The worldwide commerce panorama took one other hit as China and Canada retaliated in opposition to the newest spherical of US tariffs, inching the world’s largest economies nearer to a full-blown commerce warfare.

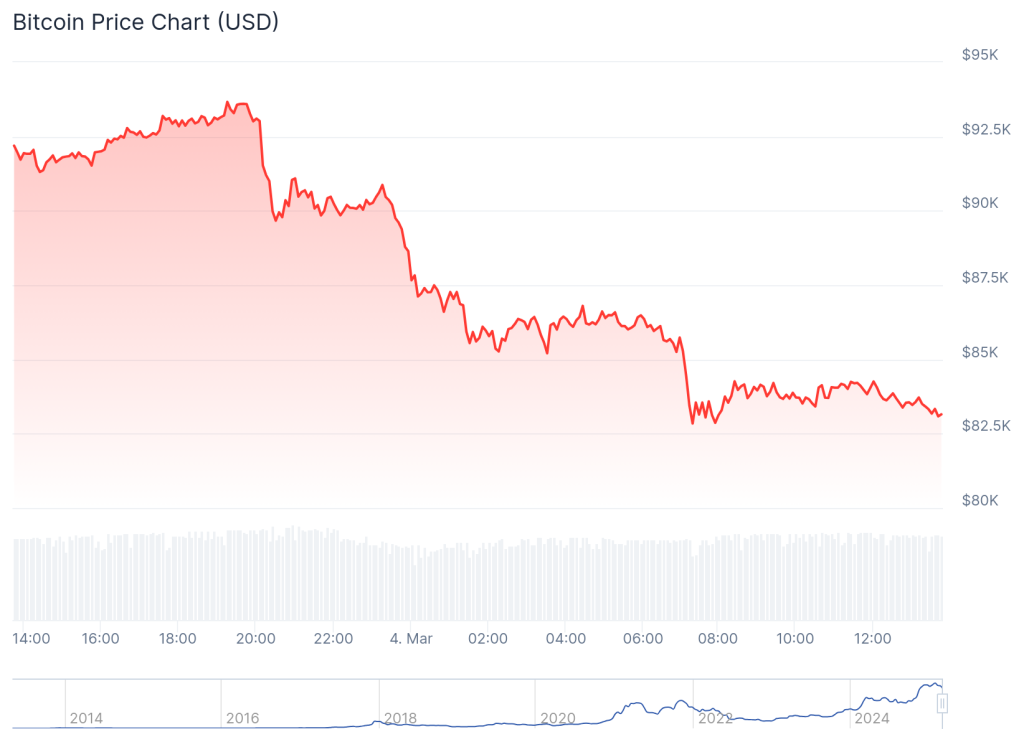

The crypto market was already underneath strain earlier than the retaliatory strikes, with property slipping 12% on Tuesday as traders continued to reassess threat publicity amid rising financial uncertainty.

Canada Slaps US Imports with 25% Tariffs

Canadian Prime Minister Justin Trudeau introduced retaliatory tariffs late Monday, confirming {that a} 25% tariff on $20.8b price of US imports would take impact on March 5. These countermeasures will stay in place till the US rolls again its tariffs on Canadian items.

Notably, the duties is not going to apply to items already in transit, making certain minimal speedy disruption for shipments already en route.

This response follows US President Donald Trump’s resolution to maneuver ahead with 25% tariffs on Canadian and Mexican items, alongside 10% duties on Canadian vitality merchandise, after a short lived reprieve expired. Trudeau hinted at the potential of extra measures, however particulars on particular items focused on this spherical stay unclear.

China Blacklists 25 US Corporations in Response to New Tariffs

In the meantime, China has responded to the newest US tariff hikes with a two-pronged method. The nation has raised import duties by 10%-15% on a wide range of American agricultural and meals merchandise.

On the identical time, Beijing has blacklisted 25 US corporations, inserting them underneath export and funding restrictions on account of nationwide safety considerations.

#BREAKING: Beginning March 10, 2025, #China will impose extra tariffs on choose #US imports:

15% on hen, wheat, corn, and cotton.

10% on sorghum, soybeans, pork, beef, seafood, fruits, greens, and dairy.

Present tax exemptions stay unchanged, however these new… pic.twitter.com/PQFa0a6WIw— Shanghai Each day (@shanghaidaily) March 4, 2025

Whereas earlier retaliatory measures from China focused well-known manufacturers, this time, Beijing has prevented going after family names, as an alternative specializing in protection contractors concerned in US arms gross sales to Taiwan.

The timing of China’s transfer is essential—it got here simply as the extra 10% U.S. obligation on Chinese language items kicked in, successfully elevating the cumulative tariff burden to twenty% on sure exports. The White Home justified this newest tariff hike as a response to what it sees as Chinese language inaction on controlling illicit drug flows into the US, additional complicating already fraught commerce negotiations.

Crypto Market Sinks Regardless of Trump’s Coverage Push

The crypto market, which initially surged on Trump’s weekend proposal to determine a U.S. strategic crypto reserve, has since reversed course. Tuesday’s 12% decline in whole market capitalization exhibits how traders are grappling with conflicting alerts—bullish sentiment round potential US crypto adoption is being tempered by broader financial instability triggered by escalating commerce tensions.

Whereas Bitcoin and Ethereum led the retreat, smaller altcoins have been hit tougher as merchants rotated capital into defensive property. The renewed commerce warfare rhetoric additionally spilled over into conventional markets, with equities experiencing volatility as traders moved away from riskier property that lack safety from geopolitical headwinds.

Markets Brace for US Response as Canada and China Push Again

With Canada’s tariffs now in impact and China taking a extra focused retaliatory method, all eyes are on how Washington will reply. Trump has beforehand advised that extra levies might be on the desk if commerce companions refuse to adjust to US calls for.

If the scenario worsens, the continued uncertainty might proceed to weigh on threat property, together with crypto, which has more and more mirrored macroeconomic tendencies lately.

The submit China, Canada Hit US With Counter Tariffs, Fueling Commerce Warfare Fears appeared first on Cryptonews.