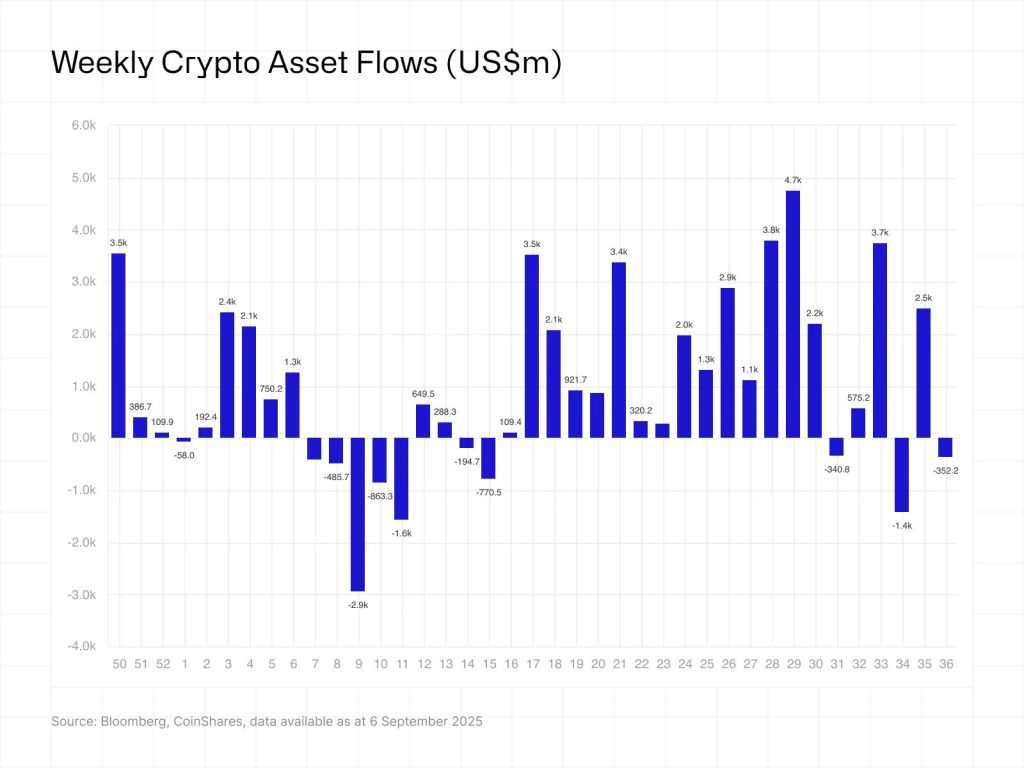

Crypto investment products experienced $352 million in weekly outflows as Federal Reserve rate-cut optimism failed to boost digital asset sentiment, with Ethereum leading the exodus at $912 million while Bitcoin attracted $524 million in inflows.

CoinShares’ report shows trading volumes dropped 27% week-over-week, suggesting a cooled appetite for digital assets despite improving prospects for September interest rate cuts.

Year-to-date inflows remain strong at $35.2 billion, running 4.2% ahead of last year’s total.

Regional Divergence Amid Fed Uncertainty

The United States recorded $440 million in outflows, while Germany and Hong Kong saw inflows of $85.1 million and $8.1 million, respectively.

Ethereum products experienced daily outflows across seven consecutive trading days spanning multiple ETP issuers.

According to SosoValue, Spot Ethereum ETFs posted a record $788 million in weekly outflows, with no single fund recording net inflows.

Bitcoin spot ETFs contrasted with $246 million weekly inflows, marking two consecutive weeks of positive flows.

Solana extended its streak to 21 consecutive weeks of inflows totaling $1.16 billion year to date, while XRP reached $1.22 billion over the same period.

Both assets continue attracting steady weekly inflows of $16.1 million and $14.7 million, respectively.

The outflows occurred despite weak August payroll data that reinforced rate cut expectations. U.S. job growth slowed sharply, with unemployment rising to 4.3%, the highest level since 2021, strengthening the case for monetary easing.

According to Reuters, Standard Chartered has revised its projection to expect 50 basis point cuts at September’s Federal Open Market Committee meeting, doubling its previous forecasts.

Markets price in a 90% probability of 25-basis-point reductions with a 10% chance of larger cuts.

Similarly, Morgan Stanley and Deutsche Bank maintain that August employment data wasn’t weak enough for 50-basis-point cuts, though consecutive meeting reductions remain possible.

Fed Chair Jerome Powell previously indicated that rate cuts were possible while cautioning about persistent inflation threats.

Traditional Markets Rally While Crypto Cools

Stock markets responded positively to rate cut optimism, with S&P 500 futures gaining 0.2% on Monday following weak employment data.

European and Asian shares rose 0.3% and 0.6%, respectively, as Treasury yields held at lower levels.

Gold surged to record highs above $3,630 per ounce, gaining 38% year to date after a 27% increase in 2024.

Lower borrowing costs enhance non-yielding bullion appeal while geopolitical uncertainty drives safe-haven demand amid Fed independence concerns.

China’s central bank extended gold purchases to 10 consecutive months in August as part of dollar diversification efforts.

Additionally, Goldman Sachs projects gold could reach $5,000 per ounce if Federal Reserve independence deteriorates and investors shift from Treasuries.

The Trump administration moves to exempt gold bullion from country-based tariffs, formalizing previous customs rulings.

Political uncertainty in Japan and France contributed to dollar weakness despite rate-cut expectations supporting traditional risk assets.

Oil prices climbed more than 2% after OPEC+ agreed to slower output increases from October amid weaker global demand expectations.

Brent crude and West Texas Intermediate both posted strong gains following the production adjustment announcement.

Industry Outlook Amid Rate Cut Cycle

Earlier this month, Crypto.com CEO Kris Marszalek expected a strong fourth-quarter performance if September rate cuts materialize, citing improved liquidity conditions for risk assets.

This projection came as the exchange generated $1.5 billion in revenue last year with a $1 billion gross profit.

However, late last month, Santiment warned that social media discussion of Federal Reserve rate cuts reached an 11-month peak, historically indicating euphoric levels preceding market corrections.

Rising Fed rate cut chatter may be risky for crypto, as Santiment warns social sentiment hits an 11-month peak, suggesting a potential market top ahead.#Bitcoin #FedRatehttps://t.co/sIEJBJO2no

— Cryptonews.com (@cryptonews) August 24, 2025

Bitcoin exchange supply accumulation has risen by approximately 70,000 coins since June.

Ethereum technical indicators suggest caution despite strong price performance, with short-term MVRV approaching 15% and long-term readings at 58.5%.

These levels historically correspond with profit-taking activity and potential retracements.

Manufacturing PMI data could influence rate-cut timing, with forecasts expecting ISM Manufacturing PMI at 48.9 versus the previous 48.0. Levels below 49.5 typically extend correction periods while improvements support recovery narratives.

Amid this fed rate-cut optimism, European Central Bank President Christine Lagarde warned, in regard to Trump’s threats to the Fed chair, that undermining Fed independence would create “very serious danger” for global economic stability.

She believes that political control over monetary policy carries “very worrying” implications for worldwide markets.

The post Crypto Investment Products Record $352M Weekly Outflows Despite Strong Year-to-Date Performance appeared first on Cryptonews.