Crypto exchange-traded funds (ETFs) and exchange-traded products (ETPs) listed globally recorded net outflows of $2.95 billion in November marking the first month of net withdrawals in 2025, according to new research from ETFGI.

Despite the monthly setback the sector remains significantly larger than a year ago. Total assets invested in global crypto ETFs stood at $179.16 billion at the end of November reflecting a 17.8% increase year-to-date from $152.10 billion at the end of 2024.

Crypto ETFs listed globally suffered net outflows of US$2.95 Bn in November, @etfgi https://t.co/TyXvIqjrN9 #Register your interest for our 2026 events at https://t.co/ZYBgBU4o5I pic.twitter.com/zAJ3wgcxUw

— ETFGI (@etfgi) December 31, 2025

Assets Pull Back From Record Highs

The November outflows followed a sharp pullback from September’s record asset level of $229.53 billion as crypto markets cooled and investors took profits after a strong run earlier in the year.

ETFGI notes that heightened volatility across digital asset markets weighed on investor sentiment during the month. Year-to-date net inflows total $47.87 billion making 2025 the second-strongest year on record for crypto ETF flows.

Only 2024, which saw $72.08 billion in net inflows, posted a higher annual figure, while 2021 ranked third with $9.02 billion.

Bitcoin and Ethereum Drive Monthly Declines

Bitcoin and Ethereum-linked products accounted for the bulk of November’s outflows. Bitcoin-focused ETFs and ETPs which dominate the market saw $2.36 billion in net outflows during the month, while Ethereum products recorded $1.36 billion in withdrawals.

At the end of November Bitcoin-related products represented $142.46 billion in assets across 127 products, while Ethereum ETFs and ETPs held $25.05 billion across 62 products.

Despite the November decline, ETFGI reports Bitcoin and Ethereum continue to lead year-to-date inflows attracting $26.26 billion and $12.89 billion, respectively.

ETFGI data show that the global crypto ETF market remains highly concentrated. iShares is the largest provider with $83.15 billion in assets, representing 46.4% market share followed by Grayscale Advisors with $25.49 billion (14.2%) and Fidelity International with $21.86 billion (12.2%). Together, the top three providers account for 72.8% of global crypto ETF assets, out of a total of 75 issuers.

Smaller Tokens Gain Modest Traction

While Bitcoin and Ethereum dominate, smaller crypto themes are gradually gaining exposure. Solana-linked products held $1.38 billion in assets across nine products with $0.90 billion in year-to-date inflows.

Cardano and Polkadot products remain niche, each holding well under $100 million in assets, though both posted modest positive flows in November.

Select Products Buck the Trend

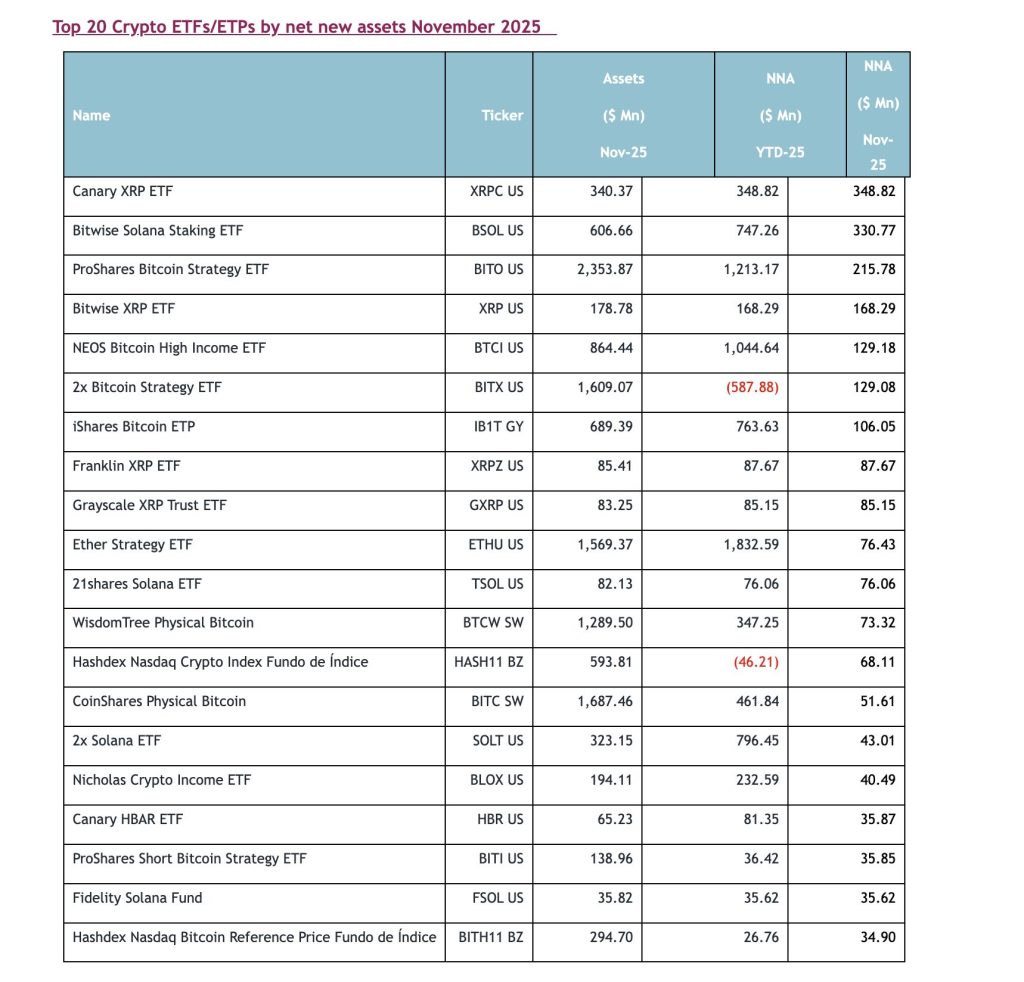

Notably, the top 20 crypto ETFs and ETPs by net new assets collectively attracted $2.17 billion in November offsetting broader market outflows.

The Canary XRP ETF led individual inflows, gathering $348.82 million highlighting continued investor appetite for selective crypto exposures even amid wider withdrawals.

Overall, ETFGI said November’s data underscore a maturing crypto ETF market where periods of consolidation follow rapid growth rather than signal a structural retreat from digital assets.

Sudden Reversal: Spot Bitcoin ETFs Pull In $355M

U.S. spot Bitcoin ETFs recorded a sharp reversal on December 30, pulling in $355 million in net inflows and ending a seven-day stretch of persistent capital withdrawals.

The move marked the strongest daily inflow since mid-December and came after nearly two weeks in which ETF investors steadily reduced exposure as prices softened and year-end liquidity thinned.

Sosovalue data shows that the rebound was led by BlackRock’s iShares Bitcoin Trust which attracted $143.75 million in fresh capital on the day.

The post Crypto ETFs Post First Monthly Outflows of 2025 as Assets Retreat From September Peak: ETFGI appeared first on Cryptonews.