer view of how market manipulation manifests within the crypto area: https://t.co/dg7RZZBpsz

— Chainalysis (@chainalysis) January 29, 2025

“We suspect that ERC20 and BEP20 wash trades on choose blockchains account for as much as $2.57 Billion in buying and selling quantity,” Web optimization stated.

Web optimization defined that Chainalysis created two distinct heuristics to reveal this illicit exercise.

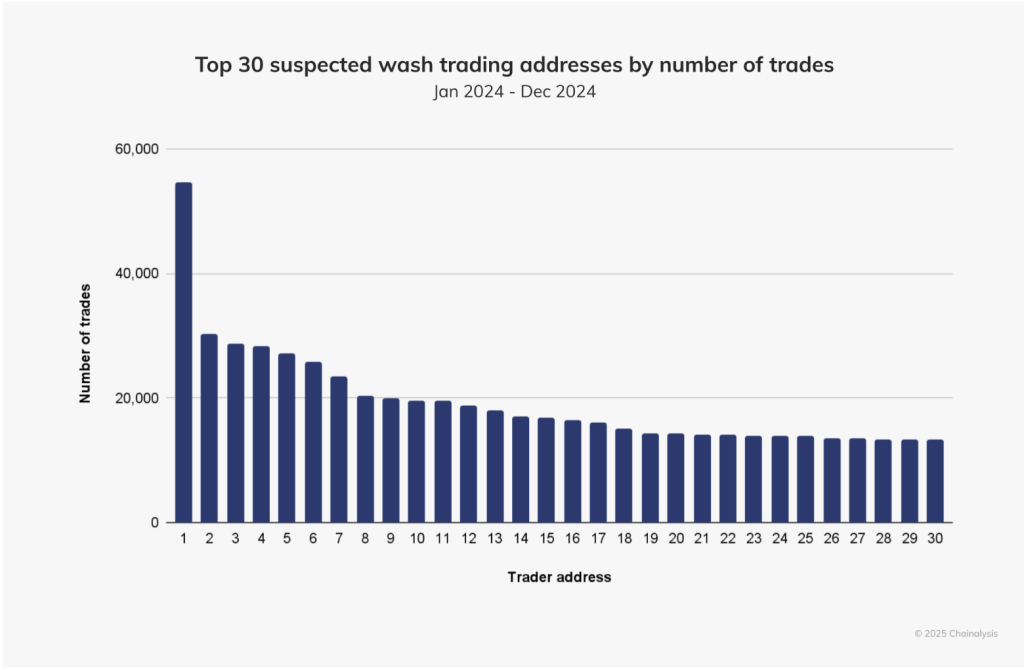

Apparently, each strategies revealed a long-tail distribution, indicating {that a} restricted variety of actors are accountable for almost all of those trades.

“For instance, the primary heuristic reveals that 10% of the addresses accounted for 43% of the entire wash trades, and one single handle executed greater than 54,000 buy-and-sell transactions of just about an identical quantities,” Web optimization stated.

“The second wash buying and selling heuristic exhibits that one unhealthy actor accounted for 16.7% of the entire wash trades,” she added.

Pump-And-Dump Schemes Enhance

Market manipulators make use of wash buying and selling for varied causes, together with artificially inflating token exercise in pump-and-dump schemes.

“That is the place people inflate the exercise of a token they’ve launched to draw traders, after which dump the token to understand a revenue,” Web optimization stated. “One other kind entails unhealthy actors offering wash trades as a service to token creators, serving to them inflate the token’s exercise and receives a commission for the service they supply.”

A latest instance concerned social media influencer Hailey Welch, also referred to as “Hawk Tuah,” whose meme coin, $HAWK, sparked issues over a pump-and-dump scheme.

The Hawk Tuah controversy deepens! @HalieyWelchX, the "Hawk Tuah Lady," vows to cooperate amid the $HAWK lawsuit following a surprising 90% crash and $151K in losses.#HawkTuah #Lawsuithttps://t.co/YXXv9DSLtB

— Cryptonews.com (@cryptonews) December 20, 2024

Welch got here below authorized scrutiny after $HAWK plummeted 90%, erasing over $151,000 in investor funds.

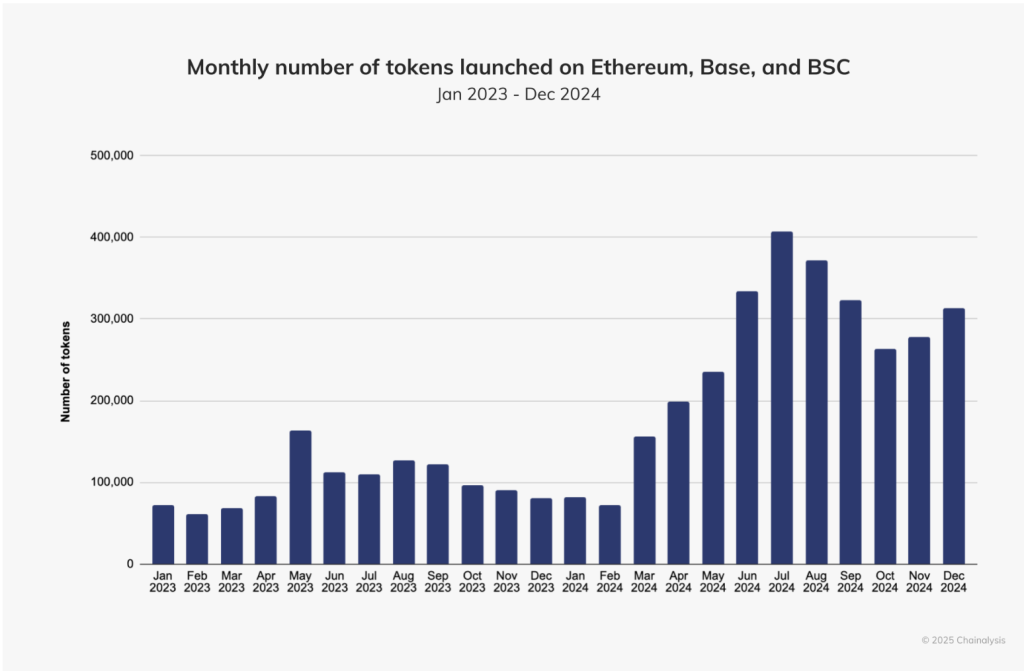

Chainalysis discovered that pump-and-dump schemes accounted for 4.52% of market exercise in 2024, up from 3.59% in 2023. The rise is partly attributed to decrease transaction charges, pushed by the rise of latest Layer 2 options and rising curiosity in cheaper Layer 1 chains.

Affect of Market Manipulation on Crypto Sector

The Chainalysis findings elevate severe issues in regards to the integrity of crypto market exercise.

Blake Benthall, Founder and CEO of blockchain analytics agency Fathom(x), informed Cryptonews that wash buying and selling is changing into extra widespread throughout exchanges and decentralized finance (DeFi).

“That is inflating volumes and making it troublesome to evaluate actual market exercise,” Benthall stated.

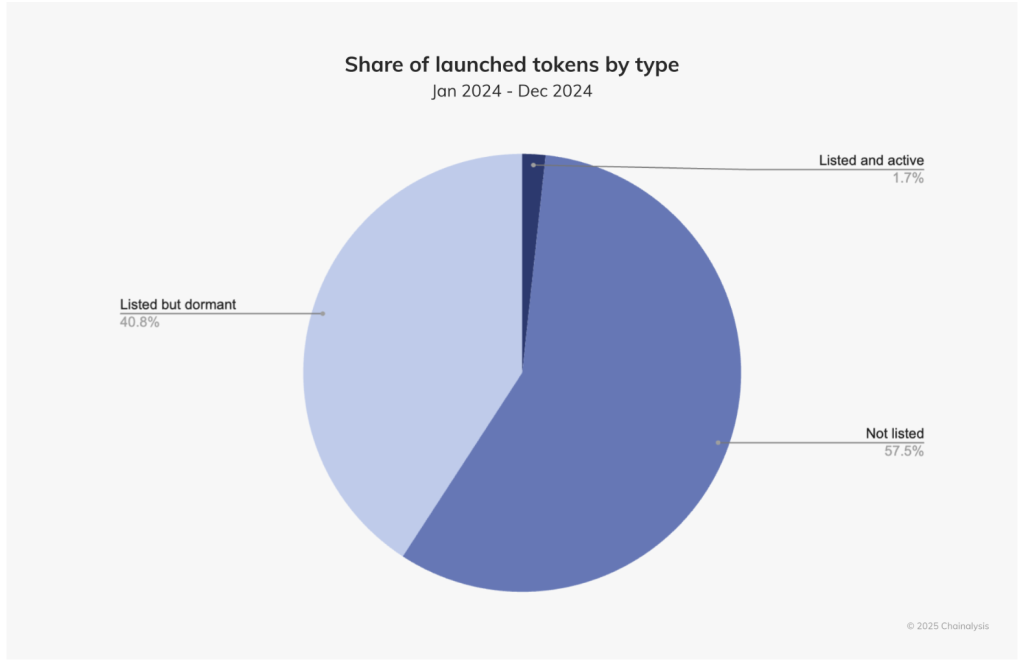

The Chainalysis report places this difficulty into perspective, revealing that greater than 3 million tokens have been launched within the blockchain ecosystem final 12 months. Roughly 1.29 million of those (42.54%) have been listed on a DEX.

Nevertheless, regardless of the excessive variety of new tokens, just one.7% remained actively traded up to now 30 days, largely as a result of market manipulation ways similar to wash trades, pump-and-dump schemes, and rug pulls.

Benthall famous that business insiders usually leverage unannounced software program, superior market-making instruments, and prebuilt mining capabilities to realize a bonus, even in open-source initiatives.

He additionally identified that personality-driven hype can result in excessive volatility.

“In the meantime, character cults drive volatility – one tweet from a outstanding determine can ship a token crashing, revealing simply how centralized these markets actually are,” he added.

Combating Market Manipulation

Sadly, market manipulation is predicted to persist within the crypto sector.

“Because the business matures, it inherits unhealthy actors from conventional finance, simply because the web inherited scammers and fraudsters from the actual world,” Benthall remarked. “Crypto has additionally entered the political mainstream and manipulation is evolving.”

Whereas this problem persists, sure actions will be taken to assist fight market manipulation.

Web optimization defined that Chainalysis has discovered that almost all market manipulation is concentrated within the actions of some refined unhealthy actors who repeatedly execute the identical patterns over time.

“This implies that if the unhealthy actor had been recognized early on and proactively banned from buying and selling, that would have prevented the next wash trades,” she stated.

Given this, Web optimization believes that clear laws and market surveillance are more and more mandatory for the crypto business.

“This could assist to rapidly detect patterns, take motion, and forestall larger-scale misconduct,” she stated.

Benthall added that the transparency of public blockchains means insider buying and selling and shady dealings can typically be uncovered.

“Whereas crypto can be utilized to bypass conventional oversight, each transaction stays on-chain, making a digital breadcrumb path that could possibly be scrutinized for years to come back,” he stated.

A number of initiatives are already in place to fight illicit exercise within the crypto sector. The T3 Monetary Crime Unit (FCU), for instance, was launched in September final 12 months to observe unlawful USDT transactions on the TRON blockchain.

Ari Redbord, Vice President and World Head of Coverage and Authorities Affairs at TRM Labs, informed Cryptonews that blockchain expertise inherently supplies transparency, however when mixed with analytics, it permits real-time detection of market manipulation.

“Collaboration between the non-public sector, regulators, and regulation enforcement might be key to addressing these challenges and making a safer surroundings for traders,” Redbord stated.

The put up Chainalysis Report: Market Manipulation Impacts Billions in Crypto Buying and selling Quantity appeared first on Cryptonews.