Citigroup invested in stablecoin infrastructure company BVNK through its venture capital arm Citi Ventures, which is a sharp reversal from the bank’s previous warnings about deposit flight risks from yield-bearing stablecoins.

BVNK’s core technology operates as a payments rail facilitating global stablecoin transactions, allowing customers to move money between fiat and cryptocurrency.

US Regulatory Clarity Drives Stablecoin Infrastructure Growth

According to CNBC, the company declined to disclose Citi’s investment amount or its current valuation.

However, co-founder Chris Harmse confirmed the valuation exceeds the $750 million publicly disclosed at its last funding round.

BVNK, also backed by Coinbase and Tiger Global, operates in a highly competitive space alongside newcomers like Alchemy Pay and TripleA, as well as established players like Ripple vying for the cross-border digital money market.

Harmse said the company is experiencing momentum, particularly in the United States, which has been its fastest-growing market over the past 12 to 18 months following the passage of the GENIUS Act earlier this year.

The legislation established regulatory clarity for the stablecoin market, creating what the industry views as a more favorable environment.

The investment comes as CEO Jane Fraser confirmed in July that Citigroup is considering issuing its own stablecoin and developing custodian services for crypto assets.

Fraser said the bank aims to deliver “the benefits of advancements in stablecoin and digital assets to our clients in a safe and sound manner by modernizing our own infrastructure.”

Banking Industry Split Over Stablecoin Competition

The backing arrives just months after Citigroup analyst Ronit Ghose warned in August that stablecoin interest payments could trigger 1980s-style deposit flight from traditional banks.

Ghose drew parallels to the late 1970s and early 1980s when money market funds skyrocketed from $4 billion to $235 billion in seven years, draining deposits from banks whose deposit rates were tightly regulated.

Major U.S. banking groups, including the American Bankers Association and Bank Policy Institute, lobbied Congress to close what they called a “loophole” in the GENIUS Act allowing crypto exchanges and affiliated businesses to offer yields on third-party stablecoins.

The groups cited Treasury estimates suggesting yield-bearing stablecoins could result in up to $6.6 trillion in deposit outflows, fundamentally changing how banks fund loans.

However, crypto industry groups pushed back against these concerns.

Coinbase Chief Legal Officer Paul Grewal dismissed the banking lobby’s efforts, calling it an “unrestrained effort to avoid competition.”

This was no loophole and you know it. 376 Democrats and Republicans in the House and Senate rejected your unrestrained effort to avoid competition. So did one President. It's time to move on. https://t.co/CGCGxDqKNa

— paulgrewal.eth (@iampaulgrewal) August 13, 2025

At the same time, the Crypto Council for Innovation argued that restricting stablecoin yields would “tilt the playing field in favour of legacy institutions” and stifle consumer choice.

Just last month, Coinbase research found no meaningful correlation between stablecoin adoption and deposit flight for community banks over the past five years.

The apparent contradiction between Ghose’s warnings and Citi’s investment might have resulted from the simultaneous fear and embrace of stablecoin technology.

Fraser emphasized during the bank’s July earnings call that “digital assets are the next evolution in the broader digitization of payments, financing, and liquidity” and that the bank’s focus remains on meeting client needs.

Wall Street Accelerates Digital Asset Integration

JPMorgan Chase also launched its own stablecoin-like token called JPMD this year, after earlier allowing clients to buy bitcoin.

Bank of New York Mellon is already testing tokenized deposits, while HSBC has also launched a tokenized deposit service, as traditional financial institutions race to integrate blockchain technology.

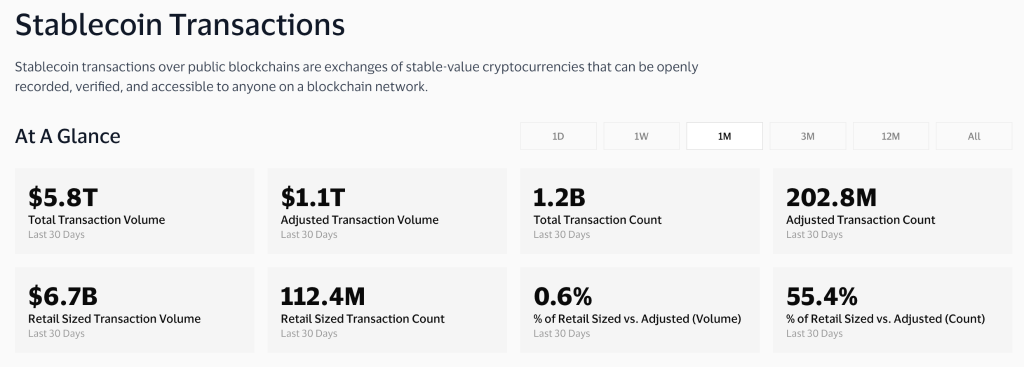

In the last 30 days alone, stablecoins processed over $5 trillion in transactions, according to Visa, while total stablecoin market capitalization has exceeded $300 billion per DefiLlama data.

The assets have evolved from tools for quickly trading in and out of cryptocurrencies like Bitcoin to potential infrastructure for cross-border transactions due to speed, low cost, and 24/7 settlement capabilities.

Treasury Secretary Scott Bessent recently expressed support for stablecoin adoption, arguing that “stablecoins will expand dollar access for billions across the globe and lead to a surge in demand for U.S. Treasuries” as backing assets.

Implementing the GENIUS Act is essential to securing American leadership in digital assets.

Stablecoins will expand dollar access for billions across the globe and lead to a surge in demand for U.S. Treasuries, which back stablecoins.

It’s a win-win-win for everyone involved:… https://t.co/p5nRQpBfnw— Treasury Secretary Scott Bessent (@SecScottBessent) August 18, 2025

For this latest backing, Harmse said BVNK has “dipped in and out of profitability” as the company invested in growth, but is on track to be profitable next year.

He noted that “U.S. banks at the scale of Citi, because of the GENIUS Act, are putting their weight behind investing in leading businesses in the space to make sure they are at forefront of this technological shift in payments.“

The post Citi Backs Stablecoin Firm BVNK Despite Previously Opposing Crypto Payment Rails appeared first on Cryptonews.