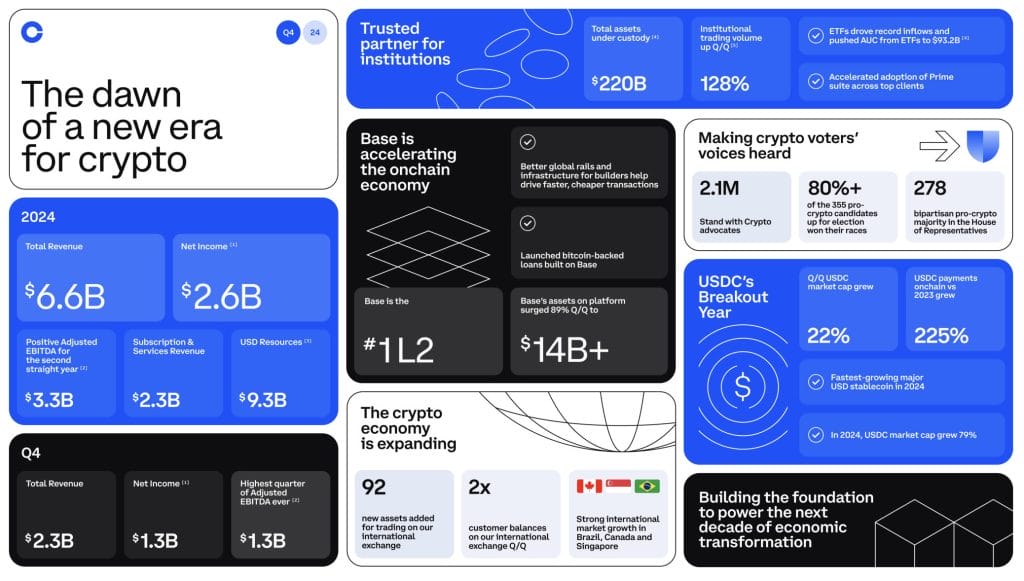

A variety of consideration has been paid to Coinbase’s field workplace earnings within the remaining three months of 2024.

That’s with good cause. The crypto trade’s outcomes far surpassed analyst expectations, with the very best quarterly revenues for 3 years.

Internet revenue stood at $1.3 billion from October to December — a 280% rise in comparison with the identical interval a 12 months earlier, when the bull run was kicking off.

Everyone knows why. Donald Trump’s return to the White Home as a pro-Bitcoin president has sparked a buying and selling frenzy, and a ‘golden age’ for crypto.

Coinbase’s CEO Brian Armstrong just lately met Trump in Mar-a-Lago — and is tipped to serve within the administration’s crypto advisory council.

And meaning his outlook on the state of the trade, to not point out his firm’s plans for the longer term, now issues an amazing deal.

His trade performed an instrumental function within the Stand With Crypto marketing campaign that fastidiously scrutinized the coverage positions of U.S. election candidates — a job this group will undoubtedly reprise through the midterms.

Armstrong can be banging the drum for regulatory change, particularly on the Securities and Alternate Fee, after years of frustration.

On an earnings name with traders, he argued that “it’s exhausting to overstate the importance of the change that’s occurred in the previous few months.”

The CEO says the transformation in attitudes towards crypto within the U.S. is prompting the remainder of the world to take discover, and Coinbase now has a tried-and-tested playbook for increasing into worldwide markets.

Daring Predictions

Crypto executives are susceptible to creating skyhigh predictions about the whole lot from Bitcoin’s value to mass adoption throughout bull markets. We’ve seen it time and time and time once more… in 2017 and 2021 particularly.

However admittedly, the panorama feels fairly completely different now Wall Avenue establishments are piling into the house — with governments brazenly pondering whether or not to start out holding Bitcoin on their stability sheets.

Maybe the newsiest little bit of Armstrong’s name with analysts was when he mentioned this:

“It’s a bit of bit just like the early 2000s when each firm had to determine the right way to adapt to the Web. As much as 10% of worldwide GDP could possibly be working on crypto rails by the tip of this decade. And Coinbase goes to be the popular associate to come back in and construct this for lots of the firms on the market as a result of we now have probably the most trusted and scalable infrastructure with the longest monitor document.”

That’s a enormous prediction not far into the longer term — however then once more, stablecoins are actually taking off, and Coinbase has shut ties with USDC.

“We even have a stretch objective to make USDC the primary greenback stablecoin. We’re very bullish on stablecoins. We predict USDC has a community impact behind it. And the compliant method that they’ve taken is, I feel, going to be actually defensible long run. So we’ll be accelerating the market cap development of USDC with extra partnerships and leaning into new use circumstances like including fee help throughout our product suite.”

Armstrong argued that crypto “is far, rather more than an asset class that folks wish to commerce” — and shortly, there can be “day by day use circumstances for everyone on this planet as crypto updates the worldwide monetary system.”

“We’re already at scale, I’d say, on stablecoin funds. There was $30 trillion of crypto stablecoin quantity final 12 months. That was up 3x 12 months over 12 months. And so we’re shifting with haste to combine crypto funds throughout our whole suite of merchandise. We predict that’ll be a giant enterprise over time.”

Coinbase is well-positioned to reap the benefits of this seismic shift, with chief monetary officer Alesia Haas revealing that the trade was managing $404 billion in belongings as of December 31 — equal to 12% of the full market cap of all cryptocurrencies.

When grilled particularly on the altering regulatory regime in Washington, Armstrong mentioned:

“It’s actually been a sea change and it’s been nice. I feel we now have entry to all of the related determination makers and people in authorities now. It doesn’t imply they’re all going to do what we wish, however at the very least we are able to get conferences and share our viewpoint. They will take enter from all of the related events to give you clear guidelines.”

As he’s beforehand prompt on X, one space of focus is altering Coinbase’s itemizing course of, as the corporate’s overview group is presently unable to maintain up with vetting the huge variety of tokens getting into the ecosystem every week. Some estimates put that determine at a million.

He argues the platform “must deeply combine decentralized exchanges into our product” — including:

“We additionally have to stability giving clients entry to what they need with acceptable disclosures and client safety in order that they know that they’re buying and selling the suitable asset … there is perhaps 100,000 leads to Google, however you type of wish to solely take a look at the primary web page or if you happen to seek for some product on Amazon, there is perhaps hundreds of them, however you wish to purchase the one with the very best evaluations. So I feel there’s quite a lot of ways in which we are able to stability that client safety with giving clients entry to the broad vary of belongings on the market.”

A recurring theme through the Q&A was belief, with Brian Armstrong capitalizing on the model recognition it has constructed lately.

“We actually need everybody to come back into crypto. And I hold saying this and possibly individuals don’t absolutely imagine me, nevertheless it’s actually true. We’re attempting to get the worldwide monetary system up to date and have increasingly international GDP run on crypto rails. We predict {that a} extra environment friendly, honest and free world will speed up progress, and it creates financial freedom. And we’re going to must have each financial institution, each fee firm, each brokerage combine crypto into their platforms.”

Ought to the bull run proceed to realize steam — and shake off its present paralysis — Coinbase could possibly be a inventory price watching.

The publish Coinbase Simply Made Large Predictions on Crypto’s Future appeared first on Cryptonews.